- 投资

- 2021年01月22 日

加密货币会与黄金竞争吗?

- 加密货币率先以比特币的形式出现,目前已有10多年的历史,并于不久前大幅反弹,形势类似于20世纪70年代的黄金、80年代的日本股票、90年代的互联网股票、21世纪初的油价和20世纪10年代的科技股。

- 但是数字货币仍然不太可能取代国家货币成为交易媒介。

- 不过随着时间的推移,加密货币可能将部分取代黄金,通过电子而非实物的方式提供价值储存。

- 不过数字货币仍需解决信任、波动性、监管层认可度和声誉风险等一系列重要问题,但一旦解决,数字货币有望起到温和的避险作用。

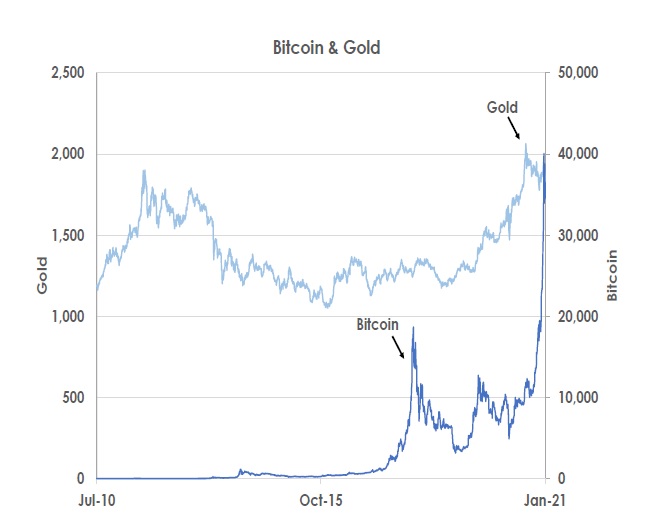

第一种加密货币比特币,现在已经有十多年的历史。在过去的12个月内,比特币获得了相当大的关注,价格从2020年3月的4000美元左右飙升至今年的40000美元以上,之后朝30000美元的水平回落(见图)。

比特币的惊人涨幅与过去几十年的巨大投资热潮不相上下,包括20世纪70年代的黄金、80年代的日本股票、90年代的互联网股票、21世纪初的油价和20世纪10年代的科技股。

但是比特币仍然不太可能取代国家货币成为经济中的主要交易媒介。不过随着时间的推移,数字货币可能将部分取代黄金,通过电子而非实物的方式提供价值储存。

在本文中,我们认为加密货币仍然必须克服的重大问题包括信任、波动性、监管认可度和声誉风险。但一旦这些问题得到解决,数字货币有望成为一种避险资产,在投资者的投资组合中起到温和的避险作用。

介绍

货币有三个核心功能:作为交易媒介、记账单位和价值储存。

资料来源:新加坡银行、彭博

第一批比特币持有者最初旨在拥有一种私人发行且供应量有限的数字货币。政府可通过量化宽松、过度造币和通货膨胀等方式降低法定货币或纸币的价值,但无法通过同样的方式降低比特币的价格。

因此加密货币作为一种交易媒介、记账单位和价值储存手段,将与各国货币相抗衡。

交易媒介

然而,私人发行的加密货币由于其作为交易媒介存在缺陷,不太可能在未来取代政府发行的国家货币。

首先,比特币和黄金一样,进行跨境支付的效率太低,不具有竞争力。

Ethereum是一种能够更快交易的数字货币,但仍然远落后于SWIFT(环球银行金融电信协会)和其他传统支付系统。

其次,通常情况下数字货币的供应量如同黄金一样有限,如果「流通速度」不能相应提高,就无法促进经济活动的增长。

在20世纪30年代大萧条之前的数十年里,政府将本国货币与贵金属挂钩,造就金本位制,产生的重大缺陷则是流通速度低。稀缺的黄金储备限制了货币供应,抑制了经济增长,并引发了多轮通缩。

第三,政府不会容忍任何货币直接威胁到其货币主权。

例如,科技公司Facebook宣布推行数字货币libra不久,就面临着非常强烈的监管阻力。

各国政府对任何有可能取代本国货币的科技均非常警惕,因为这可能不利于决策层在经济危机期间印钱或在平时从「铸币税」获取利益。铸币税是指以面值减去纸币和硬币的生产成本后发行法定货币的财务收益。

值得注意的是,一些央行正在使用自己的区块链技术推出数字货币,但新的电子货币仍将以各国央行的本币计价。

记账单位

如果随着时间的推移,商品和劳务变成以比特币、ethereum等作为报价单位,加密货币可能获得市场更多的青睐。在这种情况下,数字货币将作为一种「记账单位」,使消费者能够以加密货币的形式比较不同产品的价格。

不过这仍然需要店主以多种货币提供商品,但有进取心的卖家将能够利用好这个机会。过去十年,由于香港店家做好准备,收取大陆游客的在岸人民币(CNY),促使了离岸人民币(CNH)兴起。

价值储存

然而,加密货币最有可能作为价值存储的替代手段。未来,数字货币可能会与黄金竞争,成为一种避险资产。

与黄金相比,加密货币有一些明显的优势。数字货币更受年轻人的欢迎。在数字钱包中存放比特币和其他电子货币亦比较方便。

相比之下,贵金属难以用于日常交易,需要存放在安全的物理地点。

加密货币与黄金亦有几个相似之处。

两者均不赚取任何收益或利息。两种资产的价格在很大程度上都是由投资者需求和金融投机决定的,不过贵金属存在与珠宝商和行业挂钩的真实需求。此外,一些加密货币(包括比特币但不包括ethereum)和黄金一样,供应量有限。

例如,根据世界黄金协会的数据,地面上的黄金储量估计约为19.8万公顿,另有5.7万公吨仍在地下。

因此,以目前每盎司1870美元的价格计算,黄金总供应量约为16.8万亿美元。同样,比特币的总供应量亦仅限于2100万枚,其中近90%已被「开采」。以目前3万美元左右的价格计算,现有比特币供应量价值5670亿美元。

相比之下,法定货币的供应量远大于黄金或加密货币。美联储估计美国广义货币供应量M3为18.8万亿美元。

而这仅为一个国家的纸币。此外,美联储目前正在通过印钞和每月购买1200亿美元的国内债券扩大美元供应,以通过量化宽松支持美国经济。

不过,与黄金或纸币相比,数字货币有一些明显的劣势。

比特币的波动性很大,过去一年从4000美元涨到40000多美元,然后又回到30000美元,大幅的价格波动就说明了这一点。一个月的波动率超过90vols。相比之下,同样衡量欧元和黄金的隐含波动率分别约为6vols和16vols。

除非作为反周期避险工具进行交易,比特币亦与股票和其他风险资产相关

在金融危机中,加密货币更有可能在市场崩盘期间被投资者抛售,犹如2020年3月疫情开始时的市场崩盘。相比之下,黄金自古以来一直被用作价值存储和对冲通货膨胀的工具。

加密货币面临着数字钱包被盗和诈骗的风险。

此外因为比特币和其他私人发行的电子货币可能因匿名特征而受到毒贩、洗钱者和其他犯罪分子的青睐,所以比特币亦存在明显的声誉风险。

最后,黄金作为一种避险贵金属,仅面临与白银的竞争。相比之下,没有什么事物能阻止未来推出新的增强型加密货币,从而使所有其他已经存在的数字货币贬值。

风险

为成为能够实现投资组合多样化的资产,特别是为了在未来作为避险工具与黄金竞争,加密货币需要克服几个重大障碍。

首先,投资者需要值得信赖的机构,能够安全地持有数字货币。

自2009年比特币首次出现以来,持有者丢失电子钱包钥匙或遭受交易所盗窃的风险一直居高不下。据彭博报道,2014年,日本的一家交易所Mount Gox遭到黑客攻击,导致客户损失约85万枚比特币。

其次,流动性需要大幅提高,将波动性降低到可控水平。

即使加密货币首次开始流通后已经过10年,市场走势仍经常令人费解,价格数据不完善,难以分析当前趋势或做出预测。

未来,机构投资者(相对于对冲基金和散户投资者而言,资产管理公司拥有更长的时间跨度)进一步参与比特币交易,将有助于增加流动性,降低波动性,并使价格走势更多地由基本面驱动,而非由投机行为驱动。

第三,监管机构需要对数字货币更加包容,让机构和散户投资者更广泛地参与其中。

2020年10月,英国金融行为监理总署禁止向散户出售涉及加密货币的衍生品。金融行为监理总署亦警告称,此类产品估值困难,还存在市场滥用、网络盗窃和价格极度波动的风险。

相比之下,美国监管机构可能更青睐加密货币。商品期货交易委员会(CFTC)前主席格里·根斯勒将成为美国证券交易委员会的下一任主席。美国证券交易委员会一直对电子货币持怀疑态度。但根斯勒最近一直在麻省理工学院(MIT)教授金融技术和数字货币,因此可能愿意允许更广泛地投资加密货币。

第四,政府机构需要遏制犯罪活动,降低持有数字货币的声誉风险。

美国财政部提议,加密货币托管人和交易所应收集和报告可识别利用「非托管钱包」(即在金融机构之外持有的加密货币账户)进行大型交易的讯息,以保护国家安全,打击洗钱和其他犯罪行为。

但财政部杜绝非法交易的提议,目前正遭到业界的强烈反对。

里程碑

上述障碍表明,投资者能够广泛将数字货币纳入投资组合之前,数字货币仍然存在明显的障碍——信任、波动性、监管层认可度和声誉风险。

如果美国证券交易委员会批准比特币或另一种加密货币的交易所买卖基金(ETF),这将是一个重要的里程碑。此举将提供一个值得信赖并且可靠的投资工具,允许新参与者投资数字货币,提高流动性,降低波动性,并有助于降低声誉风险。

2004年11月,纽约证券交易所推出了SPDR黄金股票交易所买卖基金。该基金由实物黄金提供支持,并在黄金价格达到每盎司400美元时开始交易。

与黄金挂钩的交易所买卖基金推出后,吸引了更多的黄金投资者,并支持金价连年上涨。去年,金价创下每盎司2075美元的历史新高。

结论

加密货币在未来有望成为一代替代资产,起到温和的避险作用。

然而,私人发行的电子货币不太可能在未来取代政府发行的法定货币所起到的交易媒体地位。但是,一旦克服了包括信任、波动性、监管层认可度和声誉风险等重大障碍,数字货币可能会随着时间的推移部分取代黄金,通过电子而非实物的方式提供价值储存。

免责声明适用于推荐This product may only be offered: (i) in Hong Kong, to qualified Private Banking Customers and Professional Investors (as defined under the Securities and Futures Ordinance); and (ii) in Singapore, to Accredited Investors (as defined under the Securities and Futures Act) and (iii) in the Dubai International Financial Center to Professional Clients (as defined under the Dubai Financial Services Authority rules) only. No other person should act on the contents of this document.

This product may involve derivatives. Do NOT invest in it unless you fully understand and are willing to assume the risks associated with it. If you have any doubt, you should seek independent professional financial, tax and/or legal advice as you deem necessary.

Please carefully read and make sure that you understand all Risk Disclosures, Selling Restrictions, and Disclaimers. This document must be read together with the relevant Prospectus & Offering Documents &/or Key Fact Statement.

Disclaimer

This document is prepared by Bank of Singapore Limited (Co Reg. No.: 197700866R) (the “Bank”), is for information purposes only, and is not, by itself, intended for anyone other than the recipient. It may contain information proprietary to the Bank which may not be reproduced or redistributed in whole or in part without the Bank’s prior consent. It is not an offer or a solicitation to deal in any of the investment products referred to herein or to enter into any legal relations, nor an advice or by itself a recommendation with respect to such investment products. It does not have regard to the specific investment objectives, investment experience, financial situation and the particular needs of any recipient or customer. Customers should exercise caution in relation to any potential investment. Customers should independently evaluate each investment product and consider the suitability of such investment product, taking into account customer’s own specific investment objectives, investment experience, financial situation and/or particular needs. Customers will need to decide on their own as to whether or not the contents of this document are suitable for them. If a customer is in doubt about the contents of this document and/or the suitability of any investment products mentioned in this document for the customer, the customer should obtain independent financial, legal and/or tax advice from its professional advisers as necessary, before proceeding to make any investments.

The Bank, its Affiliates and their respective employees are not in the business of providing, and do not provide, tax, accounting or legal advice to any clients. The material contained herein is prepared for informational purposes and is not intended or written to be used, and cannot be used or relied upon for tax, accounting or legal advice. Any such client is responsible for consulting his/her own independent advisor as to the tax, accounting and legal consequences associated with his/her investments/transactions based on the client’s particular circumstances.

This document and other related documents have not been reviewed by, registered or lodged as a prospectus, information memorandum or profile statement with the Monetary Authority of Singapore nor any regulator in Hong Kong or elsewhere.

This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Bank’s prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction outside Singapore, Hong Kong, or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank and its related corporations, connected persons, associated persons and/or affiliates (collectively, “Affiliates”) to any registration, licensing or other requirements within such jurisdiction.

Investments in financial instruments or other products carry significant risk, including the possible loss of the principal amount invested. Financial instruments or other products denominated in a foreign currency are subject to exchange rate fluctuations, which may have an adverse effect on the price or value of an investment in such products. No liability is accepted by the Bank for any loss (whether direct, indirect or consequential) that may arise from any use of the information contained in or derived from this document. Past performance is not a guarantee or indication of future results. Any prices provided in this document (other than those that are identified as being historical) are indicative only and do not represent firm quotes as to either price or size. You should contact your local representative directly if you are interested in buying or selling any financial instrument or other product or pursuing any trading strategy, investment strategy or wealth planning structure that may be mentioned in this document.

While reasonable efforts have been made to ensure that the contents of this document have been obtained or derived from sources believed by the Bank and its Affiliates to be reliable, neither the Bank nor its Affiliates has independently verified the accuracy of such source(s). The Bank and its Affiliates and their respective officers, employees, agents and representatives do not make any express or implied representations, warranties or guarantees as to the accuracy, timeliness or completeness of the information, data or prevailing state of affairs that are mentioned in this document and do not accept any liability for any loss or damage whatsoever, direct or indirect, arising from or in connection with the use of the contents of this document.

The Bank and its Affiliates may have issued other reports, analyses, or other documents expressing views different from the contents hereof and all views expressed in all reports, analyses and documents are subject to change without notice. The Bank and its Affiliates reserve the right to act upon or use the contents hereof at any time, including before its publication herein.

The author of this document may have discussed the information contained therein with others within or outside the Bank and the author and/or such other Bank personnel may have already acted on the basis of this information (including communicating the information contained herein to other customers of the Bank). The Bank, its personnel (including those with whom the author may have consulted in the preparation of this communication), and other customers of the Bank may be long or short the financial instruments or other products referred to in this document, may have acquired such positions at prices and market conditions that are no longer available, and may have interests different from or adverse to your interests. The persons providing the information to you may receive commissions, fees, rebates or other non-monetary benefits from any counterparty, broker, agent or another affiliate of the OCBC Group or any other party in respect of any trades or transactions effected for you including in relation to the investments referred to herein.

Bank of Singapore Limited is a licensed bank regulated by the Monetary Authority of Singapore in Singapore. Bank of Singapore Limited, Hong Kong Branch, is an Authorized Institution as defined in the Banking Ordinance of Hong Kong (Cap 155), regulated by the Hong Kong Monetary Authority in Hong Kong and a Registered Institution as defined in the Securities and Futures Ordinance of Hong Kong (Cap.571) regulated by the Securities and Futures Commission in Hong Kong. Bank of Singapore Limited, its employees and discretionary accounts managed by its Singapore Office may have long or short positions or may be otherwise interested in any of the investment products (including derivatives thereof) referred to in this document and may from time to time dispose of any such investment products. Bank of Singapore Limited forms part of the OCBC Group (being for this purpose Oversea-Chinese Banking Corporation Limited and its subsidiaries, related and affiliated companies). OCBC Group, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Group and its Related Persons may also be related to, and receive fees from, providers of such investment products.

Bank of Singapore Limited adheres to a group policy (as revised and updated from time to time) that provides how entities in the OCBC Group manage or eliminate any actual or potential conflicts of interest which may impact the impartiality of research reports issued by any research analyst in the OCBC Group.

Past performance is not always indicative of likely or future results. The value of any investment or income may go down as well as up. All investments involve an element of risk, including capital loss. Customers who are interested to invest in such investment products should read the risk disclosures and governing terms and conditions that are set out in the relevant offering documents.

Dual currency investments, structured deposits and other investment products are not insured by the Singapore Deposit Insurance Corporation or the Hong Kong Deposit Protection Scheme.

Applicable to clients booked and/or managed in the Dubai International Financial Center (DIFC) only: The information contained herein is exclusively addressed to the recipient. The offering of certain products in this document has not been and will not be registered with the Central Bank of United Arab Emirates or Securities & Commodities Authority in the United Arab Emirates. Any products in this document that are being offered or sold do not constitute a public offering or distribution of securities under the applicable laws and regulations of the United Arab Emirates. This document is not intended for circulation or distribution in or into the UAE, other than to persons in the UAE to whom such circulation or distribution is permitted by, or is exempt from the requirements of, the applicable laws and regulations of the United Arab Emirates. The distribution of the information contained herein by the recipient is prohibited. Where applicable, this document relates to securities which are listed outside of the Abu Dhabi Securities Exchange and the Dubai Financial Market. Bank of Singapore Limited is not authorized to provide investment research regarding securities listed on the exchanges of the United Arab Emirates which are outside of the DIFC.

Cross-Border Marketing

Hong Kong SAR: Bank of Singapore Limited is an Authorized Institution as defined in the Banking Ordinance of Hong Kong (Cap 155), regulated by the Hong Kong Monetary Authority in Hong Kong and a Registered Institution as defined in the Securities and Futures Ordinance of Hong Kong (Cap. 571), regulated by the Securities and Futures Commission in Hong Kong. This document is for information only and is not intended for anyone other than the recipient. It has not been reviewed by any regulatory authority in Hong Kong. It is not by itself an offer or a solicitation to deal in any of the financial products referred to herein or to enter into any legal relations, nor an advice or a recommendation with respect to such financial products. It does not have regard to the specific investment objectives, financial situation, investment experience and the particular needs of any recipient or Investor. This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Bank’s prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction outside Hong Kong, or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank and its related corporations, connected persons, associated persons and/or affiliates to any registration, licensing or other requirements within such jurisdiction. Indonesia: The offering of the investment product in reliance of this document is not registered under the Indonesian Capital Market Law and its implementing regulations, and is not intended to constitute a public offering of securities under the Indonesian Capital Market Law and its implementing regulations. According, this investment product may not be offered or sold, directly or indirectly, within Indonesia or to citizens (wherever they are domiciled or located), entities or residents, in any manner which constitutes a public offering of securities under the Indonesian Capital Market Law and its implementing regulations. Japan: The information contained in this document is for general reference purposes only. It does not have regard to your specific investment objectives, financial situation, risk tolerance and particular needs. Nothing in this document constitutes an offer to buy or sell or an invitation to offer to buy or sell or a recommendation or a solicitation to buy or sell any securities or investment. We do not have any intention of conducting regulated business in Japan. You acknowledge that nothing in this document constitutes investment or financial advice or any advice of any nature. Malaysia: Bank of Singapore Limited does not hold any licence, registration or approval to carry on any regulated business in Malaysia (including but not limited to any businesses regulated under the Capital Markets & Services Act 2007 of Malaysia), nor does it hold itself out as carrying on or purport to carry on any such business in Malaysia. Any services provided by Bank of Singapore Limited to residents of Malaysia are provided solely on an offshore basis from outside Malaysia, either as a result of “reverse enquiry” on the part of the Malaysian residents or where Bank of Singapore Limited has been retained outside Malaysia to provide such services. As an integral part of the provision of such services from outside Malaysia, Bank of Singapore Limited may from time to time make available to such residents documents and information making reference to capital markets products (for example, in connection with the provision of fund management or investment advisory services outside of Malaysia). Nothing in such documents or information is intended to be construed as or constitute the making available of, or an offer or invitation to subscribe for or purchase any such capital markets product. Myanmar: This document and information herein is made available by Bank of Singapore Limited, which is not licensed or registered under the Financial Institutions Law (Law No. 20/2016) or other Myanmar legislation to carry on, nor do they purport to carry on, any regulated activity in Myanmar. The provision of any products and services by Bank of Singapore Limited shall be solely on an offshore basis. You shall ensure that you have and will continue to be fully compliant with all applicable laws in Myanmar when entering into discussion or contracts with Bank of Singapore Limited. Oman: This document does not constitute a public offer of investment, securities or financial services in the Sultanate of Oman, as contemplated by the Commercial Companies Law of Oman (Royal Decree No. 4/1974), Banking Law of Oman (Royal Decree No. 114/2000) or the Capital Market Law of Oman (Royal Decree No. 80/1998) and the Executive Regulations of the Capital Market Law (Ministerial Decision No. 1/2009) or an offer to sell or the solicitation of any offer to buy non-Omani investment products, securities or financial services and products in the Sultanate of Oman. This document is strictly private and confidential. It is being provided to a limited number of sophisticated investors solely to enable them to decide whether or not to make an offer to invest in financial products mentioned in this document, outside of the Sultanate of Oman, upon the terms and subject to the restrictions set out herein and may not be reproduced or used for any other purpose or provided to any person other than the original recipient. Additionally, this document is not intended to lead to the making of any contract within the territory or under the laws of the Sultanate of Oman. The Capital Market Authority of Oman and the Central Bank of Oman take no responsibility for the accuracy of the statements and information contained in this document or for the performance of the financial products mentioned in this document nor shall they have any liability to any person for damage or loss resulting from reliance on any statement or information contained herein. Russia: The investment products mentioned in this document have not been registered with or approved by the local regulator of any country and are not publicly distributed in Singapore or elsewhere. This document does not constitute or form part of an offer or invitation to the public in any country to subscribe for the products referred to herein. South Korea: The document does not constitute an offer, solicitation or investment advertisement to trade in the investment product referred to in the document. Taiwan: The provision of the information and the offer of the service concerned herewith have not been and will not be registered with the Financial Supervisory Commission of Taiwan pursuant to relevant laws and regulations of Taiwan and may not be provided or offered in Taiwan or in circumstances which requires a prior registration or approval of the Financial Supervisory Commission of Taiwan. No person or entity in Taiwan has been authorised to provide the information and to offer the service in Taiwan. Thailand: Please note that neither Bank of Singapore Limited nor any other entities in the Bank of Singapore Limited’s group maintains any licences, authorisations or registrations in Thailand nor is any of the material and information contained, or the relevant securities or products specified herein approved or registered in Thailand. Interests in the relevant securities or products may not be offered or sold within Thailand. The attached information has been provided at your request for informational purposes only and shall not be copied or redistributed to any other person without the prior consent of Bank of Singapore Limited or its relevant entities and in no way constitutes an offer, solicitation, advertisement or advice of, or in relation to, the relevant securities or products by Bank of Singapore Limited or any other entities in Bank of Singapore Limited’s group in Thailand. The Philippines: The information contained in this document is not intended to constitute a public offering of securities under the Securities Regulation Code of the Philippines. Dubai International Financial Center (DIFC): Bank of Singapore Limited has a branch registered in the Dubai International Financial Centre ("DIFC") which is regulated by the Dubai Financial Services Authority (“DFSA”). Bank of Singapore Limited (DIFC Branch) is not a financial institution licensed in the United Arab Emirates outside of the DIFC and does not undertake banking or financial activities in the United Arab Emirates nor is it licensed to do so outside of the DIFC. This material is provided for information purposes only and it is general information not specific in any way to any particular investor, investor type, strategy, investment need or other financial circumstance. As such this information is not financial advice or a financial promotion, nor is it intended to influence an investor's decision to invest. It is not to be construed as an offer to buy or sell or solicitation of an offer to buy or sell any financial instruments or to participate in any particular trading strategy in any jurisdiction. The material is only intended for persons who fulfill the criteria to be classified as “Professional Clients” as defined under the DFSA rules and should not be reviewed, received, provided to or relied upon by any other person. United Arab Emirates (U.A.E): The information contained herein is exclusively addressed to the recipient. The offering of certain products in this document has not been and will not be registered with the Central Bank of United Arab Emirates or Securities & Commodities Authority in the United Arab Emirates. Any products in this document that are being offered or sold do not constitute a public offering or distribution of securities under the applicable laws and regulations of the United Arab Emirates. This document is not intended for circulation or distribution in or into the UAE, other than to persons in the UAE to whom such circulation or distribution is permitted by, or is exempt from the requirements of, the applicable laws and regulations of the United Arab Emirates. The distribution of the information contained herein by the recipient is prohibited. Where applicable, this document relates to securities which are listed outside of the Abu Dhabi Securities Exchange and the Dubai Financial Market. The Bank of Singapore Limited is not authorized to provide investment research regarding securities listed on the exchanges of the United Arab Emirates which are outside of the DIFC. United Kingdom: In the United Kingdom, this document is being made available only to the person or the entity to whom it is directed being persons to whom it may lawfully be directed under applicable laws and regulations of the United Kingdom (such persons are hereinafter referred to as ‘relevant persons’). Accordingly, this document is communicated only to relevant persons. Persons who are not relevant persons must not act on or rely on this document or any of its contents. Any investment or investment activity to which this document relates is available only to relevant persons and will be engaged in only with relevant persons. Relevant persons in receipt of this document must not distribute, publish, reproduce, or disclose this document (in whole or in part) to any person who is not a relevant person. United States of America: This product may not be sold or offered within the United States or to U.S. persons.

Brunei: This document has not been delivered to, licensed or permitted by the Autoriti Monetari Brunei Darussalam, the authority as designated under the Brunei Darussalam Securities Markets Order, 2013 and the Banking Order, 2006; nor has it been registered with the Registrar of Companies, Registrar of International Business Companies or the Brunei Darussalam Ministry of Finance. The products mentioned in this document are not registered, licensed or permitted by the Autoriti Monetari Brunei Darussalam or by any other government agency or under any law in Brunei Darussalam. Any offers, acceptances, sales and allotments of the products shall be made outside Brunei Darussalam.