Source: AFP

When unsure of the correct answer, the most effective strategy is to build a portfolio, consisting of a diverse set of exposures that provides both resilience and the potential for solid gains. This is true in investing as in other aspects of life.

Broadly speaking, "portfolio thinking" is an approach that involves spreading risk and improving potential rewards by diversifying decisions, investments, or efforts across a range of options, rather than relying on a single outcome. It can refer to any strategy which results in:

Here, we explore the concept of uncertainty. Recognising sources of uncertainty and factoring them into investment decisions are foundational to building out investment exposures and overall risk management.

Uncertainty sits at the core of investment decisions

Investing requires developing a view on expected (i.e., forward) returns, formed by considering a range of possible outcomes, each weighted by an assessment of their respective probabilities. When viewed on a standalone basis, any investment is undertaken because of an expectation that it can provide a favourable return, given a certain degree of acceptable downside. The actual return may and does usually deviate from the expected return. The downside may be deeper or shallower than originally anticipated. These divergences between predicted and actual outcomes, or so-called “errors in estimation,” can result in unintended outsized losses. Investors have at least some aversion to uncertainty surrounding expected returns because it introduces unpredictability into their investment outcomes. As a result, uncertainty makes it harder to plan for financial goals, manage risk, and maintain confidence in a portfolio strategy.

Often, even though we as investors recognise that uncertainty around an expectation exists, we proceed to apply a simple point estimate to anchor investment decisions. Instead, we can conceptually regard, and measure expected returns and downside risk, as ranges. These ranges constitute the “band of uncertainty” and reflect the degree of conviction subjectively placed on the forecast. We can then use this band, or range, as a key input to sizing investment exposures in diversified portfolios that provide more resilience to adverse scenarios than portfolios built from point estimates of return alone. Also, we can find solutions to reducing estimation error and reduce (albeit not completely) uncertainty.

The benefits of diversification

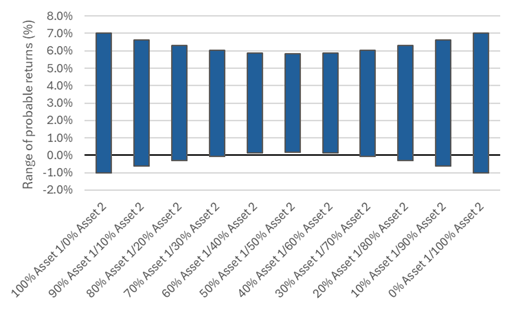

While uncertainty can never fully be eliminated, a diversified portfolio of investments goes a long way in reducing the overall investment uncertainty. Consider the following simplified example. Assume two assets, each expected to return 3%, but within a range of -1% to 7%. Assume these assets are independent of one another (i.e., the correlation of their returns is 0). If we create a portfolio split equally between these two investments, we can show that the expected return narrows from -1% to 7%, to 0.2% to 5.8% (the average of 3% remains unchanged). This is 70% the span of the original range of probable outcomes, and this shrinkage in likely scenarios can be valuable for investors who appreciate greater certainty for financial planning. The following figure illustrates this thought experiment showing the range of probable returns for various weights across these two assets.

Exhibit 1: Illustrative range of expected returns for varying sets of two independent assets

Source: Bank of Singapore.

This is overly simplified, in that most assets with similar characteristics will exhibit some non-zero (positive) correlation with one another. But the conclusion would still hold: assembling at least two or more assets which have similar expected returns and bands of uncertainty would produce a portfolio equal in expected return but with a higher level of conviction around that estimate.

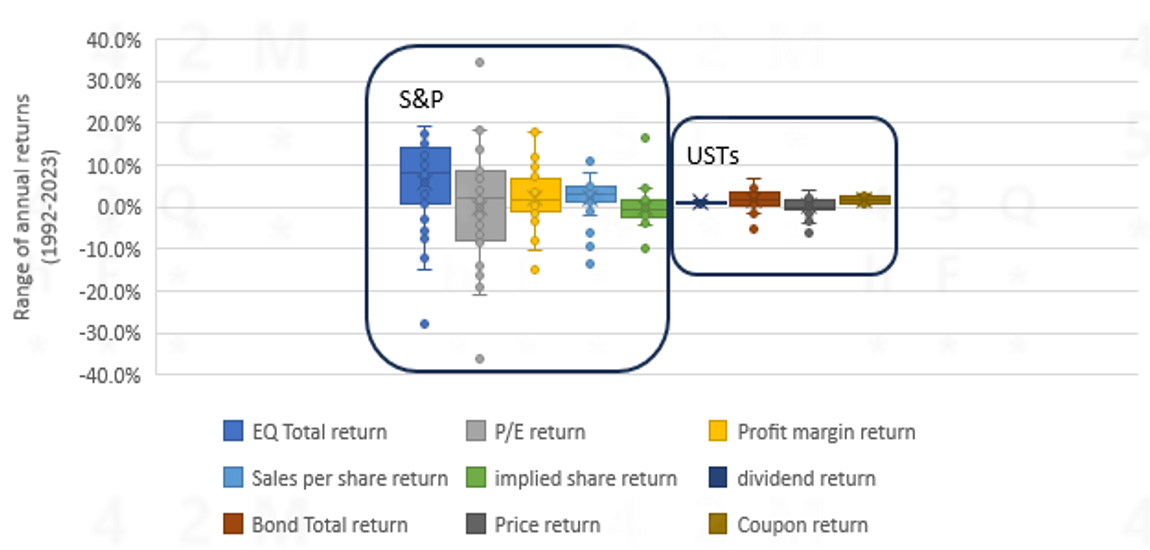

In this piece, we focus on exploring the uncertainty inherent in the formation of return expectations. This is the single greatest source of uncertainty investors face, and arises from multiple factors, namely economic, market sentiment, policy and regulatory, and geopolitical. How can we use historical performance or available data to improve the forecast by boosting conviction and narrowing the uncertainty band? To help illustrate where uncertainty can enter return estimates, we look at two asset classes residing at opposite ends of the returns continuum: the S&P 500 Index, a mainstay of most diversified portfolios, and US Treasuries (UST), its standard hedge.

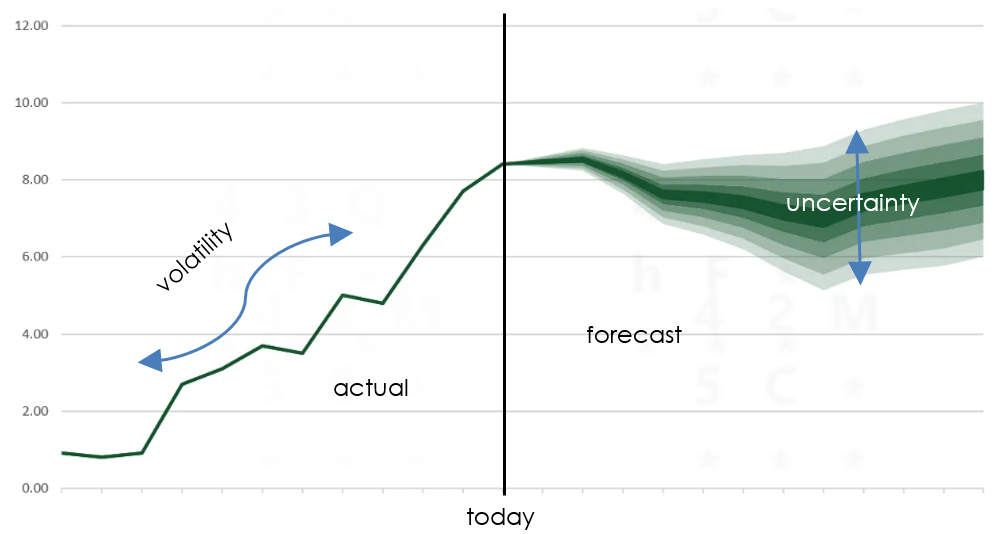

Uncertainty vs volatility

At this point, it’s helpful to distinguish between “return volatility” and “return uncertainty”: two related but different concepts.

Volatility, a more well-known concept in investing, refers to the statistical measure of the dispersion or variability of returns for a given asset or portfolio over a specific period. It quantifies how much the returns fluctuate from their average (mean) return. Higher volatility means the asset's returns swing more widely, both positively and negatively. Volatility is often expressed as the standard deviation of returns and is used as a proxy for risk.

Uncertainty, on the other hand, is broader. It refers to the lack of confidence in predicting future returns due to various known and unknown factors. As noted earlier, these factors may include economic conditions, geopolitical events, market sentiment, or unexpected policy changes, along with uncountable other drivers. While volatility captures the historical or expected variability in returns, uncertainty encompasses all the risks and unknowns that make future returns hard to predict.

Exhibit 2: Stylized chart of a cumulative returns index: volatility vs uncertainty

Source: Bank of Singapore.

Statistically, volatility measures the variability along a single path of returns, while uncertainty measures the variability of expected returns across different potential paths. These concepts are positively related (asset classes which have experienced high (low) volatility usually are those with high (low) uncertainty), which allows us to use the historic volatility of an asset class as an initial estimate for the range of potential outcomes. But because uncertainty pertains to the unknown future events or conditions that could affect returns, it could be high even if volatility has historically been low.

In terms of predictability, volatility can be observed and measured using historical data, providing some degree of expectation for future variability. The uncertainty band around returns, however, includes unforeseeable risks or new market dynamics that may not be reflected in the historical return volatility. Volatility can be computed using data; uncertainty also leverages data but involves a greater degree of qualitative assessment.

Use historical data thoughtfully in building return expectations

So how do we use historical data as a guide for expected performance? With a healthy understanding of its limits. There are ways to improve on the accuracy of forecasts. In the case of equities, we can explore other factors that correspond with returns, beyond the well-established deterministic relationship between actual P/E levels and profitability and their respective forward 1Y returns. By expanding the forecast horizon over a longer time frame to take advantage of mean reversion in valuations and profitability ratios, we can reduce the error around forecasts by removing the conditionality of correctly calling the business cycle. Moreover, these components exhibit a low correlation with one another, which suggests they behave independently, hence interaction across the building blocks is more limited and does not need to be modelled explicitly – another level of complexity that can be avoided.

A forecast for expected returns for the index depends on individual estimates around P/E changes, profit margin evolution, sales growth, dividends, and share buybacks or dilution. The degree of uncertainty around each adds to the overall uncertainty of the S&P 500 Index return forecast. Given this band of uncertainty around returns, approaching investing in a concentrated manner introduces an outsized exposure to miscalculations.

In the case of bonds, however, a forecast-free approach using starting yields as an anchor for expected returns, especially over the longer term, is a reasonable approximation and can meaningfully reduce the uncertainty around the expected return.

As we have seen in earlier segments, the range of historical outcomes is greater for the S&P 500 Index than for USTs, and this is reflected in the relative bands of uncertainty we should anticipate for the two asset classes. The following exhibit reproduces the ranges for equities and bonds.

Exhibit 3: Distribution of S&P 500 Index, UST Index return and their respective components (annual data, 1992-2023)

Source: Bloomberg, Bank of Singapore.

Putting equities and fixed income together: Diversification reduces uncertainty

As stated at the outset: When unsure of the correct answer, the most effective strategy is to build a portfolio - a diverse set of exposures that provides both resilience and the potential for solid gains. By holding a mix of assets with different risk profiles and return drivers, investors can reduce the impact of any one investment’s range of performance, thereby smoothing overall portfolio performance.

Investors who dislike uncertainty typically respond by adopting more conservative approaches to asset allocation in several ways:

The degree of investor aversion to uncertainty influences asset allocation; the more averse, the more conservative an approach to generate the intended narrower, and more certain, set of outcomes. The tradeoff is between greater certainty and higher potential returns: investors’ tolerance for uncertainty will determine where to comfortably reside on this spectrum.

Summary points

The degree of investor aversion to uncertainty will be key to asset allocation: The tradeoff is between greater certainty and higher potential returns.

Disclaimers and Disclosures

This material is prepared by Bank of Singapore Limited (Co Reg. No.: 197700866R) (the “Bank”) and is distributed in Singapore by the Bank.

This material does not provide individually tailored investment advice. This material has been prepared for and is intended for general circulation. The contents of this material does not take into account the specific investment objectives, investment experience, financial situation, or particular needs of any particular person. You should independently evaluate the contents of this material, and consider the suitability of any product discussed in this material, taking into account your own specific investment objectives, investment experience, financial situation and particular needs. If in doubt about the contents of this material or the suitability of any product discussed in this material, you should obtain independent financial advice from your own financial or other professional advisers, taking into account your specific investment objectives, investment experience, financial situation and particular needs, before making a commitment to purchase any product.

The Bank shall not be responsible or liable for any loss (whether direct, indirect or consequential) that may arise from, or in connection with, any use of or reliance on any information contained in or derived from this material, or any omission from this material, other than where such loss is caused solely by the Bank’s wilful default or gross negligence.

This material is not and should not be construed, by itself, as an offer or a solicitation to deal in any product or to enter into any legal relations. You should contact your own licensed representative directly if you are interested in buying or selling any product discussed in this material.

This material is not intended for distribution, publication or use by any person in any jurisdiction outside Singapore, Hong Kong or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank or its related corporations, connected persons, associated persons or affiliates (collectively “Affiliates”) to any licensing, registration or other requirements in such jurisdiction.

The Bank and its Affiliates may have issued other reports, analyses, or other documents expressing views different from the contents of this material, and may provide other advice or make investment decisions that are contrary to the views expressed in this material, and all views expressed in all reports, analyses and documents are subject to change without notice. The Bank and its Affiliates reserve the right to act upon or use the contents of this material at any time, including before its publication.

The author of this material may have discussed the information or views contained in this material with others within or outside the Bank, and the author or such other Bank employees may have already acted on the basis of such information or views (including communicating such information or views to other customers of the Bank).

The Bank, its employees (including those with whom the author may have consulted in the preparation of this material))and discretionary accounts managed by the Bank may have long or short positions (including positions that may be different from or opposing to the views in this material or may be otherwise interested in any of the product(s) (including derivatives thereof) discussed in material, may have acquired such positions at prices and market conditions that are no longer available, may from time to time deal in such product(s) and may have interests different from or adverse to your interests.

Analyst Declaration

The analyst(s) who prepared this material certifies that the opinions contained herein accurately and exclusively reflect his or her views about the securities of the company(ies) and that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein.

The analyst(s) who prepared this material and his/her associates [have / do not] have financial interests in the company(ies). Financial interests refer to investments in securities, warrants and/or other derivatives. The analyst(s) receives compensation based on the overall revenues of Bank of Singapore Limited, and no part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this material. The reporting line of the analyst(s) is separate from and independent of the business solicitation or marketing departments of Bank of Singapore Limited.

The analyst(s) and his/her associates confirm that they do not serve as directors or officers of the company(ies) and the company(ies)or other third parties have not provided or agreed to provide any compensation or other benefits to the analyst(s) in connection with this material.

An “associate” is defined as (i) the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child, or any sibling or step-sibling of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, parent or step-parent, minor child (natural or adopted) or minor step-child, or sibling or step-sibling is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Conflict of Interest Declaration

The Bank is a licensed bank regulated by the Monetary Authority of Singapore in Singapore. Bank of Singapore Limited, Hong Kong Branch (incorporated in Singapore with limited liability), is an Authorized Institution as defined in the Banking Ordinance of Hong Kong (Cap 155), regulated by the Hong Kong Monetary Authority in Hong Kong and a Registered Institution as defined in the Securities and Futures Ordinance of Hong Kong (Cap.571) regulated by the Securities and Futures Commission in Hong Kong. The Bank, its employees and discretionary accounts managed by its Singapore Office/Hong Kong Office may have long or short positions or may be otherwise interested in any of the investment products (including derivatives thereof) referred to in this document and may from time to time dispose of any such investment products. The Bank forms part of the OCBC Group (being for this purpose Oversea-Chinese Banking Corporation Limited (“OCBC Bank”) and its subsidiaries, related and affiliated companies). OCBC Group, their respective directors and/or employees (collectively “Related Persons”) may have interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Group and its Related Persons may also be related to, and receive fees from, providers of such investment products. There may be conflicts of interest between OCBC Bank, the Bank, OCBC Investment Research Private Limited, OCBC Securities Private Limited or other members of the OCBC Group and any of the persons or entities mentioned in this report of which the Bank and its analyst(s) are not aware due to OCBC Bank’s Chinese Wall arrangement.

The Bank adheres to a group policy (as revised and updated from time to time) that provides how entities in the OCBC Group manage or eliminate any actual or potential conflicts of interest which may impact the impartiality of research reports issued by any research analyst in the OCBC Group.

Other Disclosures

Singapore

Where this material relates to structured deposits, this clause applies:

The product is a structured deposit. Structured deposits are not insured by the Singapore Deposit Insurance Corporation. Unlike traditional deposits, structured deposits have an investment element and returns may vary. You may wish to seek independent advice from a financial adviser before making a commitment to purchase this product. In the event that you choose not to seek independent advice from a financial adviser, you should carefully consider whether this product is suitable for you.

Where this material relates to dual currency investments, this clause applies:

The product is a dual currency investment. A dual currency investment product (“DCI”) is a derivative product or structured product with derivatives embedded in it. A DCI involves a currency option which confers on the deposit-taking institution the right to repay the principal sum at maturity in either the base or alternate currency. Part or all of the interest earned on this investment represents the premium on this option.

By purchasing this DCI, you are giving the issuer of this product the right to repay you at a future date in an alternate currency that is different from the currency in which your initial investment was made, regardless of whether you wish to be repaid in this currency at that time. DCIs are subject to foreign exchange fluctuations which may affect the return of your investment. Exchange controls may also be applicable to the currencies your investment is linked to. You may incur a loss on your principal sum in comparison with the base amount initially invested. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether this product is suitable for you.

Hong Kong

This material has not been delivered for registration to the Registrar of Companies in Hong Kong and its contents have not been reviewed by any regulatory authority in Hong Kong. Accordingly: (i) the shares/notes may not be offered or sold in Hong Kong by means of any document other than to persons who are "Professional Investors" within the meaning of the Securities and Futures Ordinance (Cap. 571) of Hong Kong and the Securities and Futures (Professional Investor) Rules made thereunder or in other circumstances which do not result in the document being a "prospectus" within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance; and (ii) no person may issue any invitation, advertisement or other material relating to the shares/notes whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to the shares/notes which are or are intended to be disposed of only to persons outside Hong Kong or only to "Professional Investors" within the meaning of the Securities and Futures Ordinance and the Securities and Futures (Professional Investor) Rules made thereunder.

Where this material involves derivatives, do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you have any doubt, you should seek independent professional financial, tax and/or legal advice as you deem necessary.

Where this material relates to a Complex Product, this clause applies:

Warning Statement and Information about Complex Product

(Applicable to accounts managed by Hong Kong Relationship Manager)

Where this material relates to a Complex Product – funds and ETFs, this clause applies additionally:

Where this material relates to a Complex Product (Options and its variants, Swap and its variants, Accumulator and its variants, Reverse Accumulator and its variants, Forwards), this clause applies additionally:

Where this material relates to a Loss Absorption Product, this clause applies:

Warning Statement and Information about Loss Absorption Products

(Applicable to accounts managed by Hong Kong Relationship Manager)

Before you invest in any Loss Absorption Product (as defined by the Hong Kong Monetary Authority), please read and ensure that you understand the features of a Loss Absorption Product, which may generally have the following features:

Where this material relates to a certificate of deposit, this clause applies:

It is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Where this material relates to a structured deposit, this clause applies:

It is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Where this material relates to a structured product, this clause applies:

This is a structured product which involves derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you are in any doubt about the risks involved in the product, you may clarify with the intermediary or seek independent professional advice.

Dubai International Financial Center

Where this material relates to structured products and bonds, this clause applies:

The Distributor represents and agrees that it has not offered and will not offer the product to any person in the Dubai International Financial Centre unless such offer is an “Exempt Offer” in accordance with the Market Rules of the Dubai Financial Services Authority (the “DFSA”).

The DFSA has no responsibility for reviewing or verifying any documents in connection with Exempt Offers.

The DFSA has not approved the Information Memorandum or taken steps to verify the information set out in it, and has no responsibility for it.

The product to which this document relates may be illiquid and/or subject to restrictions in respect of their resale. Prospective purchasers of the products offered should conduct their own due diligence on the products.

Please make sure that you understand the contents of the relevant offering documents (including but not limited to the Information Memorandum or Offering Circular) and the terms set out in this document. If you do not understand the contents of the relevant offering documents and the terms set out in this document, you should consult an authorised financial adviser as you deem necessary, before you decide whether or not to invest.

Where this material relates to a fund, this clause applies:

This Fund is not subject to any form of regulation or approval by the Dubai Financial Services Authority (“DFSA”). The DFSA has no responsibility for reviewing or verifying any Prospectus or other documents in connection with this Fund. Accordingly, the DFSA has not approved the Prospectus or any other associated documents nor taken any steps to verify the information set out in the Prospectus, and has no responsibility for it. The Units to which this Fund relates may be illiquid and/or subject to restrictions on their resale. Prospective purchasers should conduct their own due diligence on the Units. If you do not understand the contents of this document you should consult an authorized financial adviser. Please note that this offer is intended for only Professional Clients and is not directed at Retail Clients.

These are also available for inspection, during normal business hours, at the following location:

Bank of Singapore

Office 30-34 Level 28

Central Park Tower

DIFC, Dubai

U.A.E

BOS Wealth Management Europe S.A., UK Branch

BOS Wealth Management Europe S.A., UK Branch (BOSWME UK), is authorized and regulated by the Financial Conduct Authority (FCA) and is providing this material for informational purposes only. BOSWME UK does not endorse any specific investments or financial products mentioned in this material. BOSWME UK and its employees accept no liability for any loss or damage arising from the use of this material or reliance on its content.

This material is being distributed to and is directed only at persons in the UK who meet the requirements to be considered “Professional Clients” within the meaning of the Conduct of Business Sourcebook rules on client categorisation, part of the FCA Handbook (the “FCA Rules”) and is not intended for retail investors.

Any person in the UK who receives this material will be deemed to have represented and agreed that it can be considered a Professional Client. Any such recipient will also be deemed to have represented and agreed that it has not received this material on behalf of persons in the UK other than Professional Clients for whom the investor has authority to make decisions on a wholly discretionary basis. BOSWME UK will rely upon the truth and accuracy of the foregoing representations and agreements. Any person who is not a Professional Client should not act or rely on this material or any of their contents.

Investing in financial markets carries the risk of losing capital, and investors should be aware of and carefully consider this risk before making any investment decisions. The value of investments can fluctuate, and there is no guarantee that investors will recoup their initial investment. Past performance is not indicative of future results, and the performance of investments can be affected by various factors, including but not limited to market conditions, economic factors, and changes in regulations or tax laws. Forward-looking statements should not be considered as guarantees or predictions of future events. Investors should be prepared for the possibility of losing all or a portion of their invested capital. It is recommended that investors seek professional advice and conduct thorough research before making any investment decisions.

Cross Border Disclaimer and Disclosures

Refer to https://www.bankofsingapore.com/Disclaimers_and_Disclosures.html for cross-border marketing disclaimers and disclosures.