The holy grail for investors is to buy low and sell high, but the brutal truth is that few people manage to get this right consistently. “Timing the market” sounds like a genius move, but is a losing game for most investors in reality. The alternative? Staying invested, letting time and compounding growth do the heavy lifting. History has proven that those who try to outsmart the market usually end up worse off than those who simply stay in it. This paper breaks down why time in the market beats timing the market – and why patience, not prediction, is the real key to wealth.

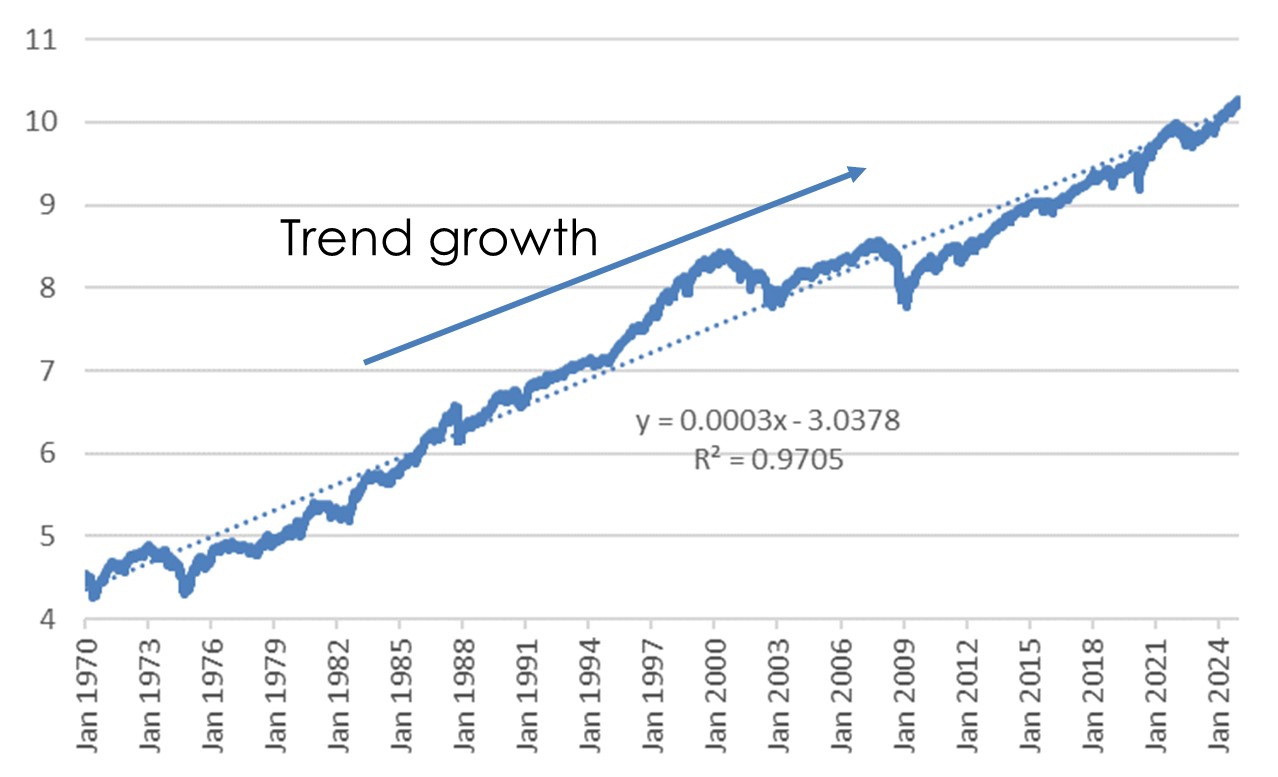

To illustrate the value of a long-term versus short-term mindset, consider the following chart showing the S&P 500 Total Return Index using daily data since 1970. The index shows the steady upward trend of US equities, punctuated by temporary episodes of downturns.[1] A long-term mindset focused on multi-year performance seeks to capture the return potential arising from secular, fundamental forces: market competition that enhances profitability, durable trends that bolster revenue growth, and greater financial market participation which deepens demand for financial products. These are some key fundamental drivers underpinning the long-term growth in equities.

Exhibit 1: S&P 500 Total Returns Index (in natural logs, daily observations, 1970-2024)

Source: Bloomberg, Bank of Singapore.

In contrast, a short-term mindset aims to time entry and exit to maximise returns. This has to be timed exquisitely – selling before a drop and buying back before a rally – in order to be profitable. Most investors get one or both of these decisions wrong, held back by fear of missing out and selling a rally, or fear of entering a market that has sold off.

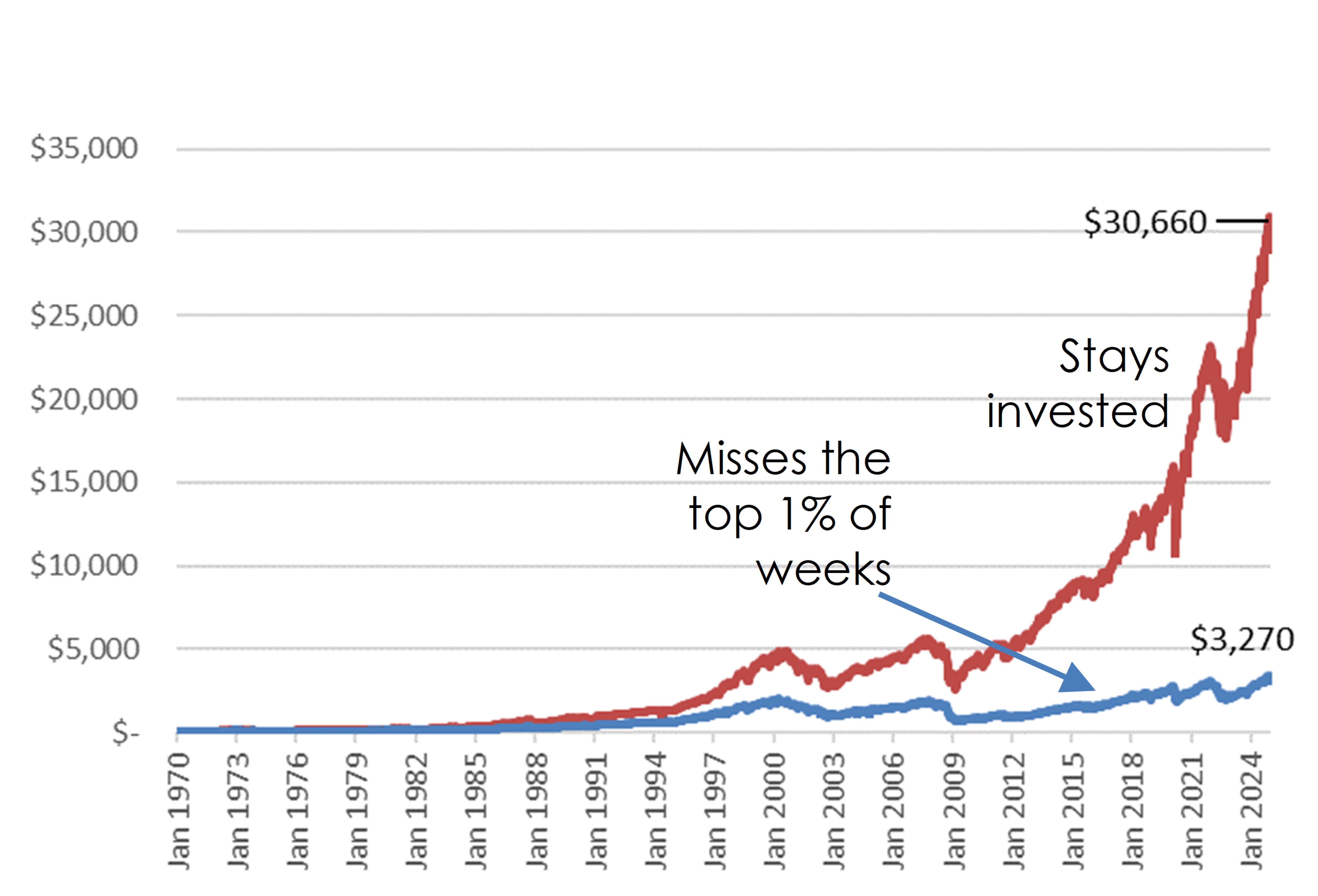

Timing is crucial, and the costs of bad timing can be significant. Statistical evidence shows that missing just a few of the best-performing periods significantly reduces returns. The following example shows the final value of USD100 invested in the S&P 500 Index in 1970 for an investor who stays invested through 2024, and the final value of the same initial USD100 if the investor misses the best 1% of weeks. The disparity is stark.

Exhibit 2: Value of USD100 invested in 1970 in the S&P 500 Index when fully invested, and when missing the 1% best weekly returns

Source: Bloomberg, Bank of Singapore.

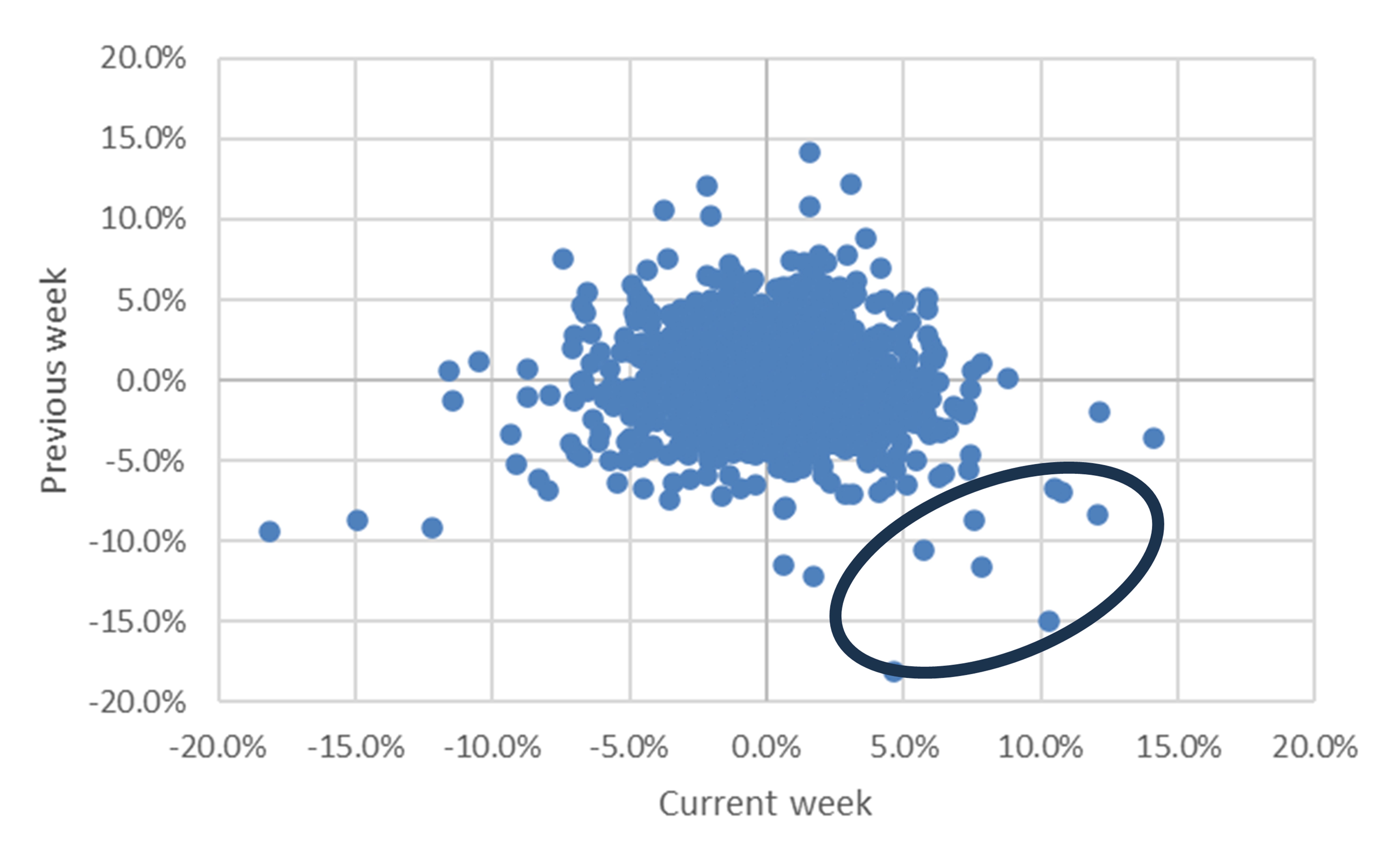

Weekly (or other such high frequency) returns are random in nature, such that no clear pattern exists between current observations and previous ones (the following scatter plot illustrates this by mapping weekly returns vs the previous week’s). Moreover, factors driving high frequency returns are difficult to predict (more on that later). Hence, perfect timing is a Herculean task.

Exhibit 3: S&P 500 Index weekly total returns versus previous weekly returns (1970-2024)

Source: Bloomberg, Bank of Singapore.

Instead, mistakes in timing are often made, with missing the top 1% returns a stylized, but not outlandish example. The best and worst weeks are frequently close together: historically, the stock market’s biggest upswings often happen immediately after its biggest downswings (highlighted in the bottom right quadrant of the above chart). Well-documented investor behavioural biases mean that fear and panic can drive impulsive and sub-optimal decisions, such as selling at the bottom, forgoing the recovery phase, which often includes the top weekly performance.

Mindset shift: Reframe the time frame

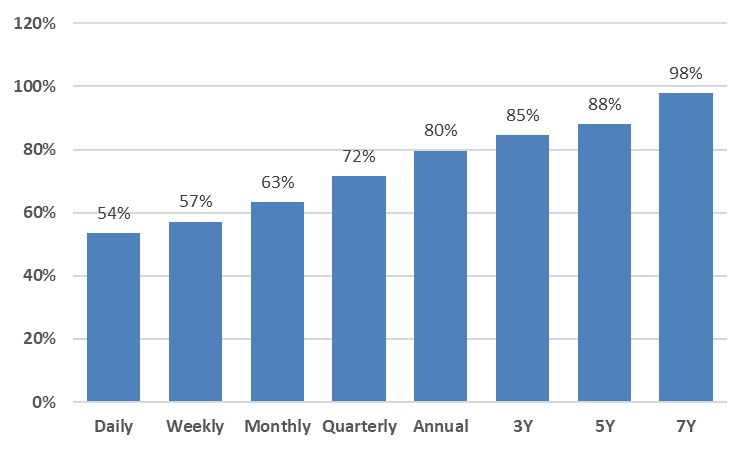

Intentionally pivoting the focus from daily, weekly or monthly returns to a longer time horizon, such as annual or multi-year, shifts the perspective from short-term noise to long-term growth, reinforcing the case of time in the market over timing the market. The following chart shows the share of positive returns in the S&P 500 Index using different frequencies (i.e., returns computed over daily, monthly, quarterly, annual and multi-year horizons).

Exhibit 4: Share of positive total returns in the S&P 500 Index over 1970-2024 using returns computed over different frequencies

Source: Bloomberg, Bank of Singapore.

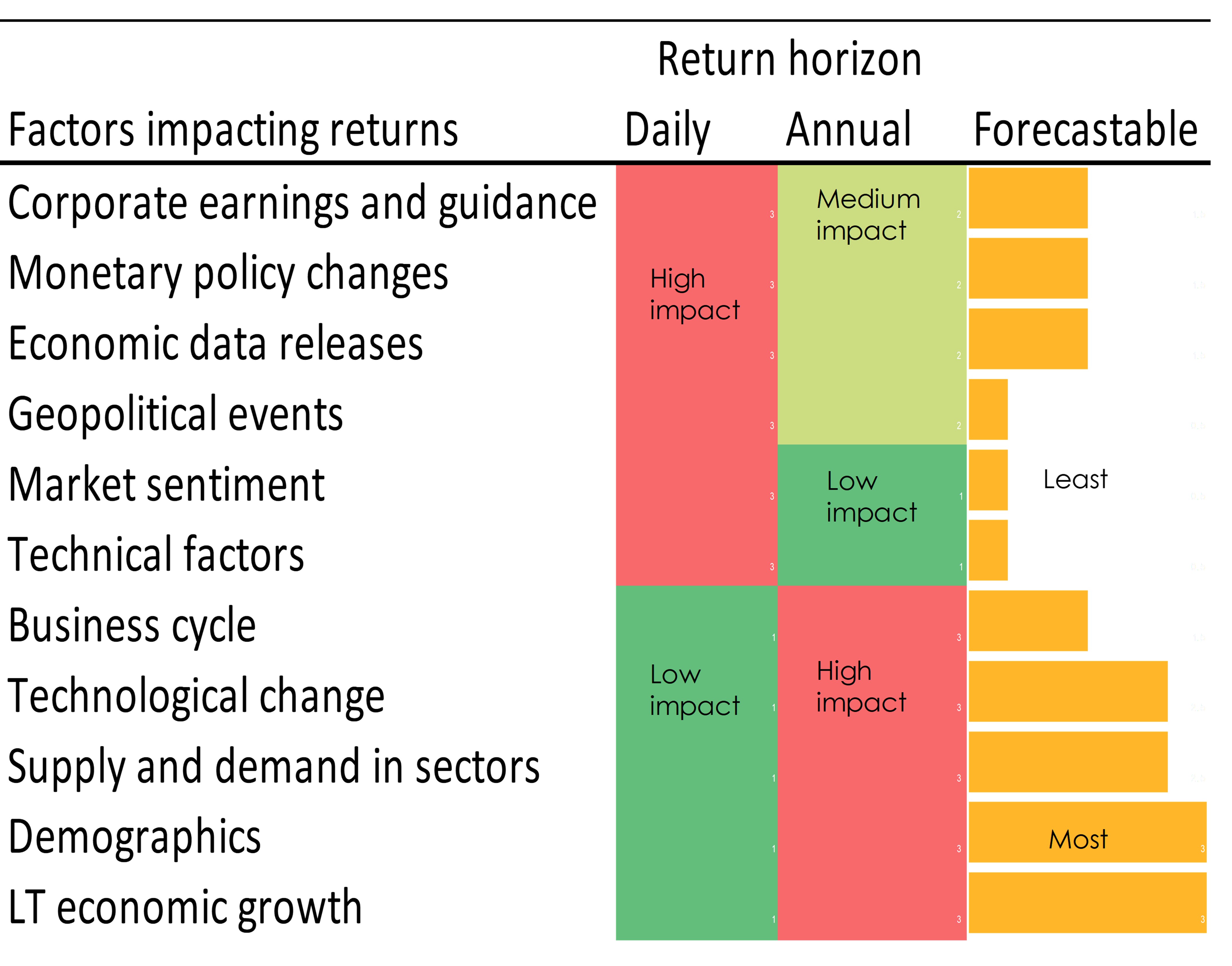

Investors focused on daily returns observe 54% positive days vs 46% negative. These returns fluctuate significantly, and can lead to stress and impulsive decision making, such as panic selling and overtrading. Moreover, many factors that exert a large impact on short-term return dynamics – such as geopolitical events, jolts to market sentiment, and technical factors – are at best difficult to predict, and often, impossible to anticipate (see the top part of Exhibit 5, which lists the high impact” factors driving daily performance). Overconfidence bias leads investors to believe they can consistently predict market movements, when in fact, many of the short-term drivers are outside the forecasting realm.

Exhibit 5: Factors driving short-term and long-term performance of equity markets

Source: Bank of Singapore.

However, as the horizon expands beyond daily, to monthly or even multiyear frames of reference, the share of positive return outcomes rises (see Exhibit 4): higher frequency fluctuations are smoothed out, and fundamental factors that drive earnings prevail. Measured over a 12 month horizon, the share of positive outcomes jumps to 80%, and for investors patient enough to invest over a full business cycle (usually 7 years), the proportion of positive return outcomes jumps to 98%, as peaks and dips in returns associated with business cycle fluctuations are levelled out.

Moreover, the factors that drive long-term multi-year performance can be more systematically approximated, as illustrated in the bottom half of Exhibit 5, listing “high impact” factors for annual returns: for example, pre-determined demographic trends, and estimates of long-term economic growth grounded in equilibrium concepts around labour and investment growth, contribute to greater conviction around forecasting. Hence, by pivoting to a longer-term lens used to evaluate investments, investors can gain some assurance and benefit from a higher probability of positive performance, anchored by durable hypotheses backing returns.

Compounding: the “8th wonder of the world”

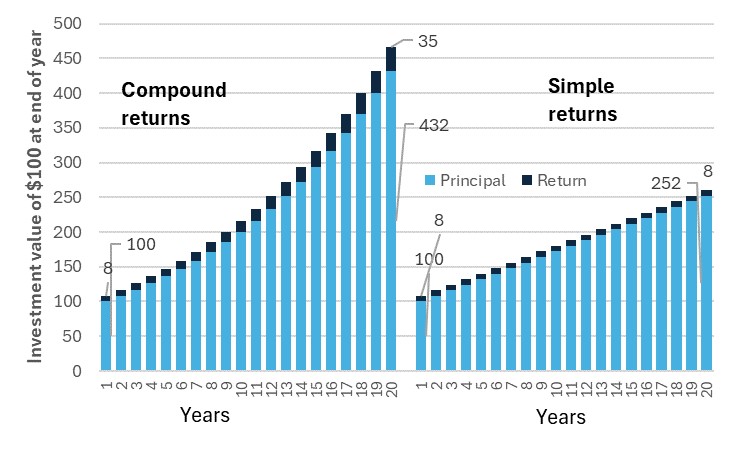

A notable benefit of a long-term investing strategy is access to compounding growth. Compounding is a powerful tool for building wealth, yet impossibly underappreciated: with compounding, each year’s return is reinvested and added to the principal, and this new total has the potential to earn more returns. This creates a snowball effect, where investments can grow exponentially. To reap the benefits of compounding growth requires time in the market to reap the returns on returns. Without reinvestment of returns, the investment grows linearly. Investors who trade around and stay for the short term, can at best capture a simple (non-compounded) return.

To compare the materially different outcomes of compound vs simple returns, the following exhibit illustrates a stylized example of a $100 investment earning 8% consistently over 20 years. In the compounding instance, the returns are reinvested and added to the principal, with the total amount earning 8%: $8 earned in year 1 is added to the original $100, such that 8% on this total $108, or $8.64 is earned in year 2, and 8% on $116.64 (equal to $9.33) is earned in year 3, and so forth. In the case where returns are not reinvested, the investment generates 8% on the original principal (a fixed $8) per annum, and the investment grows linearly by $8 a year. The gap between compound and simple returns widens with time: at year 1 the difference is value between a compounding vs a simple return portfolio stands at zero, while at year 20 this gap widens to $206, or a considerable 80% of the simple return portfolio. Hence, the longer investors stay in the market, the more compounding works in their favour.

Exhibit 6: Illustration of $100 returning 8% simple vs compounded return over 20 years

Source: Bloomberg, Bank of Singapore.

In the real world, returns are rarely stable or predictable, as in the above stylized example. Time in the market is not without costs, as it exposes investors to the risk of drawdowns, which we have described in great detail in Navigating Drawdowns.

Strategies for Maximising Time in the Market

Given the benefits of time in the market, and the difficulty of timing the market, it is worth considering some useful risk management strategies to maximise time in the market, as well as stressing the importance of harnessing compounding and approaching markets with a long-term mindset.

Closing thoughts

Investing success is not about perfectly timing market highs and lows: it’s about staying invested and letting time work in your favour. The data consistently shows that those who remain in the market benefit from compounding, long-term economic growth, and the recovery of short-term downturns. While daily and weekly price movements are driven by noise, fundamentals drive equity performance over years and decades. By focusing on strategies such as DCA, diversification, and reinvesting dividends, investors can avoid emotional pitfalls and maximise their wealth over time. In the end, the most reliable way to build long-term financial success is not predicting the market’s next move – it’s staying in it.

[1] We show the total return index in logarithmic scale, in order to capture the compound growth more accurately. As we have shown in previous primers, equity markets grow exponentially, not linearly, due to compounding returns. A logarithmic scale better represents this growth by making percentage changes appear proportional, regardless of starting value. A linear scale can make recent gains look much larger than early gains, even if percentage increases are the same. A log scale normalises this effect, showing consistent representation of identical growth magnitudes over time.

Disclaimers and Disclosures

This material is prepared by Bank of Singapore Limited (Co Reg. No.: 197700866R) (the “Bank”) and is distributed in Singapore by the Bank.

This material does not provide individually tailored investment advice. This material has been prepared for and is intended for general circulation. The contents of this material does not take into account the specific investment objectives, investment experience, financial situation, or particular needs of any particular person. You should independently evaluate the contents of this material, and consider the suitability of any product discussed in this material, taking into account your own specific investment objectives, investment experience, financial situation and particular needs. If in doubt about the contents of this material or the suitability of any product discussed in this material, you should obtain independent financial advice from your own financial or other professional advisers, taking into account your specific investment objectives, investment experience, financial situation and particular needs, before making a commitment to purchase any product.

This material is not and should not be construed, by itself, as an offer or a solicitation to deal in any product or to enter into any legal relations. You should contact your own licensed representative directly if you are interested in buying or selling any product discussed in this material.

This material is not intended for distribution, publication or use by any person in any jurisdiction outside Singapore, Hong Kong or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank or its related corporations, connected persons, associated persons or affiliates (collectively “Affiliates”) to any licensing, registration or other requirements in such jurisdiction.

The Bank and its Affiliates may have issued other reports, analyses, or other documents expressing views different from the contents of this material, and may provide other advice or make investment decisions that are contrary to the views expressed in this material, and all views expressed in all reports, analyses and documents are subject to change without notice. The Bank and its Affiliates reserve the right to act upon or use the contents of this material at any time, including before its publication.

The author of this material may have discussed the information or views contained in this material with others within or outside the Bank, and the author or such other Bank employees may have already acted on the basis of such information or views (including communicating such information or views to other customers of the Bank).

The Bank, its employees (including those with whom the author may have consulted in the preparation of this material))and discretionary accounts managed by the Bank may have long or short positions (including positions that may be different from or opposing to the views in this material or may be otherwise interested in any of the product(s) (including derivatives thereof) discussed in material, may have acquired such positions at prices and market conditions that are no longer available, may from time to time deal in such product(s) and may have interests different from or adverse to your interests.

Analyst Declaration

The analyst(s) who prepared this material certifies that the opinions contained herein accurately and exclusively reflect his or her views about the securities of the company(ies) and that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein.

The analyst(s) who prepared this material and his/her associates do not have financial interests in the company(ies). Financial interests refer to investments in securities, warrants and/or other derivatives. The analyst(s) receives compensation based on the overall revenues of Bank of Singapore Limited, and no part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this material. The reporting line of the analyst(s) is separate from and independent of the business solicitation or marketing departments of Bank of Singapore Limited.

The analyst(s) and his/her associates confirm that they do not serve as directors or officers of the company(ies) and the company(ies)or other third parties have not provided or agreed to provide any compensation or other benefits to the analyst(s) in connection with this material.

An “associate” is defined as (i) the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child, or any sibling or step-sibling of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, parent or step-parent, minor child (natural or adopted) or minor step-child, or sibling or step-sibling is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Conflict of Interest Declaration

The Bank is a licensed bank regulated by the Monetary Authority of Singapore in Singapore. Bank of Singapore Limited, Hong Kong Branch (incorporated in Singapore with limited liability), is an Authorized Institution as defined in the Banking Ordinance of Hong Kong (Cap 155), regulated by the Hong Kong Monetary Authority in Hong Kong and a Registered Institution as defined in the Securities and Futures Ordinance of Hong Kong (Cap.571) regulated by the Securities and Futures Commission in Hong Kong. The Bank, its employees and discretionary accounts managed by its Singapore Office/Hong Kong Office may have long or short positions or may be otherwise interested in any of the investment products (including derivatives thereof) referred to in this document and may from time to time dispose of any such investment products. The Bank forms part of the OCBC Group (being for this purpose Oversea-Chinese Banking Corporation Limited (“OCBC Bank”) and its subsidiaries, related and affiliated companies). OCBC Group, their respective directors and/or employees (collectively “Related Persons”) may have interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Group and its Related Persons may also be related to, and receive fees from, providers of such investment products. There may be conflicts of interest between OCBC Bank, the Bank, OCBC Investment Research Private Limited, OCBC Securities Private Limited or other members of the OCBC Group and any of the persons or entities mentioned in this report of which the Bank and its analyst(s) are not aware due to OCBC Bank’s Chinese Wall arrangement.

The Bank adheres to a group policy (as revised and updated from time to time) that provides how entities in the OCBC Group manage or eliminate any actual or potential conflicts of interest which may impact the impartiality of research reports issued by any research analyst in the OCBC Group.

If this material pertains to an offer, it may only be offered (i) in Hong Kong, to qualified Private Banking Customers and Professional Investors (as defined under the Securities and Futures Ordinance); (ii) in Singapore, to Accredited Investors (as defined under the Securities and Futures Act 2001); and (iii) in the Dubai International Financial Center, to Professional Clients (as defined under the Dubai Financial Services Authority rules). No other persons may act on the contents of the material.

Other Disclosures

Singapore

Where this material relates to structured deposits, this clause applies:

The product is a structured deposit. Structured deposits are not insured by the Singapore Deposit Insurance Corporation. Unlike traditional deposits, structured deposits have an investment element and returns may vary. You may wish to seek independent advice from a financial adviser before making a commitment to purchase this product. In the event that you choose not to seek independent advice from a financial adviser, you should carefully consider whether this product is suitable for you.

Where this material relates to dual currency investments, this clause applies:

The product is a dual currency investment. A dual currency investment product (“DCI”) is a derivative product or structured product with derivatives embedded in it. A DCI involves a currency option which confers on the deposit-taking institution the right to repay the principal sum at maturity in either the base or alternate currency. Part or all of the interest earned on this investment represents the premium on this option.

By purchasing this DCI, you are giving the issuer of this product the right to repay you at a future date in an alternate currency that is different from the currency in which your initial investment was made, regardless of whether you wish to be repaid in this currency at that time. DCIs are subject to foreign exchange fluctuations which may affect the return of your investment. Exchange controls may also be applicable to the currencies your investment is linked to. You may incur a loss on your principal sum in comparison with the base amount initially invested. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether this product is suitable for you.

Hong Kong

This document has not been delivered for registration to the Registrar of Companies in Hong Kong and its contents have not been reviewed by any regulatory authority in Hong Kong. Accordingly: (i) the shares/notes may not be offered or sold in Hong Kong by means of any document other than to persons who are "Professional Investors" within the meaning of the Securities and Futures Ordinance (Cap. 571) of Hong Kong and the Securities and Futures (Professional Investor) Rules made thereunder or in other circumstances which do not result in the document being a "prospectus" within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance; and (ii) no person may issue any invitation, advertisement or other document relating to the shares/notes whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to the shares/notes which are or are intended to be disposed of only to persons outside Hong Kong or only to "Professional Investors" within the meaning of the Securities and Futures Ordinance and the Securities and Futures (Professional Investor) Rules made thereunder.

The product may involve derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you have any doubt, you should seek independent professional financial, tax and/or legal advice as you deem necessary.

Where this material relates to a Complex Product, this clause applies:

Warning Statement and Information about Complex Product

(Applicable to accounts managed by Hong Kong Relationship Manager)

Where this material relates to a Complex Product – funds and ETFs, this clause applies additionally:

Where this material relates to a Complex Product (Options and its variants, Swap and its variants, Accumulator and its variants, Reverse Accumulator and its variants, Forwards), this clause applies additionally:

Where this material relates to a Loss Absorption Product, this clause applies:

Warning Statement and Information about Loss Absorption Products

(Applicable to accounts managed by Hong Kong Relationship Manager)

Before you invest in any Loss Absorption Product (as defined by the Hong Kong Monetary Authority), please read and ensure that you understand the features of a Loss Absorption Product, which may generally have the following features:

Where this material relates to a certificate of deposit, this clause applies:

It is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Where this material relates to a structured deposit, this clause applies:

It is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Where this material relates to a structured product, this clause applies:

This is a structured product which involves derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you are in any doubt about the risks involved in the product, you may clarify with the intermediary or seek independent professional advice.

Dubai International Financial Center

Where this material relates to structured products and bonds, this clause applies:

The Distributor represents and agrees that it has not offered and will not offer the product to any person in the Dubai International Financial Centre unless such offer is an “Exempt Offer” in accordance with the Market Rules of the Dubai Financial Services Authority (the “DFSA”).

The DFSA has no responsibility for reviewing or verifying any documents in connection with Exempt Offers.

The DFSA has not approved the Information Memorandum or taken steps to verify the information set out in it, and has no responsibility for it.

The product to which this document relates may be illiquid and/or subject to restrictions in respect of their resale. Prospective purchasers of the products offered should conduct their own due diligence on the products.

Please make sure that you understand the contents of the relevant offering documents (including but not limited to the Information Memorandum or Offering Circular) and the terms set out in this document. If you do not understand the contents of the relevant offering documents and the terms set out in this document, you should consult an authorised financial adviser as you deem necessary, before you decide whether or not to invest.

Where this material relates to a fund, this clause applies:

This Fund is not subject to any form of regulation or approval by the Dubai Financial Services Authority (“DFSA”). The DFSA has no responsibility for reviewing or verifying any Prospectus or other documents in connection with this Fund. Accordingly, the DFSA has not approved the Prospectus or any other associated documents nor taken any steps to verify the information set out in the Prospectus, and has no responsibility for it. The Units to which this Fund relates may be illiquid and/or subject to restrictions on their resale. Prospective purchasers should conduct their own due diligence on the Units. If you do not understand the contents of this document you should consult an authorized financial adviser. Please note that this offer is intended for only Professional Clients and is not directed at Retail Clients.

These are also available for inspection, during normal business hours, at the following location:

Bank of Singapore

Office 30-34 Level 28

Central Park Tower

DIFC, Dubai

U.A.E

Cross Border Disclaimer and Disclosures

Refer to https://www.bankofsingapore.com/Disclaimers_and_Disclosures.html for cross-border marketing disclaimers and disclosures.