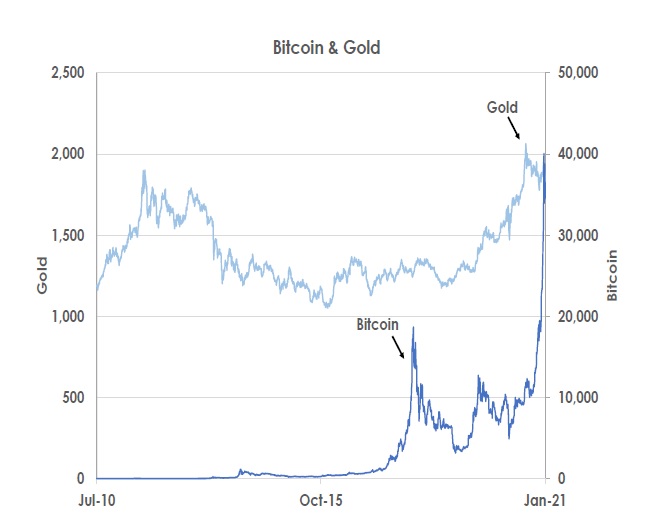

The first cryptocurrency, bitcoin, is now more than a decade old. Over the past twelve months it has gained considerable attention by soaring in price from around USD4,000 in March 2020 to over USD40,000 this year before falling back towards USD30,000 (see chart).

Bitcoin’s staggering rally is on a par with the great investment booms of the last few decades including gold in the 1970s, Japanese equities in the 1980s, internet stocks in the 1990s, oil prices in the 2000s and technology companies in the 2010s.

But cryptocurrencies are still very unlikely to replace national currencies as any economy’s principal medium of exchange. Instead, digital money over time may partially displace gold by offering an electronic - rather than physical - store of value.

In this note we argue that cryptocurrencies must still overcome important hurdles including trust, volatility, regulatory acceptance and reputational risks. But once these disadvantages have been addressed, digital currencies may play a modest but still useful role in investor portfolios as a potential safe-haven asset.

Introduction

Money has three core functions: to be a medium of exchange, a unit of account and a store of value.

Source: Bank of Singapore, Bloomberg

The original vision of the first bitcoin holders was to have a privately issued digital currency of limited supply that could not be debased by governments in the same way that fiat or paper currencies could through quantitative easing, excessive money creation and inflation.

Thus, cryptocurrencies would come to rival national currencies as a medium of exchange, a unit of account and a store of value.

Medium of exchange

Privately issued cryptocurrencies, however, are very unlikely to replace government issued national currencies in future because of their flaws as a medium of exchange.

First, bitcoin, like gold, is too inefficient to make cross-border payments in a competitive manner.

Ethereum is a digital currency with the capacity to undertake faster transactions but it is still far behind SWIFT - the Society for Worldwide Interbank Financial Telecommunication - and other conventional payment systems.

Second, digital currencies - often limited in supply like gold - are unable to facilitate growing economic activity if their ‘velocity of circulation’ does not rise correspondingly.

This was the crucial disadvantage of the gold standard when governments linked their national currencies to the precious metal in the decades leading up to the 1930s Great Depression. Scarce reserves of gold constrained the supply of money, holding back economic growth and causing bouts of deflation.

Third, governments will not tolerate any direct challenges to their monetary sovereignty.

For example, Facebook’s digital currency, libra, faced very strong regulatory resistance as soon as the technology firm announced its plans.

Governments are very wary of any technology that could potentially displace national currencies. This would reduce the ability of policymakers to print money during economic crises or to benefit during ordinary times from ‘seigniorage’ - the financial gain from issuing fiat currencies at face value less the cost of producing notes and coins.

Notably, several central banks are launching digital currencies using their own blockchain technology. But the new electronic money will still be denominated in each central bank’s domestic currency.

Unit of account

Cryptocurrencies are likely to be gain more traction over time if goods and services become quoted in bitcoin, ethereum, etc. In that case, digital money will act as a ‘unit of account’ allowing consumers to compare the prices of different products in cryptocurrency terms.

This will still require shopkeepers to offer wares in more than one currency. But enterprising sellers will take the opportunity. The rise of the offshore yuan (CNH) over the last decade was initially spurred by Hong Kong storeowners being ready to accept onshore yuan (CNY) from Chinese tourists visiting from the mainland.

Store of value

The most likely role for cryptocurrencies, however, is as an alternative store of value. Digital money may compete in future with gold as a potential safe-haven asset.

Cryptocurrencies have some clear advantages over gold. Digital money is more popular with younger people. It is also easier to hold bitcoins and other electronic money in digital wallets.

In contrast, precious metals are unwieldly to use for everyday transactions and need to be stored in secure, physical locations.

Cryptocurrencies also have several similarities to gold.

Neither earn any yield or interest. Both assets’ prices are largely determined by investor demand and financial speculation - though precious metals have underlying, real demand from jewellers and industry. Further, some cryptocurrencies - including bitcoin but not ethereum - are limited in supply like gold.

For example, gold holdings above ground are estimated to be around 198,000 metric tonnes with another 57,000 metric tonnes still below ground according to the World Gold Council.

Thus, at current prices of USD1,870 an ounce, total gold supply is worth around USD16.8 trillion. Similarly, total bitcoin supply is limited to 21 million coins of which almost 90% have already been ‘mined’. At current prices around USD30,000, existing bitcoin supply is worth USD567 billion.

In contrast, the supply of fiat currencies is much greater than that of gold or cryptocurrencies. The Federal Reserve estimates America’s broad money supply, M3, stands at USD18.8 trillion.

This is just one country’s paper currency. Moreover, the Fed is currently expanding the supply of dollars by printing money and buying USD120 billion a month of domestic bonds to support the US economy through quantitative easing.

Digital money, however, has some clear disadvantages versus gold or paper currencies.

Bitcoin is highly volatile as its rally over the past year from USD4,000 to over USD40,000 and then back towards USD30,000 shows. One-month volatility is over 90 vols. In contrast the same measure of implied volatility for the EUR and for gold are around 6 vols and 16 vols respectively.

Bitcoin is also correlated with stocks and other risk assets rather than trading as a counter-cyclical safe-haven.

In a financial crisis, cryptocurrencies are more likely to be dumped by investors during a market meltdown as occurred at the start of the pandemic in March 2020. In contrast, gold has been used since ancient times as a store of value and a hedge against inflation.

Cryptocurrencies are at risk of theft from digital wallets as well as from fraud.

There are also clear reputational risks as bitcoin and other privately issued electronic currencies may be favoured by drug dealers, money launders and other criminals for their anonymity.

Last, gold only faces competition from silver as a safe-haven precious metal. In contrast, there is nothing to stop new enhanced cryptocurrencies from being launched in future, devaluing all other digital currencies already in existence.

Risks

To become a feasible asset for portfolio diversification - particularly to compete with gold as a safe-haven hedge in future - cryptocurrencies need to overcome several significant hurdles.

First, investors need trustworthy institutions to be able to hold digital currencies securely.

Since bitcoin first appeared in 2009, the risk of holders losing the keys to electronic wallets or suffering theft from exchanges has been significant. In 2014, Mount Gox, an exchange in Japan, was hacked, resulting in customers losing around 850,00 bitcoins according to Bloomberg.

Second, liquidity needs to improve significantly to reduce volatility to manageable levels.

Even a decade after cryptocurrencies first started circulating, market action still often seems inexplicable and poor data on prices makes it hard to analyse current trends or make forecasts.

In future, increased participation by institutional investors - asset managers with longer-term time horizons compared to hedge funds and retail investors - would help to increase liquidity, lower volatility and result in price action being driven more by fundamentals than by speculation.

Third, regulators need to become more accommodative of digital currencies to allow broader participation by institutional and retail investors.

In October 2020, the UK Financial Conduct Authority banned the sale of derivatives referencing cryptocurrencies to retail customers. The FCA warned of the difficulties of valuing such products as well as the risks of market abuse, cyber-theft and the extreme volatility of prices.

In contrast, US regulators may become more favourable to cryptocurrencies. Gary Gensler, a former head of the Commodity Futures Trading Commission (CFTC), is due to become the next Chairman of the US Securities and Exchange Commission. The SEC has been sceptical about electronic money. But Gensler has recently been teaching at the Massachusetts Institute of Technology (MIT) on financial technology and digital currencies and may thus be willing to allow broader investment in cryptocurrencies.

Fourth, government agencies need to curtail criminal activity to reduce the reputational risks for holding digital money.

The US Treasury is proposing that cryptocurrency custodians and exchanges should collect and report information that identifies large transactions involving ‘un-hosted wallets’ - cryptocurrency accounts held outside financial institutions - to protect national security and to clamp down on money laundering and other crimes.

But the Treasury’s proposals to stamp out illicit transactions are currently facing strong opposition from the industry.

Milestones

The above hurdles show that digital currencies still have clear barriers - trust, volatility, regulatory acceptance and reputational risks - before becoming widely suitable for investor portfolios.

An important milestone here would be if the SEC approved an exchange-traded fund (ETF) for bitcoin or another cryptocurrency. This would, offer a trustworthy, reliable investment vehicle, allow fresh participants to enter digital currencies, improve liquidity, lower volatility and help deal with reputational risks.

In November 2004, the New York Stock Exchange launched the SPDR Gold Shares ETF. It was backed by physical gold and began trading when the yellow metal was at USD400 an ounce.

The availability of a gold-linked ETF helped widen the range of bullion investors and supported a multi-year rally in prices. Last year gold hit a record high of USD2,075 an ounce.

Conclusions

Cryptocurrencies are likely to have a modest but still useful role as an alternative asset in future.

Privately issued electronic currencies are very unlikely to replace government issued fiat currencies as a medium of exchange.

But digital currencies may partially displace gold over time by offering an electronic - rather than physical - store of value once important hurdles including trust, volatility, regulatory acceptance and reputational risks have been overcome.

Disclaimers and Disclosures

This material is prepared by Bank of Singapore Limited (Co Reg. No.: 197700866R) (the “Bank”) and is distributed in Singapore by the Bank.

This material does not provide individually tailored investment advice. This material has been prepared for and is intended for general circulation. The contents of this material does not take into account the specific investment objectives, investment experience, financial situation, or particular needs of any particular person. You should independently evaluate the contents of this material, and consider the suitability of any product discussed in this material, taking into account your own specific investment objectives, investment experience, financial situation and particular needs. If in doubt about the contents of this material or the suitability of any product discussed in this material, you should obtain independent financial advice from your own financial or other professional advisers, taking into account your specific investment objectives, investment experience, financial situation and particular needs, before making a commitment to purchase any product.

This material is not and should not be construed, by itself, as an offer or a solicitation to deal in any product or to enter into any legal relations. You should contact your own licensed representative directly if you are interested in buying or selling any product discussed in this material.

This material is not intended for distribution, publication or use by any person in any jurisdiction outside Singapore, Hong Kong or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank or its related corporations, connected persons, associated persons or affiliates (collectively “Affiliates”) to any licensing, registration or other requirements in such jurisdiction.

The Bank and its Affiliates may have issued other reports, analyses, or other documents expressing views different from the contents of this material, and may provide other advice or make investment decisions that are contrary to the views expressed in this material, and all views expressed in all reports, analyses and documents are subject to change without notice. The Bank and its Affiliates reserve the right to act upon or use the contents of this material at any time, including before its publication.

The author of this material may have discussed the information or views contained in this material with others within or outside the Bank, and the author or such other Bank employees may have already acted on the basis of such information or views (including communicating such information or views to other customers of the Bank).

The Bank, its employees (including those with whom the author may have consulted in the preparation of this material))and discretionary accounts managed by the Bank may have long or short positions (including positions that may be different from or opposing to the views in this material or may be otherwise interested in any of the product(s) (including derivatives thereof) discussed in material, may have acquired such positions at prices and market conditions that are no longer available, may from time to time deal in such product(s) and may have interests different from or adverse to your interests.

Analyst Declaration

The analyst(s) who prepared this material certifies that the opinions contained herein accurately and exclusively reflect his or her views about the securities of the company(ies) and that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein.

The analyst(s) who prepared this material and his/her associates do not have financial interests in the company(ies). Financial interests refer to investments in securities, warrants and/or other derivatives. The analyst(s) receives compensation based on the overall revenues of Bank of Singapore Limited, and no part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this material. The reporting line of the analyst(s) is separate from and independent of the business solicitation or marketing departments of Bank of Singapore Limited.

The analyst(s) and his/her associates confirm that they do not serve as directors or officers of the company(ies) and the company(ies)or other third parties have not provided or agreed to provide any compensation or other benefits to the analyst(s) in connection with this material.

An “associate” is defined as (i) the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child, or any sibling or step-sibling of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, parent or step-parent, minor child (natural or adopted) or minor step-child, or sibling or step-sibling is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Conflict of Interest Declaration

The Bank is a licensed bank regulated by the Monetary Authority of Singapore in Singapore. Bank of Singapore Limited, Hong Kong Branch (incorporated in Singapore with limited liability), is an Authorized Institution as defined in the Banking Ordinance of Hong Kong (Cap 155), regulated by the Hong Kong Monetary Authority in Hong Kong and a Registered Institution as defined in the Securities and Futures Ordinance of Hong Kong (Cap.571) regulated by the Securities and Futures Commission in Hong Kong. The Bank, its employees and discretionary accounts managed by its Singapore Office/Hong Kong Office may have long or short positions or may be otherwise interested in any of the investment products (including derivatives thereof) referred to in this document and may from time to time dispose of any such investment products. The Bank forms part of the OCBC Group (being for this purpose Oversea-Chinese Banking Corporation Limited (“OCBC Bank”) and its subsidiaries, related and affiliated companies). OCBC Group, their respective directors and/or employees (collectively “Related Persons”) may have interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Group and its Related Persons may also be related to, and receive fees from, providers of such investment products. There may be conflicts of interest between OCBC Bank, the Bank, OCBC Investment Research Private Limited, OCBC Securities Private Limited or other members of the OCBC Group and any of the persons or entities mentioned in this report of which the Bank and its analyst(s) are not aware due to OCBC Bank’s Chinese Wall arrangement.

The Bank adheres to a group policy (as revised and updated from time to time) that provides how entities in the OCBC Group manage or eliminate any actual or potential conflicts of interest which may impact the impartiality of research reports issued by any research analyst in the OCBC Group.

If this material pertains to an offer, it may only be offered (i) in Hong Kong, to qualified Private Banking Customers and Professional Investors (as defined under the Securities and Futures Ordinance); (ii) in Singapore, to Accredited Investors (as defined under the Securities and Futures Act 2001); and (iii) in the Dubai International Financial Center, to Professional Clients (as defined under the Dubai Financial Services Authority rules). No other persons may act on the contents of the material.

Other Disclosures

Singapore

Where this material relates to structured deposits, this clause applies:

The product is a structured deposit. Structured deposits are not insured by the Singapore Deposit Insurance Corporation. Unlike traditional deposits, structured deposits have an investment element and returns may vary. You may wish to seek independent advice from a financial adviser before making a commitment to purchase this product. In the event that you choose not to seek independent advice from a financial adviser, you should carefully consider whether this product is suitable for you.

Where this material relates to dual currency investments, this clause applies:

The product is a dual currency investment. A dual currency investment product (“DCI”) is a derivative product or structured product with derivatives embedded in it. A DCI involves a currency option which confers on the deposit-taking institution the right to repay the principal sum at maturity in either the base or alternate currency. Part or all of the interest earned on this investment represents the premium on this option.

By purchasing this DCI, you are giving the issuer of this product the right to repay you at a future date in an alternate currency that is different from the currency in which your initial investment was made, regardless of whether you wish to be repaid in this currency at that time. DCIs are subject to foreign exchange fluctuations which may affect the return of your investment. Exchange controls may also be applicable to the currencies your investment is linked to. You may incur a loss on your principal sum in comparison with the base amount initially invested. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether this product is suitable for you.

Hong Kong

This document has not been delivered for registration to the Registrar of Companies in Hong Kong and its contents have not been reviewed by any regulatory authority in Hong Kong. Accordingly: (i) the shares/notes may not be offered or sold in Hong Kong by means of any document other than to persons who are "Professional Investors" within the meaning of the Securities and Futures Ordinance (Cap. 571) of Hong Kong and the Securities and Futures (Professional Investor) Rules made thereunder or in other circumstances which do not result in the document being a "prospectus" within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance; and (ii) no person may issue any invitation, advertisement or other document relating to the shares/notes whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to the shares/notes which are or are intended to be disposed of only to persons outside Hong Kong or only to "Professional Investors" within the meaning of the Securities and Futures Ordinance and the Securities and Futures (Professional Investor) Rules made thereunder.

The product may involve derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you have any doubt, you should seek independent professional financial, tax and/or legal advice as you deem necessary.

Where this material relates to a Complex Product, this clause applies:

Warning Statement and Information about Complex Product

(Applicable to accounts managed by Hong Kong Relationship Manager)

Where this material relates to a Complex Product – funds and ETFs, this clause applies additionally:

Where this material relates to a Complex Product (Options and its variants, Swap and its variants, Accumulator and its variants, Reverse Accumulator and its variants, Forwards), this clause applies additionally:

Where this material relates to a Loss Absorption Product, this clause applies:

Warning Statement and Information about Loss Absorption Products

(Applicable to accounts managed by Hong Kong Relationship Manager)

Before you invest in any Loss Absorption Product (as defined by the Hong Kong Monetary Authority), please read and ensure that you understand the features of a Loss Absorption Product, which may generally have the following features:

Where this material relates to a certificate of deposit, this clause applies:

It is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Where this material relates to a structured deposit, this clause applies:

It is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Where this material relates to a structured product, this clause applies:

This is a structured product which involves derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you are in any doubt about the risks involved in the product, you may clarify with the intermediary or seek independent professional advice.

Dubai International Financial Center

Where this material relates to structured products and bonds, this clause applies:

The Distributor represents and agrees that it has not offered and will not offer the product to any person in the Dubai International Financial Centre unless such offer is an “Exempt Offer” in accordance with the Market Rules of the Dubai Financial Services Authority (the “DFSA”).

The DFSA has no responsibility for reviewing or verifying any documents in connection with Exempt Offers.

The DFSA has not approved the Information Memorandum or taken steps to verify the information set out in it, and has no responsibility for it.

The product to which this document relates may be illiquid and/or subject to restrictions in respect of their resale. Prospective purchasers of the products offered should conduct their own due diligence on the products.

Please make sure that you understand the contents of the relevant offering documents (including but not limited to the Information Memorandum or Offering Circular) and the terms set out in this document. If you do not understand the contents of the relevant offering documents and the terms set out in this document, you should consult an authorised financial adviser as you deem necessary, before you decide whether or not to invest.

Where this material relates to a fund, this clause applies:

This Fund is not subject to any form of regulation or approval by the Dubai Financial Services Authority (“DFSA”). The DFSA has no responsibility for reviewing or verifying any Prospectus or other documents in connection with this Fund. Accordingly, the DFSA has not approved the Prospectus or any other associated documents nor taken any steps to verify the information set out in the Prospectus, and has no responsibility for it. The Units to which this Fund relates may be illiquid and/or subject to restrictions on their resale. Prospective purchasers should conduct their own due diligence on the Units. If you do not understand the contents of this document you should consult an authorized financial adviser. Please note that this offer is intended for only Professional Clients and is not directed at Retail Clients.

These are also available for inspection, during normal business hours, at the following location:

Bank of Singapore

Office 30-34 Level 28

Central Park Tower

DIFC, Dubai

U.A.E

Cross Border Disclaimer and Disclosures

Refer to https://www.bankofsingapore.com/Disclaimers_and_Disclosures.html for cross-border marketing disclaimers and disclosures.