Singapore's Prime Minister, Lawrence Wong. AFP.

Investment summary

Singapore’s Prime Minister (PM) Lawrence Wong delivered his first Budget Statement on 18 Feb 2025 as both PM and Finance Minister, coinciding with SG60, the 60th anniversary of Singapore’s independence. The budget focused on six key areas: i) tackling cost pressure, ii) advancing Singapore’s growth frontiers, iii) equipping workers throughout their life, iv) building a sustainable city, v) nurturing a caring and inclusive society, and vi) rallying as one united people. In line with these priorities, Singapore announced a range of support measures for households and businesses, including cost-of-relief vouchers, skills upgrading initiatives for workers, and tax rebates.

Singapore is expected to end FY24 with a surplus of SGD6.4b, or 0.9% of GDP. For FY25, a similar fiscal position (surplus of SGD6.8b) is expected as well, contrary to economists’ deficit projections. An area of interest is the Monetary Authority of Singapore's (MAS) Equities Market Review Group which recently released its first set of measures. The PM has accepted their recommendations and will be introducing tax incentives for Singapore-based companies. There will also be tax incentives for fund managers which invest substantially in Singapore-listed equities.

Meanwhile, uncertainties and rising costs remain an issue. With geopolitical tensions and rising trade tensions, regional trade and growth could be impacted in the coming years. While these measures will help to ready Singapore for part of the challenges ahead, the widespread adoption of artificial intelligence (AI) and Singapore’s ability to adapt to these changes will determine its long-term growth.

For now, we expect these announcements from the Equities Market Review Group to have a minimal impact on equities. If the Equities Market Review Group is able to generate more interest in the Singapore market, this could help to raise market valuations and potentially result in a re-rating of the Singapore market. We continue to have an overweight on the Singapore market due to its still-attractive valuations as well as a large pool of good dividend yielding stocks.

Overview: Empowering people and fuelling businesses

In the just-unveiled Singapore Budget 2025, PM Wong’s first budget as PM, an excel tracker is required to tabulate the number of goodies that were announced for individuals, households and companies – essentially in line with the theme of this budget, which was titled “Onward together for a better tomorrow”.

Near term cost-of-living relief for the people

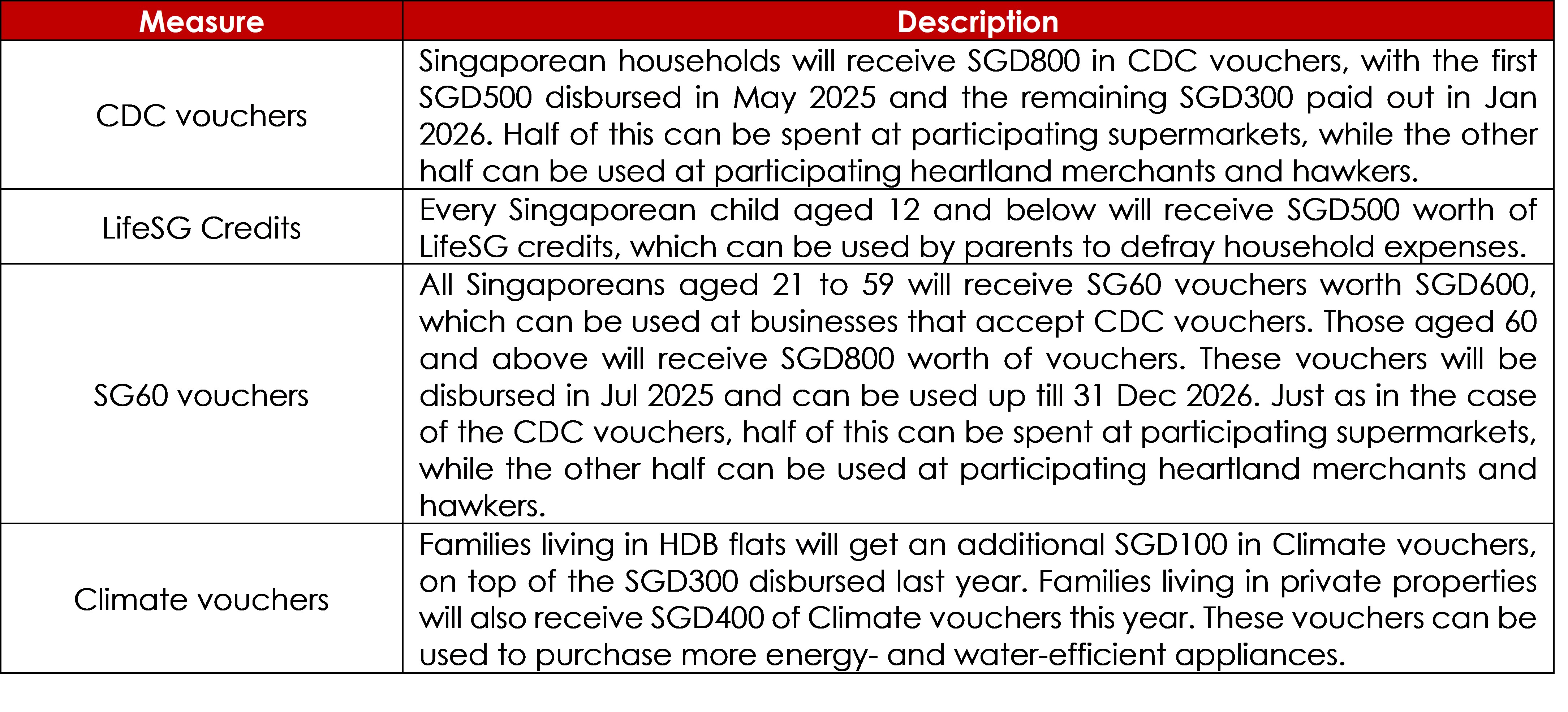

The budget covered a few key themes including skills upgrading for workers and senior citizens, readying Singapore for future growth, support for all Singaporeans and marking SG60 (Singapore’s 60th year of independence) celebrations, with all citizens aged 21 and above to receive SGD600 from Jul 2025 onwards (SGD800 for seniors aged 60 and above). Other goodies include:

While the above is largely positive for a pro-individual and pro-family budget, uncertainties and rising costs remain an issue. With geopolitical tensions and the rising trade tensions, regional trades and growth could be impacted in the coming years. While these measures will help to ready Singapore for part of the challenges ahead, the wide adoption of AI and Singapore’s ability to adapt to these changes will determine its long-term growth (with 2025 economic growth projection of 1.3%).

Long-term economic priorities and benefits for businesses

For companies, a corporate income tax rebate of 50%, capped at SGD40,000 will be given. The government is also upping the co-funding for wage increases for lower-wage Singaporeans from 30% to 40%.

On the construction and infrastructural front, more than 50,000 built-to-order (BTO) flats will be launched in the next three years. The Changi Airport Development Fund will also receive a SGD5b top-up to ensure sufficient resources to develop Singapore's air hub.

Of interest is the Equities Market Review Group which recently released its first set of measures. The PM has accepted their recommendations and will be introducing tax incentives for Singapore-based companies. There will also be tax incentives for fund managers which invest substantially in Singapore-listed equities. While details were not released in the budget statement, according to an article from The Straits Times, corporate income tax rebates will be granted to Singapore-based companies and will amount to 20% for primary listings and 10% for secondary listings. The rebates will be capped at SGD6m per year of assessment for qualifying companies with a market cap of at least SGD1b. The company will need to stay listed for five years. For fund managers, it will be a concessionary tax rate of 5% on qualifying income, provided that it or its holding company gets a primary listing on SGX and remains listed for five years. New funds need to have at least 30% of their assets under management (AUM) invested in Singapore-listed equities to get the tax exemption on qualifying income.

For now, we expect that these announcements to have a minimal impact on equities If the Equities Market Review Group is able to generate more interest in the Singapore market, this could help to raise market valuations and potentially result in a re-rating of the Singapore market. We continue to have an overweight on the Singapore market largely due to its still-attractive valuations as well as a large pool of good dividend yielding stocks.

Sector Implications

Real Estate

Unlike last year, there were no new measures announced during Budget 2025 that would directly impact the property sector in a material manner. Given the focus on addressing cost of living pressures, the CDC vouchers issued to Singaporean households and the LifeSG credits for families with Singaporean children aged 12 and below (SGD500 per child) would boost consumption spending and thus benefit retail REITs. However, the boost would be marginal as the rental income of retail REITs is predominantly made up of base rents; gross turnover rents typically contribute mid-to-high single digits of their total gross revenue.

PM Wong also highlighted that the government was paying close attention to the affordability of the public housing market and will be maintaining the robust supply pipeline of Build-To-Order (BTO) flats. The Ministry of National Development (MND) will launch more than 50k flats across different locations over the next three years. To accommodate home seekers who prefer quicker access to housing, approximately 20% (3.8k flats) of the 19.6k BTO launches planned for 2025 will have a waiting time of less than three years. In 2024, HDB resale prices jumped by 9.7%, outpacing the 4.9% increase in 2023. The new BTO supply, along with previously announced cooling measures such as the reduction in the loan-to-value (LTV) ratio of HDB loans from 80% to 75%, would help to manage price growth of the HDB resale market.

To keep up Singapore’s momentum in technology and innovation, there will be continued investments in research and development (R&D) infrastructure. For example, in the biotech sector, the government will refresh its public biosciences and medtech research infrastructure in the greater one-north area.

Industrials

PM Wong mentioned during his speech that Singapore supplies more than 10% of semiconductor chips and produces one-fifth of semiconductor equipment globally. To support further innovation and technological progress, the government will be making a SGD3b top-up to the National Productivity Fund (NPF). Within the biotech and semiconductor sectors, the government will also invest an additional SGD1b in research infrastructure, including the development of a new national semiconductor research and development (R&D) fabrication facility. Separately, the Future Energy Fund will also receive a SGD5b top-up to support expanding access to clean energy and greater energy resilience.

Finally, to develop and ensure the competitiveness of Singapore’s air hub, the Changi Airport Development Fund will receive a SGD5b boost, with Changi Airport’s Terminal 5 (T5) set to break ground in the coming months. The government will also provide a guarantee to Changi Airport Group (CAG) to lower the cost of borrowings needed to develop T5 and supporting infrastructure in the Changi East area.

Consumer

This year’s budget contained a slew of supportive measures to help households cope with the elevated cost of living.

Exhibit 1: Selected supportive measures unveiled at Budget 2025 that could encourage greater domestic consumption

Source: Bank of Singapore, Various news sources

Other measures such as U-Save rebates of up to SGD760 for eligible HDB households to offset their utility bills and personal income tax rebates of 60% for Year of Assessment 2025 (capped at SGD200) also contribute towards increasing disposable incomes. However, the incremental benefit to local retailers is more obscure given that this may also potentially encourage an increase in outbound travel, which would dilute spending domestically.

Communication Services

The government will allocate SGD150m for a new Enterprise Compute Initiative. This program aims to assist businesses in adopting AI by partnering them with major cloud service providers, granting access to AI tools, computing resources and expert consultancy services. The initiative will support enterprises that need AI solutions tailored to their needs and integrated into their business processes and systems.

Maintain an Overweight on Singapore market

We maintain a positive outlook on the Singapore market, primarily due to its defensive characteristics and attractive dividend profile. With a current dividend yield of 5.3%, investors benefit from a healthy spread of 2.4% over the 10-year Singapore government bond yield, making it an appealing income-generating option. Additionally, the Straits Times Index (STI) exhibits lower volatility compared to its regional peers, making it a viable diversification option for sheltering against overall market fluctuations.

Furthermore, despite a 16.9% price increase in 2024, the STI's valuations remain undemanding, currently trading at a forward P/E ratio of 11.8x, which is 0.5 standard deviations below its 10-year historical average. Moreover, potential capital market improvement measures proposed by the Equities Market Review Group could lead to further positive re-rating for the Singapore market.

We note that there are potential downside risks on the external front. Although Singapore ended 2024 on a strong note, achieving a growth rate of 4.4% and surpassing the Ministry of Trade and Industry's (MTI) latest expectation of 4%, the MTI has maintained its GDP growth forecast for 2025 at 1-3% year-on-year (YoY). This cautious outlook is influenced by several factors, including the escalation of geopolitical conflicts and increased uncertainty surrounding US trade policies. Even if Singapore avoids direct tariffs from the US, it remains indirectly affected; potential tariffs on its major trading partners could lead to a slowdown in global economic growth and trade.

Disclaimers and Disclosures

This material is prepared by Bank of Singapore Limited (Co Reg. No.: 197700866R) (the “Bank”) and is distributed in Singapore by the Bank.

This material does not provide individually tailored investment advice. This material has been prepared for and is intended for general circulation. The contents of this material does not take into account the specific investment objectives, investment experience, financial situation, or particular needs of any particular person. You should independently evaluate the contents of this material, and consider the suitability of any product discussed in this material, taking into account your own specific investment objectives, investment experience, financial situation and particular needs. If in doubt about the contents of this material or the suitability of any product discussed in this material, you should obtain independent financial advice from your own financial or other professional advisers, taking into account your specific investment objectives, investment experience, financial situation and particular needs, before making a commitment to purchase any product.

The Bank shall not be responsible or liable for any loss (whether direct, indirect or consequential) that may arise from, or in connection with, any use of or reliance on any information contained in or derived from this material, or any omission from this material, other than where such loss is caused solely by the Bank’s wilful default or gross negligence.

This material is not and should not be construed, by itself, as an offer or a solicitation to deal in any product or to enter into any legal relations. You should contact your own licensed representative directly if you are interested in buying or selling any product discussed in this material.

This material is not intended for distribution, publication or use by any person in any jurisdiction outside Singapore, Hong Kong or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank or its related corporations, connected persons, associated persons or affiliates (collectively “Affiliates”) to any licensing, registration or other requirements in such jurisdiction.

The Bank and its Affiliates may have issued other reports, analyses, or other documents expressing views different from the contents of this material, and may provide other advice or make investment decisions that are contrary to the views expressed in this material, and all views expressed in all reports, analyses and documents are subject to change without notice. The Bank and its Affiliates reserve the right to act upon or use the contents of this material at any time, including before its publication.

The author of this material may have discussed the information or views contained in this material with others within or outside the Bank, and the author or such other Bank employees may have already acted on the basis of such information or views (including communicating such information or views to other customers of the Bank).

The Bank, its employees (including those with whom the author may have consulted in the preparation of this material))and discretionary accounts managed by the Bank may have long or short positions (including positions that may be different from or opposing to the views in this material or may be otherwise interested in any of the product(s) (including derivatives thereof) discussed in material, may have acquired such positions at prices and market conditions that are no longer available, may from time to time deal in such product(s) and may have interests different from or adverse to your interests.

Analyst Declaration

The analyst(s) who prepared this material certifies that the opinions contained herein accurately and exclusively reflect his or her views about the securities of the company(ies) and that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein.

The analyst(s) who prepared this material and his/her associates [have / do not] have financial interests in the company(ies). Financial interests refer to investments in securities, warrants and/or other derivatives. The analyst(s) receives compensation based on the overall revenues of Bank of Singapore Limited, and no part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this material. The reporting line of the analyst(s) is separate from and independent of the business solicitation or marketing departments of Bank of Singapore Limited.

The analyst(s) and his/her associates confirm that they do not serve as directors or officers of the company(ies) and the company(ies)or other third parties have not provided or agreed to provide any compensation or other benefits to the analyst(s) in connection with this material.

An “associate” is defined as (i) the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child, or any sibling or step-sibling of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, parent or step-parent, minor child (natural or adopted) or minor step-child, or sibling or step-sibling is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Conflict of Interest Declaration

The Bank is a licensed bank regulated by the Monetary Authority of Singapore in Singapore. Bank of Singapore Limited, Hong Kong Branch (incorporated in Singapore with limited liability), is an Authorized Institution as defined in the Banking Ordinance of Hong Kong (Cap 155), regulated by the Hong Kong Monetary Authority in Hong Kong and a Registered Institution as defined in the Securities and Futures Ordinance of Hong Kong (Cap.571) regulated by the Securities and Futures Commission in Hong Kong. The Bank, its employees and discretionary accounts managed by its Singapore Office/Hong Kong Office may have long or short positions or may be otherwise interested in any of the investment products (including derivatives thereof) referred to in this document and may from time to time dispose of any such investment products. The Bank forms part of the OCBC Group (being for this purpose Oversea-Chinese Banking Corporation Limited (“OCBC Bank”) and its subsidiaries, related and affiliated companies). OCBC Group, their respective directors and/or employees (collectively “Related Persons”) may have interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Group and its Related Persons may also be related to, and receive fees from, providers of such investment products. There may be conflicts of interest between OCBC Bank, the Bank, OCBC Investment Research Private Limited, OCBC Securities Private Limited or other members of the OCBC Group and any of the persons or entities mentioned in this report of which the Bank and its analyst(s) are not aware due to OCBC Bank’s Chinese Wall arrangement.

The Bank adheres to a group policy (as revised and updated from time to time) that provides how entities in the OCBC Group manage or eliminate any actual or potential conflicts of interest which may impact the impartiality of research reports issued by any research analyst in the OCBC Group.

Other Disclosures

Singapore

Where this material relates to structured deposits, this clause applies:

The product is a structured deposit. Structured deposits are not insured by the Singapore Deposit Insurance Corporation. Unlike traditional deposits, structured deposits have an investment element and returns may vary. You may wish to seek independent advice from a financial adviser before making a commitment to purchase this product. In the event that you choose not to seek independent advice from a financial adviser, you should carefully consider whether this product is suitable for you.

Where this material relates to dual currency investments, this clause applies:

The product is a dual currency investment. A dual currency investment product (“DCI”) is a derivative product or structured product with derivatives embedded in it. A DCI involves a currency option which confers on the deposit-taking institution the right to repay the principal sum at maturity in either the base or alternate currency. Part or all of the interest earned on this investment represents the premium on this option.

By purchasing this DCI, you are giving the issuer of this product the right to repay you at a future date in an alternate currency that is different from the currency in which your initial investment was made, regardless of whether you wish to be repaid in this currency at that time. DCIs are subject to foreign exchange fluctuations which may affect the return of your investment. Exchange controls may also be applicable to the currencies your investment is linked to. You may incur a loss on your principal sum in comparison with the base amount initially invested. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether this product is suitable for you.

Hong Kong

This material has not been delivered for registration to the Registrar of Companies in Hong Kong and its contents have not been reviewed by any regulatory authority in Hong Kong. Accordingly: (i) the shares/notes may not be offered or sold in Hong Kong by means of any document other than to persons who are "Professional Investors" within the meaning of the Securities and Futures Ordinance (Cap. 571) of Hong Kong and the Securities and Futures (Professional Investor) Rules made thereunder or in other circumstances which do not result in the document being a "prospectus" within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance; and (ii) no person may issue any invitation, advertisement or other material relating to the shares/notes whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to the shares/notes which are or are intended to be disposed of only to persons outside Hong Kong or only to "Professional Investors" within the meaning of the Securities and Futures Ordinance and the Securities and Futures (Professional Investor) Rules made thereunder.

Where this material involves derivatives, do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you have any doubt, you should seek independent professional financial, tax and/or legal advice as you deem necessary.

Where this material relates to a Complex Product, this clause applies:

Warning Statement and Information about Complex Product

(Applicable to accounts managed by Hong Kong Relationship Manager)

Where this material relates to a Complex Product – funds and ETFs, this clause applies additionally:

Where this material relates to a Complex Product (Options and its variants, Swap and its variants, Accumulator and its variants, Reverse Accumulator and its variants, Forwards), this clause applies additionally:

Where this material relates to a Loss Absorption Product, this clause applies:

Warning Statement and Information about Loss Absorption Products

(Applicable to accounts managed by Hong Kong Relationship Manager)

Before you invest in any Loss Absorption Product (as defined by the Hong Kong Monetary Authority), please read and ensure that you understand the features of a Loss Absorption Product, which may generally have the following features:

Where this material relates to a certificate of deposit, this clause applies:

It is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Where this material relates to a structured deposit, this clause applies:

It is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Where this material relates to a structured product, this clause applies:

This is a structured product which involves derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you are in any doubt about the risks involved in the product, you may clarify with the intermediary or seek independent professional advice.

Dubai International Financial Center

Where this material relates to structured products and bonds, this clause applies:

The Distributor represents and agrees that it has not offered and will not offer the product to any person in the Dubai International Financial Centre unless such offer is an “Exempt Offer” in accordance with the Market Rules of the Dubai Financial Services Authority (the “DFSA”).

The DFSA has no responsibility for reviewing or verifying any documents in connection with Exempt Offers.

The DFSA has not approved the Information Memorandum or taken steps to verify the information set out in it, and has no responsibility for it.

The product to which this document relates may be illiquid and/or subject to restrictions in respect of their resale. Prospective purchasers of the products offered should conduct their own due diligence on the products.

Please make sure that you understand the contents of the relevant offering documents (including but not limited to the Information Memorandum or Offering Circular) and the terms set out in this document. If you do not understand the contents of the relevant offering documents and the terms set out in this document, you should consult an authorised financial adviser as you deem necessary, before you decide whether or not to invest.

Where this material relates to a fund, this clause applies:

This Fund is not subject to any form of regulation or approval by the Dubai Financial Services Authority (“DFSA”). The DFSA has no responsibility for reviewing or verifying any Prospectus or other documents in connection with this Fund. Accordingly, the DFSA has not approved the Prospectus or any other associated documents nor taken any steps to verify the information set out in the Prospectus, and has no responsibility for it. The Units to which this Fund relates may be illiquid and/or subject to restrictions on their resale. Prospective purchasers should conduct their own due diligence on the Units. If you do not understand the contents of this document you should consult an authorized financial adviser. Please note that this offer is intended for only Professional Clients and is not directed at Retail Clients.

These are also available for inspection, during normal business hours, at the following location:

Bank of Singapore

Office 30-34 Level 28

Central Park Tower

DIFC, Dubai

U.A.E

BOS Wealth Management Europe S.A., UK Branch

BOS Wealth Management Europe S.A., UK Branch (BOSWME UK), is authorized and regulated by the Financial Conduct Authority (FCA) and is providing this material for informational purposes only. BOSWME UK does not endorse any specific investments or financial products mentioned in this material. BOSWME UK and its employees accept no liability for any loss or damage arising from the use of this material or reliance on its content.

This material is being distributed to and is directed only at persons in the UK who meet the requirements to be considered “Professional Clients” within the meaning of the Conduct of Business Sourcebook rules on client categorisation, part of the FCA Handbook (the “FCA Rules”) and is not intended for retail investors.

Any person in the UK who receives this material will be deemed to have represented and agreed that it can be considered a Professional Client. Any such recipient will also be deemed to have represented and agreed that it has not received this material on behalf of persons in the UK other than Professional Clients for whom the investor has authority to make decisions on a wholly discretionary basis. BOSWME UK will rely upon the truth and accuracy of the foregoing representations and agreements. Any person who is not a Professional Client should not act or rely on this material or any of their contents.

Investing in financial markets carries the risk of losing capital, and investors should be aware of and carefully consider this risk before making any investment decisions. The value of investments can fluctuate, and there is no guarantee that investors will recoup their initial investment. Past performance is not indicative of future results, and the performance of investments can be affected by various factors, including but not limited to market conditions, economic factors, and changes in regulations or tax laws. Forward-looking statements should not be considered as guarantees or predictions of future events. Investors should be prepared for the possibility of losing all or a portion of their invested capital. It is recommended that investors seek professional advice and conduct thorough research before making any investment decisions.

Cross Border Disclaimer and Disclosures

Refer to https://www.bankofsingapore.com/Disclaimers_and_Disclosures.html for cross-border marketing disclaimers and disclosures.