Uncertainty is endemic, so build portolios

With uncertainty around global macro policy priorities and implementation, and an increasingly volatile, complex and ambiguous world, the diversified multi-asset investment approach becomes indispensable. A portfolio approach to investing is widely regarded as superior to a concentrated exposure for sustained investment performance, because it leverages diversification to manage risk and improve long-term returns. Diversifying across asset classes generates more consistent investment performance across economic regimes, reducing the risks associated with investment decisions based on unpredictable macroeconomic outcomes. By spreading investments across a variety of assets, sectors, or geographic regions, investors reduce the likelihood of significant losses tied to the underperformance of any single investment.

This approach mitigates volatility and downside risk, but also capitalises on the performance drivers and macro conditions underlying the differentiated performance across asset class and over time. While a concentrated exposure may offer high returns if a specific asset performs well, it also subjects investors to steeper losses which can take longer to recoup, making it a less attractive option for most investors seeking sustainable growth.

Diversification across exposures

A parsimonious set of distinct return drivers and risk factors influence asset classes in different ways, so the combination results in a diversified portfolio. The following table sumamrises some of the major asset classes, and their key return drivers (exposures) alongside factors that can be a headwind to performance (risk).

Exhibit 1: Key return drivers and risk across asset classes (macro factors highlighted in red and green)

Source: Bank of Singapore. Note: Drivers marked in green are supportive of discounted cashflows, while red reflects risks of worsening.

For example, (as described in our earlier Uncertainty in the formation of expectations report) equities generally provide returns through dividends and capital appreciation (via multiples expansion, profit margin and revenue growth), levered to actual and expected economic growth, alongside improvements in operating efficiency, market expansion and competitiveness. However, they also carry a higher risk due to market volatility and company-specific factors. Bonds, on the other hand, typically offer stable income through interest payments and are influenced by interest rate changes and credit risk, often serving as a safe haven asset during market downturns.

Commodities, such as copper and oil, are often driven by supply-demand dynamics and can act as a hedge against inflation, especially during high growth periods. Gold can be an even more consistent hedge against inflation, as well as against USD depreciation and acute geopolitical risk. Alternatives – which cover a broad range including hedge funds, private markets, infrastructure and real estate – are influenced by growth factors, but also by manager selection, deal and vintage risks, reflecting the heterogeneity of projects and investments in each Alternatives vertical.

Scenario analysis using a factor-based model of return and risk attribution can help to illustrate how the same catalyst exerts a differentiated impact across asset classes. The following exhibit illustrates the hypothetical returns associated with two distinct shocks: a rise in market implied inflation expectations (measured as a 100bps increase in the spread between 2Y US Treasuries (UST) and 2Y Treasury Inflation Protected Securities (TIPS); the blue bars), and a spike in market risk (represented as a 10% increase in the VIX index; orange bars).

Exhibit 2: Scenario analysis: Possible impact on select asset classes from rising US inflation expectations or a spike in US equity volatility

Source: Bank of Singapore, using Blackrock Aladdin

In the former case, a move higher in inflationary expectations can drive negative returns in UST as yields move higher. It is a headwind for credit markets as well, but the carry in credit markets acts as a cushion to returns and results in a small positive performance. In contrast, the inflation shock can cause investors to favour real, growth-oriented and inflation-hedged assets, leading to stronger demand and price appreciation in both equities and commodities.

The impact of higher overall market uncertainty on the same set of asset classes could not be more different. A spike in the VIX Index (a barometer for equity volatility), reflecting greater market uncertainty, has an outsized negative effect on equities and the High Yield (HY) markets. USTs are mostly immune with negligible returns. Credit asset classes are hit, with the overall market uncertainty pushing spreads wider which results in negative performance; this is more pronounced in lower rated HY where spreads widen more than Investment Grade (IG), and in the longer duration, more spread-sensitive, Developed Markets (DM) IG segment.

Understanding distinct drivers and risks helps investors strategically allocate assets to balance growth potential and mitigate risks across varying market conditions.

A brief history of macro regimes

The above scenario analysis shows how different factor exposures leads to variability in asset class responsiveness to a common catalyst. Different so-called “factor loadings” explain why performance across asset classes varies within a macro regime, making it essential for investors to understand these dynamics.

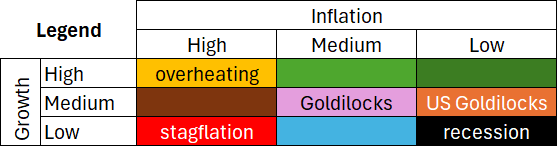

To assess the impact of the macro environment on asset class performance, we first build a macro regime framework to partition history into distinct growth and inflation episodes, then compute various asset class returns conditional on the different macro regimes.

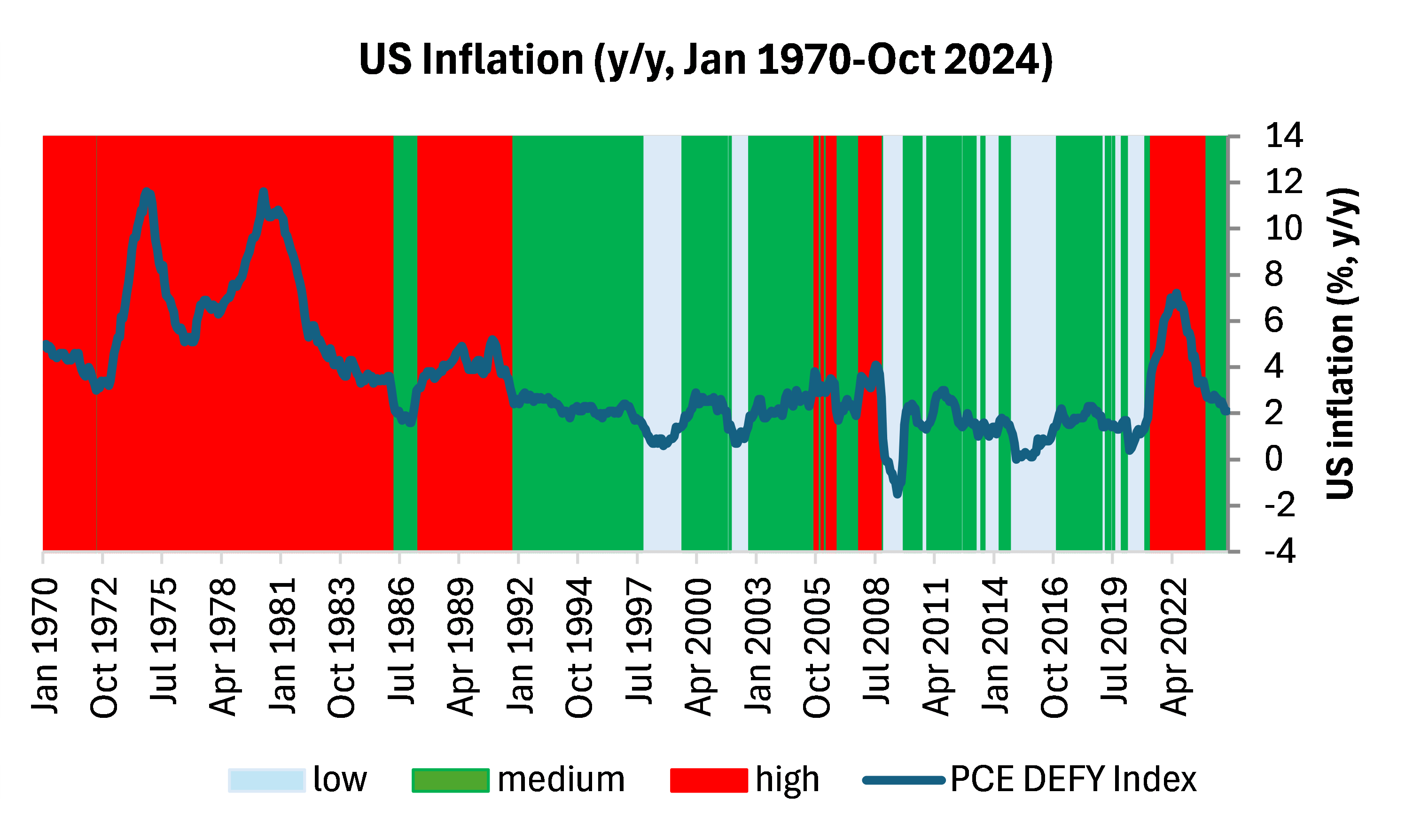

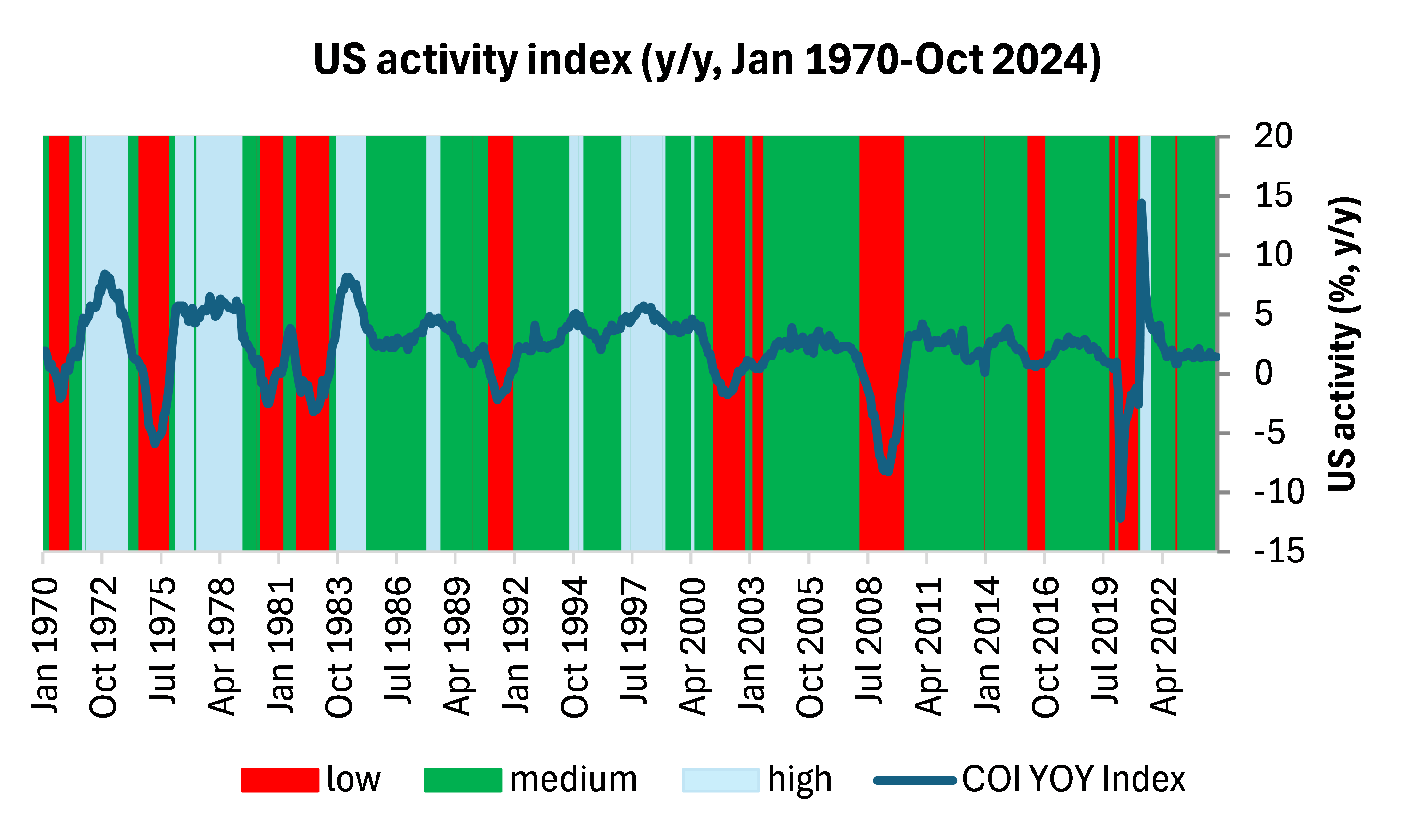

The following two exhibits illustrate the cornerstone to our regime framework: US inflation (represented by YoY changes in the monthly US PCE deflator) and economic activity (using the Conference Board’s monthly composite of coincident indicators, which comprises four cyclical economic data series which reflect employment, household income, industrial activity, and business revenues). We divide inflation and activity each into low, medium, and high outcomes. The thresholds that determine the respective ranges are based on the Federal Reserve’s (Fed) 2% inflation target (in the case of inflation), and long-run GDP growth (in the case of activity), un-adjusted for trend.

Exhibit 3: US inflation (monthly, YoY changes, Jan 1970 – Oct 2024)

Source: Bank of Singapore

Exhibit 4: US growth (monthly, YoY changes, Jan 1970 – Oct 2024)

Source: Bank of Singapore

Before reviewing market performance considering different macro environments, it is worth taking a moment to review the historical macro record and highlight any generalisable trends through the present day.

Over the last 50 years, the US economy has undergone significant changes in both growth and inflation dynamics. High inflation was a defining feature in the 1970s (expressed by the red shading in Exhibit 3), driven by the OPEC oil embargoes and loose monetary policy, but moderated to lower ranges starting in the 1990s. Also in the 1970s, the economy experienced uneven economic growth, marked by intermittent periods of deep contractions followed by growth rebounds (Exhibit 4, alternating red and light blue bars). “Stagflation” emerged to describe the simultaneous occurrence of high inflation and stagnant economic growth.

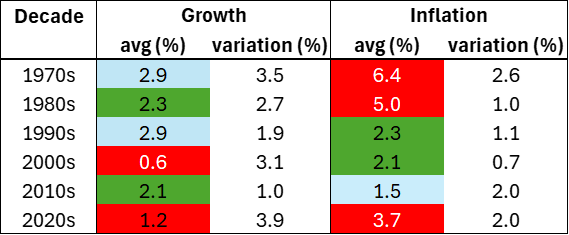

In subsequent decades, vastly different macro outcomes transpired: while this is evident in the above exhibits’ changing color sequence over time, it is even more apparent in the following summary of decadal growth and inflation average levels and their variation (which uses the same color schemes as the growth/inflation exhibits). We use the exhibits to describe history.

Deregulation, tax cuts and increased defense spending supported growth in the 1980s, while aggressive monetary policy reigned in inflation to the 4% level by the middle of the decade, which is 140bps lower on average compared to the 1970s.

The 1990s experienced steady and impressive economic expansion, underpinned by increasing globalisation and productivity gains. Inflation remained low, typically below 3%, due to stable monetary policy.

In the 2000s, growth was highly uneven, with the decade beginning and ending with two financial crises. The financial crisis in 2008-2009 led to a sharp contraction in GDP, but recovery began in 2009. On average, due to the Great Recession at its end, this decade posted the lowest average growth in the sample, with high variation. Inflation was moderate, averaging 2.3% over the decade, but concerns arose over deflation during the financial crisis.

The 2010s were characterised by steady growth, but trending lower, driven by modest productivity growth and fiscal restraint following the Great Recession. Structural changes such as deepening globalisation and digitisation, kept prices subdued, with average inflation reaching multi-decade lows.

Exhibit 5: US growth and inflation (YoY changes, Jan 1970 – Oct 2024)

Source: Bank of Singapore

In terms of broader trends up to the present, inflation peaked at over 13% in 1980, and moderated to far lower and fairly stable levels (averaging 2.3% in the 1990s, all the way to 1.5% in the 2010s) until recently, when inflation spiked higher during Covid-19 and has settled to slightly higher levels compared to the pre-Covid era.

In the case of activity, the trend has moved slightly lower, with the only instance of high growth (signified by light blue area) during the post-Covid reopening period. Red areas correspond with technical economic recessions (1970, 1973-1975, early 80s, 1990, 2001, 2007-2009, 2020) as well as mid-cycle slowdowns. Recent data show activity comfortably eluding a mid-cycle slowdown (last couple of years are firmly stable and in the green).

Macroeconomic context matters

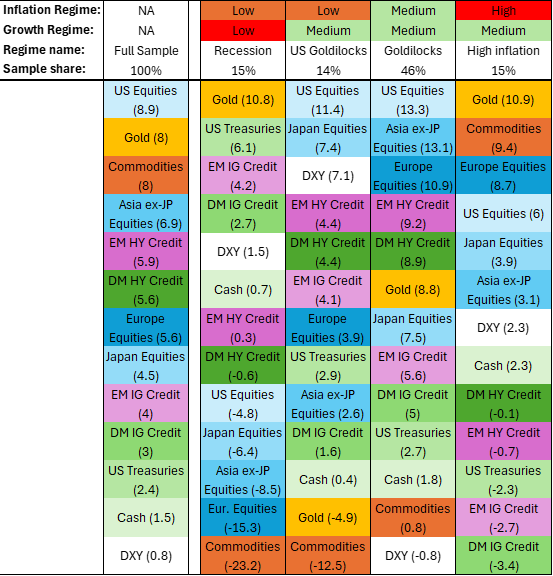

So, what do these different macro environments – combinations of growth and inflation – imply for asset prices? The following exhibit arrays asset class performance within the four macro regimes that prevailed over the last 20 years for which we have a full complement of data (note that some macro environments such as high growth/high inflation (classical “Overheating”) or low growth/high inflation (“Stagflation”) episodes did not occur). To facilitate comparison, asset classes are tagged to a unique color.

The ranking of asset class performance varies significantly across the different macro regimes and the full sample. It is worth highlighting three examples.

Exhibit 6: Asset class performance in different macro regimes, ranked in descending order (monthly YoY returns, Jan 2003 – Oct 2024)

Source: Bank of Singapore.

Note: Assets are arrayed in descending performance within the given macro regime (average returns in percent are given in parenthesis). Monthly YoY returns from 2003-2024 (longest period available across all asset classes). Only the 4 macro regimes (of 9) which reach our minimum 4% sample size are shown.

Firstly, within these selected asset classes, equities (as represented by the S&P 500 Index) has ranked as the strongest performing asset class over the last 20 years, as well as during solid non-inflationary good growth periods goldilocks-type regimes. They performed relatively well, though less so, during medium growth environments with high inflation. But recessions posed challenges, and the S&P 500 Index’s performance during these times was lower on a relative basis compared to other regimes, and versus other asset classes. Broadening this out, other equities behave similarly: posting strong relative performance in good growth environments and returning poor performance during recessions.

Secondly, in contrast to equities, USTs (alongside IG bonds) are the outperformers during recession and the underperformers during growthy times. They are poor performers in high inflation environments. Performance across UST and IG bonds tend to cluster together, reflecting the common dominance of interest rate risk.

Lastly, gold and commodities do well under the high inflation regime. Gold shines brightly during recessions (while commodities perform poorly). Both face significant headwinds in a goldilocks environment where their hedging properties are less sought and valued.

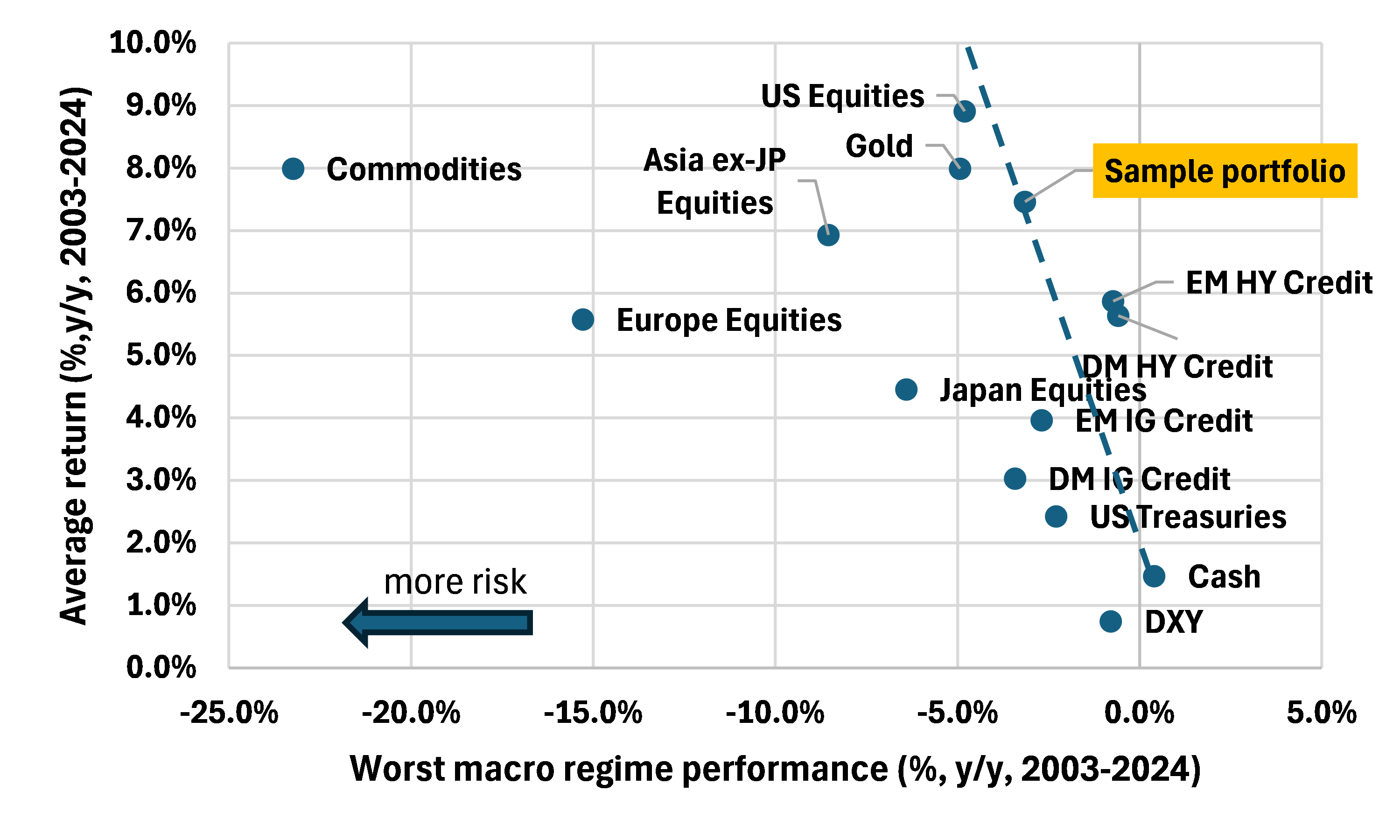

Exhibit 7: Asset class and sample portfolio worst macro regime performance vs average returns (monthly YoY returns, Jan 2003 – Oct 2024)

Source: Bank of Singapore

The variation in performance of any asset class across different macroeconomic regimes is significant. Diversifying across asset classes helps to generate more consistent investment performance across economic regimes, reducing the error associated with incorrectly forecasting the macro environment. One way to demonstrate the value of diversification is to compare unconditional regime-agnostic performance (i.e., average return) against the worst regime outcome (i.e., our definition of downside risk) for a sample portfolio and individual asset classes (see Exhibit 7).

The dotted line reflects a measure of return per unit of downside risk for the sample portfolio. Asset classes to the right exhibit a superior return adjusted for downside risk, compared to the sample portfolio. The vast majority of asset classes reside to the left of this line, reflecting a worse trade-off between return and risk.

The multi-asset portfolio improves the risk adjusted return profile of most standalone asset class investments significantly. For instance, it achieves more than double the return of DM IG, for roughly the same amount of downside risk. Portfolio returns are higher than Asia ex-Japan equities, with a third its downside risk. Plainly, the diversified approach is the dominant strategy in most cases.

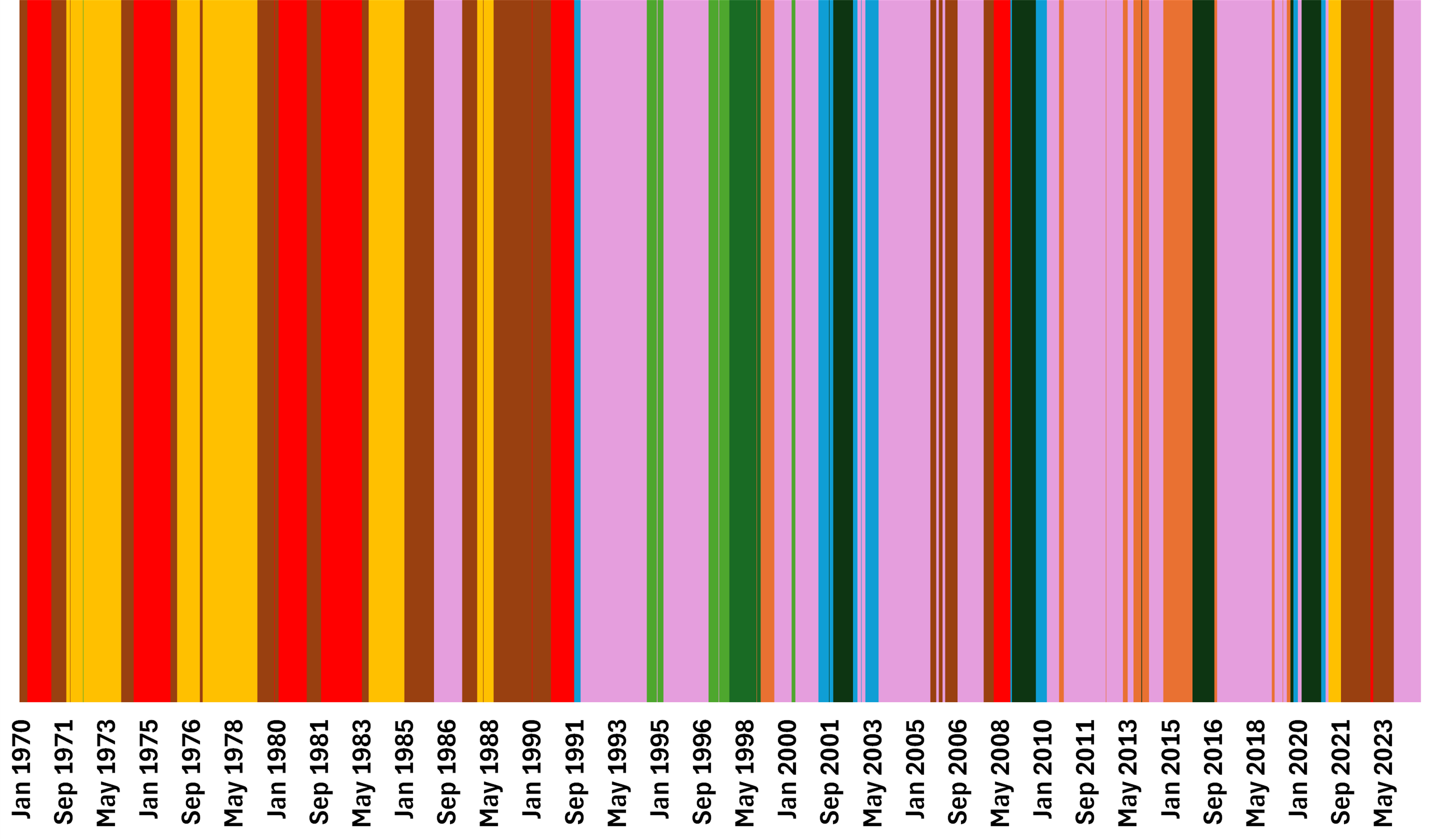

Exhibit 8: US growth and inflation regimes (9 growth/inflation combinations are colour coded, monthly, Jan 1970 – Oct 2024)

Source: Bank of Singapore

The need for diversification is amplified by increasing macroeconomic uncertainty. The last exhibit paints the nine different regimes we track, from 1970-2024. Extended high inflation periods characterised the 1970s and 1980s; a goldilocks era of good growth and moderate inflation – ideal for risk assets – prevailed in the 1990s into the GFC. The decade post-GFC was a US goldilocks macroeconomic era largely of solid growth and low inflation.

Since 2019, exogenous downside shocks to growth, extraordinarily accommodative policy, its sharp reversal to fight the inflationary spike, have produced a quick succession of changes in macro regimes. The pandemic and supply chain disruptions have challenged the balance between growth and price stability. Uncertainties around policy priorities, their implementation and ramifications, increase the likelihood of persistence in macro volatility. Ultimately, a well-diversified, multi-asset portfolio is better positioned to weather uncertainty and achieve more consistent returns across a wide expanse of economic outcomes, well telegraphed or otherwise.

Disclaimers and Disclosures

This material is prepared by Bank of Singapore Limited (Co Reg. No.: 197700866R) (the “Bank”) and is distributed in Singapore by the Bank.

This material does not provide individually tailored investment advice. This material has been prepared for and is intended for general circulation. The contents of this material does not take into account the specific investment objectives, investment experience, financial situation, or particular needs of any particular person. You should independently evaluate the contents of this material, and consider the suitability of any product discussed in this material, taking into account your own specific investment objectives, investment experience, financial situation and particular needs. If in doubt about the contents of this material or the suitability of any product discussed in this material, you should obtain independent financial advice from your own financial or other professional advisers, taking into account your specific investment objectives, investment experience, financial situation and particular needs, before making a commitment to purchase any product.

The Bank shall not be responsible or liable for any loss (whether direct, indirect or consequential) that may arise from, or in connection with, any use of or reliance on any information contained in or derived from this material, or any omission from this material, other than where such loss is caused solely by the Bank’s wilful default or gross negligence.

This material is not and should not be construed, by itself, as an offer or a solicitation to deal in any product or to enter into any legal relations. You should contact your own licensed representative directly if you are interested in buying or selling any product discussed in this material.

This material is not intended for distribution, publication or use by any person in any jurisdiction outside Singapore, Hong Kong or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank or its related corporations, connected persons, associated persons or affiliates (collectively “Affiliates”) to any licensing, registration or other requirements in such jurisdiction.

The Bank and its Affiliates may have issued other reports, analyses, or other documents expressing views different from the contents of this material, and may provide other advice or make investment decisions that are contrary to the views expressed in this material, and all views expressed in all reports, analyses and documents are subject to change without notice. The Bank and its Affiliates reserve the right to act upon or use the contents of this material at any time, including before its publication.

The author of this material may have discussed the information or views contained in this material with others within or outside the Bank, and the author or such other Bank employees may have already acted on the basis of such information or views (including communicating such information or views to other customers of the Bank).

The Bank, its employees (including those with whom the author may have consulted in the preparation of this material))and discretionary accounts managed by the Bank may have long or short positions (including positions that may be different from or opposing to the views in this material or may be otherwise interested in any of the product(s) (including derivatives thereof) discussed in material, may have acquired such positions at prices and market conditions that are no longer available, may from time to time deal in such product(s) and may have interests different from or adverse to your interests.

Analyst Declaration

The analyst(s) who prepared this material certifies that the opinions contained herein accurately and exclusively reflect his or her views about the securities of the company(ies) and that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein.

The analyst(s) who prepared this material and his/her associates [have / do not] have financial interests in the company(ies). Financial interests refer to investments in securities, warrants and/or other derivatives. The analyst(s) receives compensation based on the overall revenues of Bank of Singapore Limited, and no part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this material. The reporting line of the analyst(s) is separate from and independent of the business solicitation or marketing departments of Bank of Singapore Limited.

The analyst(s) and his/her associates confirm that they do not serve as directors or officers of the company(ies) and the company(ies)or other third parties have not provided or agreed to provide any compensation or other benefits to the analyst(s) in connection with this material.

An “associate” is defined as (i) the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child, or any sibling or step-sibling of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, parent or step-parent, minor child (natural or adopted) or minor step-child, or sibling or step-sibling is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Conflict of Interest Declaration

The Bank is a licensed bank regulated by the Monetary Authority of Singapore in Singapore. Bank of Singapore Limited, Hong Kong Branch (incorporated in Singapore with limited liability), is an Authorized Institution as defined in the Banking Ordinance of Hong Kong (Cap 155), regulated by the Hong Kong Monetary Authority in Hong Kong and a Registered Institution as defined in the Securities and Futures Ordinance of Hong Kong (Cap.571) regulated by the Securities and Futures Commission in Hong Kong. The Bank, its employees and discretionary accounts managed by its Singapore Office/Hong Kong Office may have long or short positions or may be otherwise interested in any of the investment products (including derivatives thereof) referred to in this document and may from time to time dispose of any such investment products. The Bank forms part of the OCBC Group (being for this purpose Oversea-Chinese Banking Corporation Limited (“OCBC Bank”) and its subsidiaries, related and affiliated companies). OCBC Group, their respective directors and/or employees (collectively “Related Persons”) may have interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Group and its Related Persons may also be related to, and receive fees from, providers of such investment products. There may be conflicts of interest between OCBC Bank, the Bank, OCBC Investment Research Private Limited, OCBC Securities Private Limited or other members of the OCBC Group and any of the persons or entities mentioned in this report of which the Bank and its analyst(s) are not aware due to OCBC Bank’s Chinese Wall arrangement.

The Bank adheres to a group policy (as revised and updated from time to time) that provides how entities in the OCBC Group manage or eliminate any actual or potential conflicts of interest which may impact the impartiality of research reports issued by any research analyst in the OCBC Group.

Other Disclosures

Singapore

Where this material relates to structured deposits, this clause applies:

The product is a structured deposit. Structured deposits are not insured by the Singapore Deposit Insurance Corporation. Unlike traditional deposits, structured deposits have an investment element and returns may vary. You may wish to seek independent advice from a financial adviser before making a commitment to purchase this product. In the event that you choose not to seek independent advice from a financial adviser, you should carefully consider whether this product is suitable for you.

Where this material relates to dual currency investments, this clause applies:

The product is a dual currency investment. A dual currency investment product (“DCI”) is a derivative product or structured product with derivatives embedded in it. A DCI involves a currency option which confers on the deposit-taking institution the right to repay the principal sum at maturity in either the base or alternate currency. Part or all of the interest earned on this investment represents the premium on this option.

By purchasing this DCI, you are giving the issuer of this product the right to repay you at a future date in an alternate currency that is different from the currency in which your initial investment was made, regardless of whether you wish to be repaid in this currency at that time. DCIs are subject to foreign exchange fluctuations which may affect the return of your investment. Exchange controls may also be applicable to the currencies your investment is linked to. You may incur a loss on your principal sum in comparison with the base amount initially invested. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether this product is suitable for you.

Hong Kong

This material has not been delivered for registration to the Registrar of Companies in Hong Kong and its contents have not been reviewed by any regulatory authority in Hong Kong. Accordingly: (i) the shares/notes may not be offered or sold in Hong Kong by means of any document other than to persons who are "Professional Investors" within the meaning of the Securities and Futures Ordinance (Cap. 571) of Hong Kong and the Securities and Futures (Professional Investor) Rules made thereunder or in other circumstances which do not result in the document being a "prospectus" within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance; and (ii) no person may issue any invitation, advertisement or other material relating to the shares/notes whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to the shares/notes which are or are intended to be disposed of only to persons outside Hong Kong or only to "Professional Investors" within the meaning of the Securities and Futures Ordinance and the Securities and Futures (Professional Investor) Rules made thereunder.

Where this material involves derivatives, do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you have any doubt, you should seek independent professional financial, tax and/or legal advice as you deem necessary.

Where this material relates to a Complex Product, this clause applies:

Warning Statement and Information about Complex Product

(Applicable to accounts managed by Hong Kong Relationship Manager)

Where this material relates to a Complex Product – funds and ETFs, this clause applies additionally:

Where this material relates to a Complex Product (Options and its variants, Swap and its variants, Accumulator and its variants, Reverse Accumulator and its variants, Forwards), this clause applies additionally:

Where this material relates to a Loss Absorption Product, this clause applies:

Warning Statement and Information about Loss Absorption Products

(Applicable to accounts managed by Hong Kong Relationship Manager)

Before you invest in any Loss Absorption Product (as defined by the Hong Kong Monetary Authority), please read and ensure that you understand the features of a Loss Absorption Product, which may generally have the following features:

Where this material relates to a certificate of deposit, this clause applies:

It is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Where this material relates to a structured deposit, this clause applies:

It is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Where this material relates to a structured product, this clause applies:

This is a structured product which involves derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you are in any doubt about the risks involved in the product, you may clarify with the intermediary or seek independent professional advice.

Dubai International Financial Center

Where this material relates to structured products and bonds, this clause applies:

The Distributor represents and agrees that it has not offered and will not offer the product to any person in the Dubai International Financial Centre unless such offer is an “Exempt Offer” in accordance with the Market Rules of the Dubai Financial Services Authority (the “DFSA”).

The DFSA has no responsibility for reviewing or verifying any documents in connection with Exempt Offers.

The DFSA has not approved the Information Memorandum or taken steps to verify the information set out in it, and has no responsibility for it.

The product to which this document relates may be illiquid and/or subject to restrictions in respect of their resale. Prospective purchasers of the products offered should conduct their own due diligence on the products.

Please make sure that you understand the contents of the relevant offering documents (including but not limited to the Information Memorandum or Offering Circular) and the terms set out in this document. If you do not understand the contents of the relevant offering documents and the terms set out in this document, you should consult an authorised financial adviser as you deem necessary, before you decide whether or not to invest.

Where this material relates to a fund, this clause applies:

This Fund is not subject to any form of regulation or approval by the Dubai Financial Services Authority (“DFSA”). The DFSA has no responsibility for reviewing or verifying any Prospectus or other documents in connection with this Fund. Accordingly, the DFSA has not approved the Prospectus or any other associated documents nor taken any steps to verify the information set out in the Prospectus, and has no responsibility for it. The Units to which this Fund relates may be illiquid and/or subject to restrictions on their resale. Prospective purchasers should conduct their own due diligence on the Units. If you do not understand the contents of this document you should consult an authorized financial adviser. Please note that this offer is intended for only Professional Clients and is not directed at Retail Clients.

These are also available for inspection, during normal business hours, at the following location:

Bank of Singapore

Office 30-34 Level 28

Central Park Tower

DIFC, Dubai

U.A.E

BOS Wealth Management Europe S.A., UK Branch

BOS Wealth Management Europe S.A., UK Branch (BOSWME UK), is authorized and regulated by the Financial Conduct Authority (FCA) and is providing this material for informational purposes only. BOSWME UK does not endorse any specific investments or financial products mentioned in this material. BOSWME UK and its employees accept no liability for any loss or damage arising from the use of this material or reliance on its content.

This material is being distributed to and is directed only at persons in the UK who meet the requirements to be considered “Professional Clients” within the meaning of the Conduct of Business Sourcebook rules on client categorisation, part of the FCA Handbook (the “FCA Rules”) and is not intended for retail investors.

Any person in the UK who receives this material will be deemed to have represented and agreed that it can be considered a Professional Client. Any such recipient will also be deemed to have represented and agreed that it has not received this material on behalf of persons in the UK other than Professional Clients for whom the investor has authority to make decisions on a wholly discretionary basis. BOSWME UK will rely upon the truth and accuracy of the foregoing representations and agreements. Any person who is not a Professional Client should not act or rely on this material or any of their contents.

Investing in financial markets carries the risk of losing capital, and investors should be aware of and carefully consider this risk before making any investment decisions. The value of investments can fluctuate, and there is no guarantee that investors will recoup their initial investment. Past performance is not indicative of future results, and the performance of investments can be affected by various factors, including but not limited to market conditions, economic factors, and changes in regulations or tax laws. Forward-looking statements should not be considered as guarantees or predictions of future events. Investors should be prepared for the possibility of losing all or a portion of their invested capital. It is recommended that investors seek professional advice and conduct thorough research before making any investment decisions.

Cross Border Disclaimer and Disclosures

Refer to https://www.bankofsingapore.com/Disclaimers_and_Disclosures.html for cross-border marketing disclaimers and disclosures.