Political uncertainty on the horizon

Japan stands at the crossroads as the country undergoes a wave of leadership transitions. Following former Prime Minister Fumio Kishida’s resignation, newly appointed Prime Minister Shigeru Ishiba swiftly announced a new Cabinet and moved to dissolve the Lower House, so as to pave the way for fresh elections on 27 Oct 2024.

Prior to the elections, media reports cited the possibility that the ruling coalition of the Liberal Democratic Party (LDP) and its partner Komei Party could fare poorly but the eventual result was likely worse than expected. The LDP registered a significant loss of seats, from 247 to 191 while the Komei Party saw its seat count dropping from 32 to 24. This resulted in the ruling coalition falling short of the 233 seats needed to command a majority in the Lower House.

At this stage, it remains difficult to be certain on how the final complexion of government will look like. In our view, the 3 plausible scenarios from here are:

Notwithstanding the above, a new administrative structure needs to be decided in November, given that a Special Diet session needs to be called within 30 days of the general election so as to appoint a Prime Minister.

Expecting broadly unchanged fiscal and monetary policy direction for now

Despite the political uncertainty, fiscal policy is likely to remain broadly unchanged for now, though we do not rule out areas where policy could become marginally more expansionary. This is because (i) smaller opposition parties like the DPFP and the JIP are advocating for consumption and gasoline tax cuts, while (ii) the heavy defeat by the LDP in the Lower House elections should give the Upper House elections in 2025 renewed significance. Markets are likely pricing in some of this as well, with the Nikkei 225 Index and 10Y Japanese Government Bond (JGB) yield trending higher following the results of the election.

As for monetary policy, we believe the outlook here remains unchanged, as core inflation appears to be settling around the 2% handle, and there are reasons to remain optimistic that Japan will be able to stay on the path of sustainable reflation, breaking the three decade deflationary cycle.

First, while firms had broadly refrained from passing on higher costs to consumers earlier this year, an increasing number of firms are now looking to do so as domestic demand recovers.

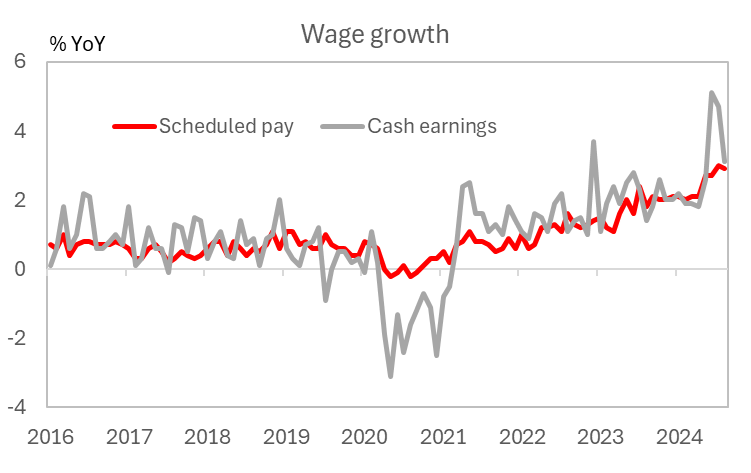

Second, wages look to be on a continued uptrend. It has been reported that Japan’s trade union confederation (Rengo) will be targeting wage hikes of “5% or more” in its 2025 spring wage negotiations, while pushing for a more aggressive target of “6% or more” for small and medium-sized enterprises. This would help to build on the strength of strong wage growth registered since 2023. This should also help to spur broad consumption and further feed into overall prices, thus creating a virtuous cycle across inflation and wages.

Hence, we see the BoJ continuing to raise rates as it embarks on gradual normalisation in light of the underlying inflationary trend. Across the various parties, we see little political pushback on higher rates due to the need to keep inflation in check, which is in-line with our view that the recent weakness of the JPY is likely to be temporal, especially as other central banks pursue rate cuts.

Flows into Japan also dependent on outlook of China

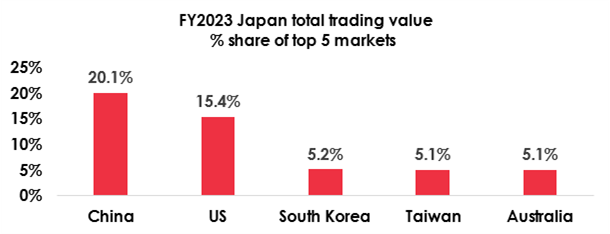

The policy stimulus blitz in China is likely to have a mixed impact on risk assets in Japan. As we expect further policy stimulus to help support China’s economy and ultimately spur consumption, this should also provide a mild boost to Japan’s economy. This is because China constitutes ~20% of trading value for Japan in FY2023 (as a proportion of the top 5 markets for Japan), and is thus Japan’s largest trading partner.

Exhibit 1: China is Japan’s largest trading partner

Source: Ministry of Finance, Bank of Singapore

However, given undemanding valuations in China, investors with a sizeable Asian allocation who prefer exposure to China might prefer to fund that from their existing Japanese holdings.

We are Neutral on Japan equities as the risk-reward appears balanced at this juncture. However, taking into account the macro and rates outlook, we see specific sectoral opportunities, including:

(a) Japanese banks as gradual interest rate normalisation will help boost return on equity (ROE) levels over time,

(b) Domestic-oriented sectors given our expectation of rising real wages and JPY appreciation ahead, and

(c) Industrial automation and robotics, benefiting from the bottoming in China’s economic growth coupled with the global easing in interest rates ahead.

Across Japan fixed income, we prefer:

(a) Selected subdebts issued by Japanese Life Insurers as a number of them appear attractively priced vs Banks’ senior Total Loss-Absorbing Capacity (TLACs), and

(b) Selected corporate borrowers, such as those with improved liquidity positions, better operational performance and significant domestic revenue levels.

Japan’s economy reflates, interest rates to rise

Despite Japan’s long-ruling LDP losing its majority in October’s election, the economy remains likely to finally escape deflation but at the cost of interest rates rising further over the next year.

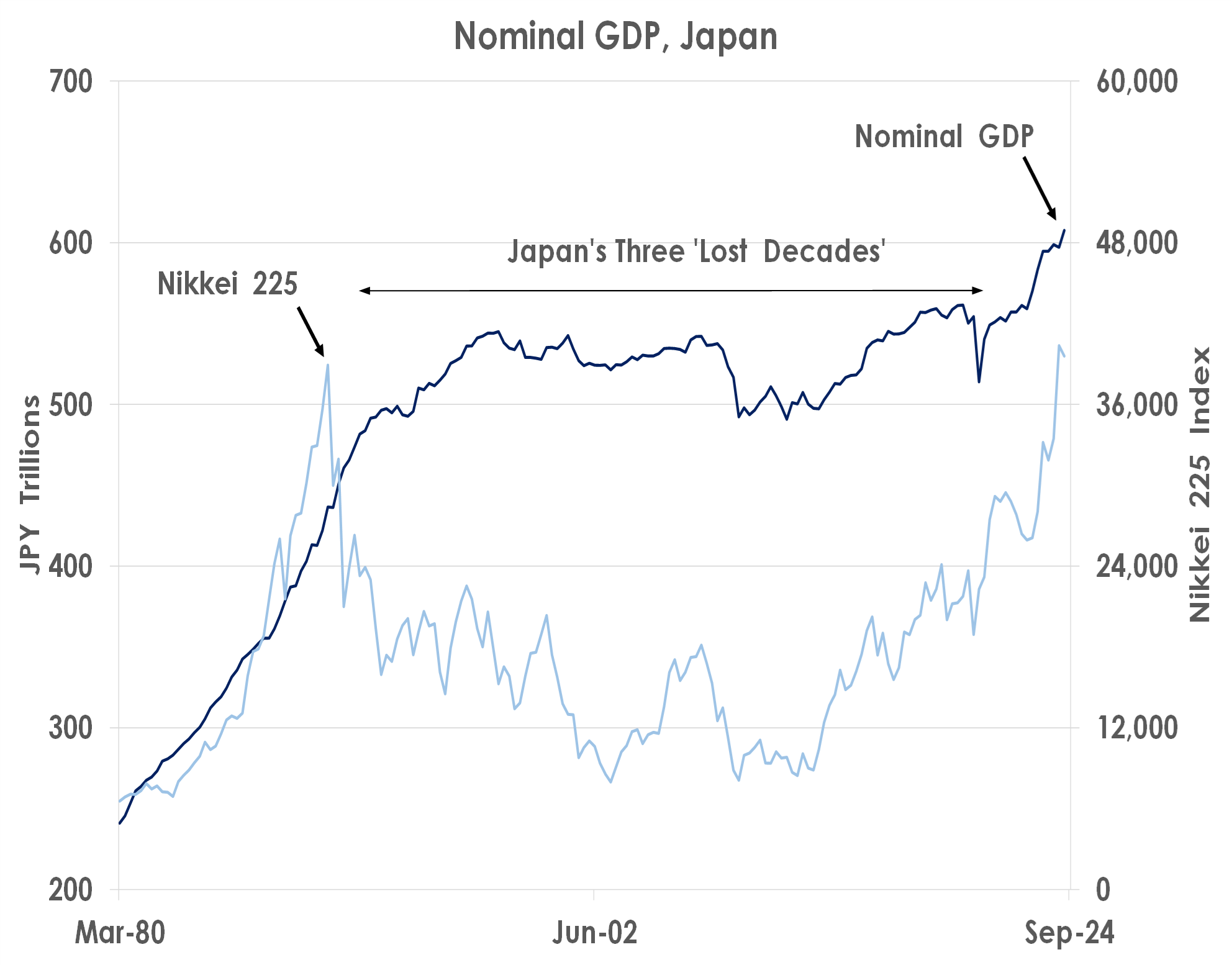

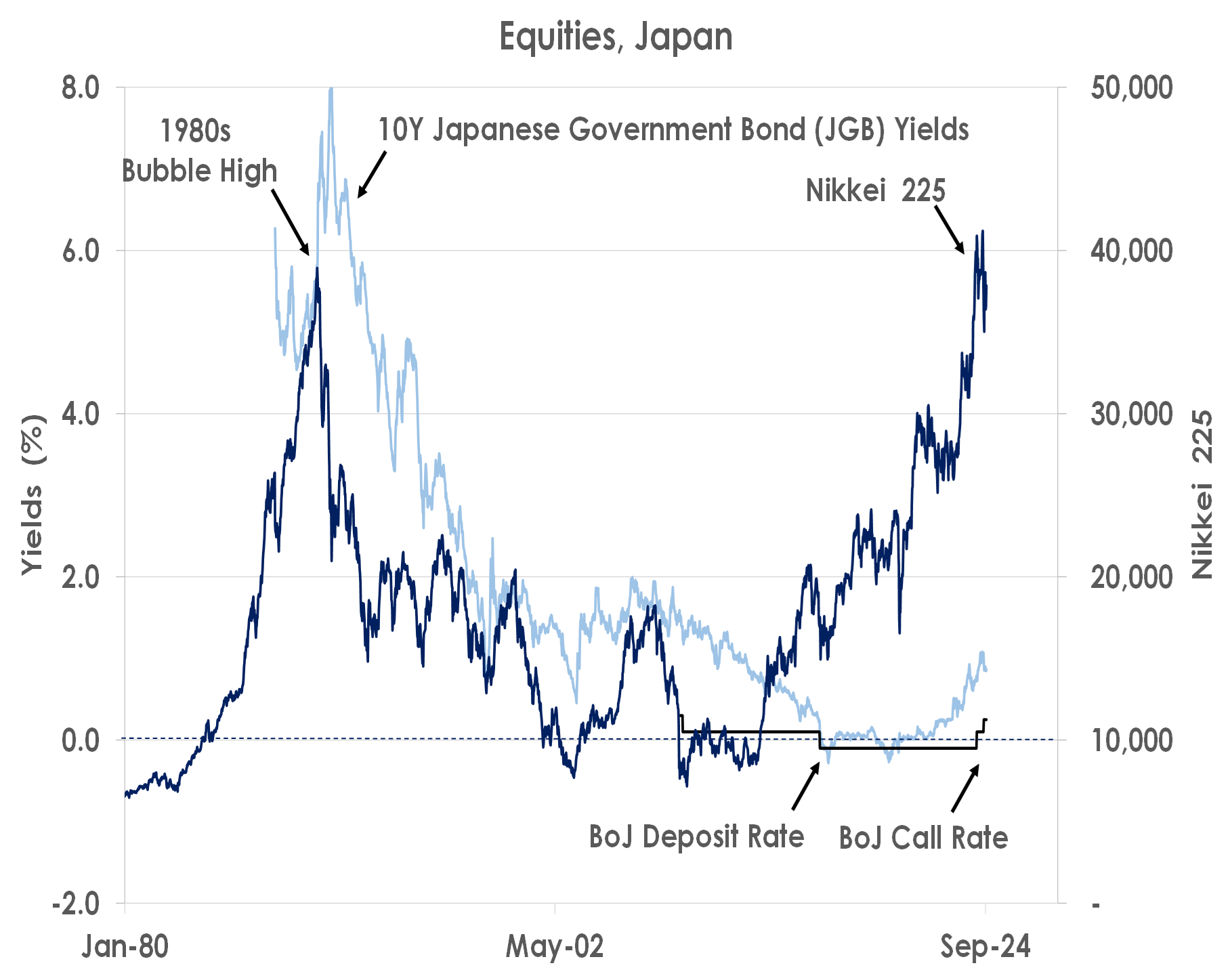

Indeed, Japan’s economy is at last moving on from its three lost decades of weak inflation and outright deflation that caused growth to stagnate after its 1980s bubble burst. Exhibit 2 shows the size of the economy exceeded JPY600t (USD4t) for the first time this year, helping spur the Nikkei 225 Index to surpass its previous peak of 39,000 set in 1989 and make new record highs above 40,000.

Exhibit 2: Nominal GDP

Source: Bloomberg, Bank of Singapore

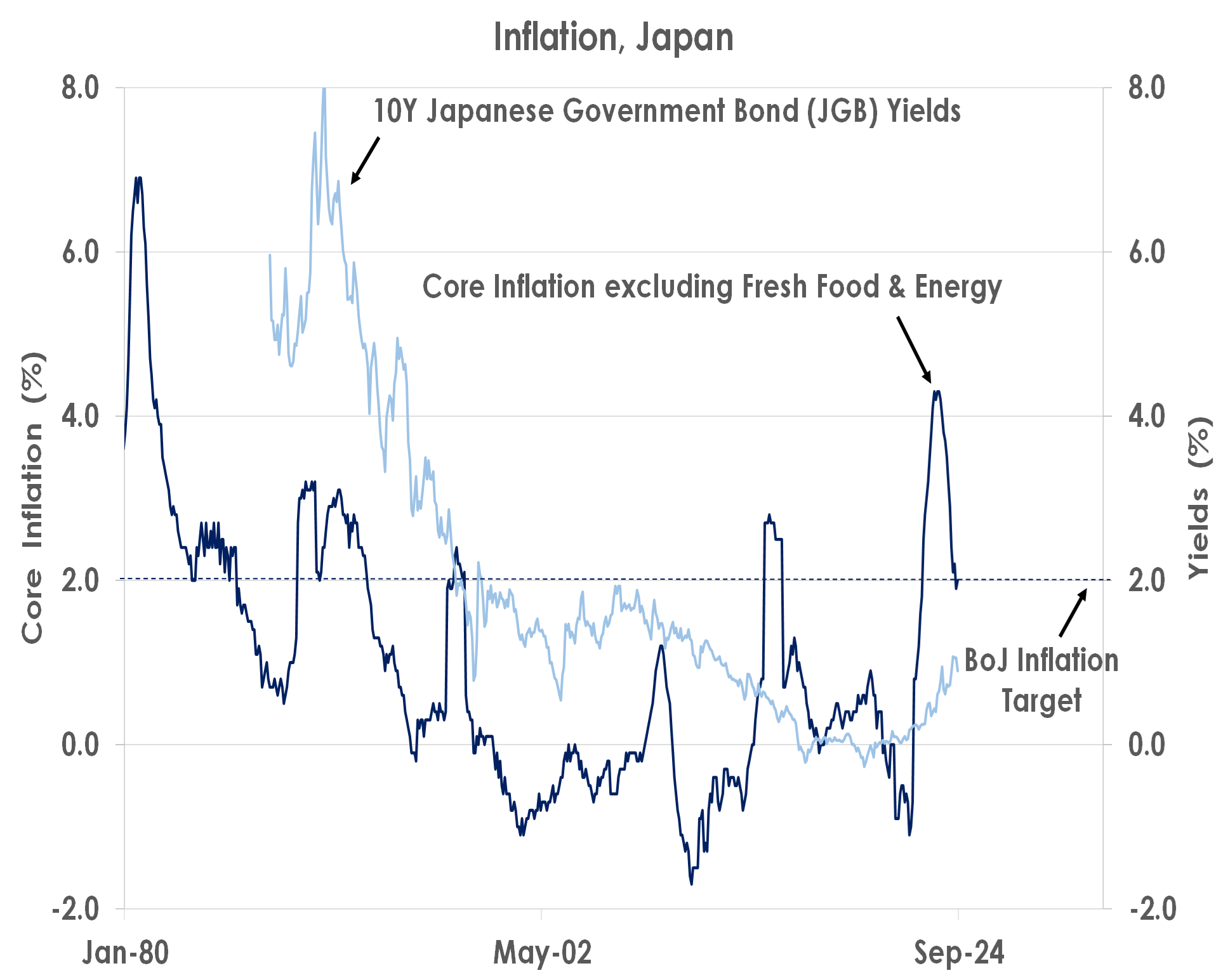

Japan’s economy is reflating again as the shocks of the pandemic, the wars in the Ukraine and the Middle East, still very low interest rates and the weakness of the JPY have caused inflation to return to the BoJ’s 2% target.

Exhibit 3: Core Inflation

Source: Bloomberg, Bank of Singapore

Exhibit 3 shows core inflation, excluding fresh food and energy costs, is setting around 2% after jumping to four decade-highs above 4% when Japan fully reopened from the pandemic.

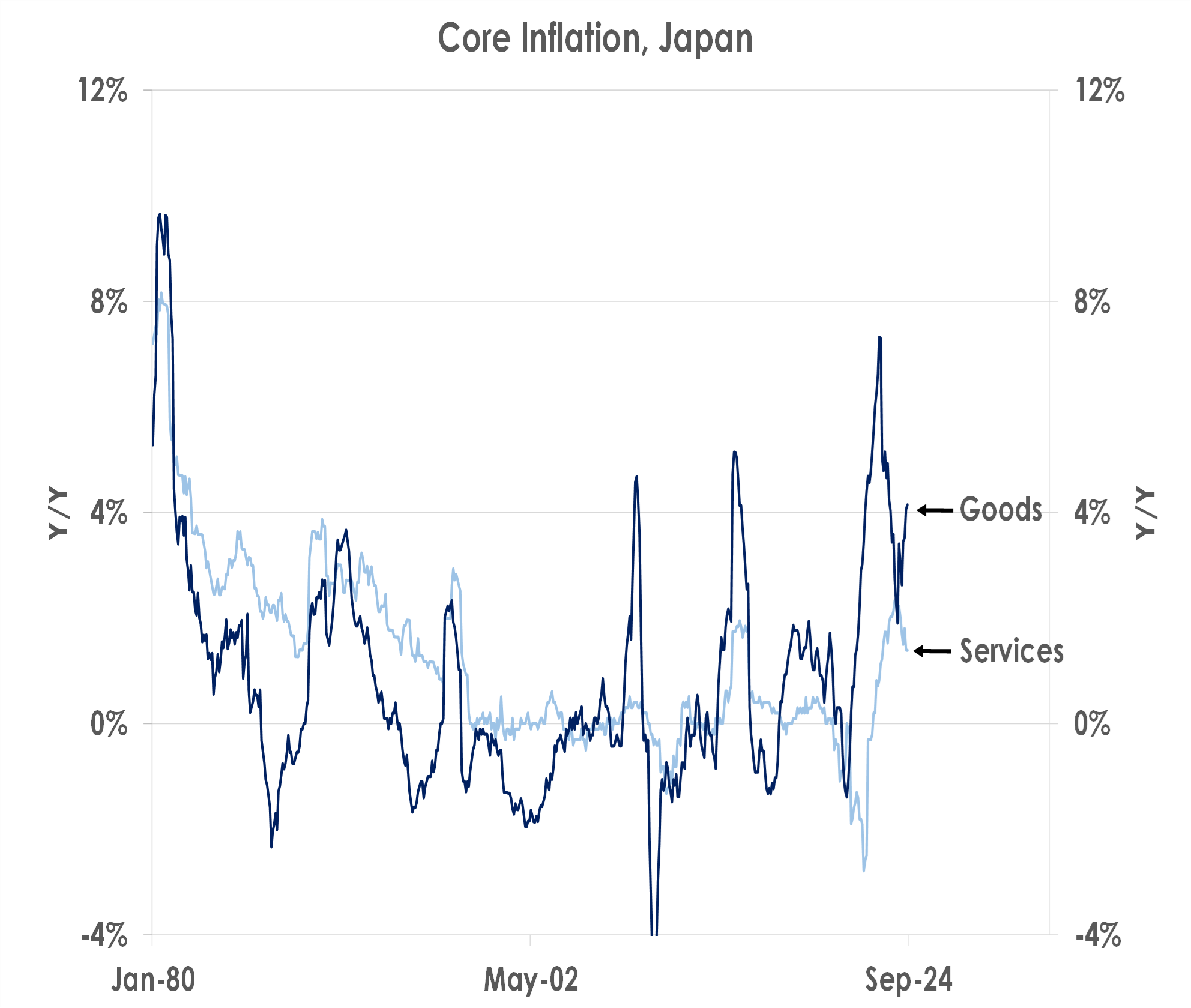

In contrast to previous bursts of inflation caused by sales tax rises in 1997 and 2014, this decade’s surge is set to be sustained as tight labour markets after the pandemic have led to the strongest increases in wages for three decades. Thus, the prices of labour-dependent services are rising close to 2% for the first time since the early 1990s as Exhibit 4 shows.

Exhibit 4: Core Inflation

Source: Bloomberg, Bank of Singapore

Services inflation is more durable than changes in goods prices, raising hopes the BoJ will be able to keep meeting its 2% inflation goal now. But while Japan’s reflating economy has spurred the Nikkei 225 Index, the BoJ has also been forced to raise interest rates twice this year from -0.10% to 0.25% now.

Exhibit 5: Bank of Japan Interest Rates

Source: Bloomberg, Bank of Singapore

We think the BoJ will need to raise interest rates to 0.50% by the end of this year and 1.00% next year to keep inflation at its 2% target. Thus, investors will need to balance the promising end to Japan’s lost decades with higher interest rates now.

JPY – Gradual appreciation

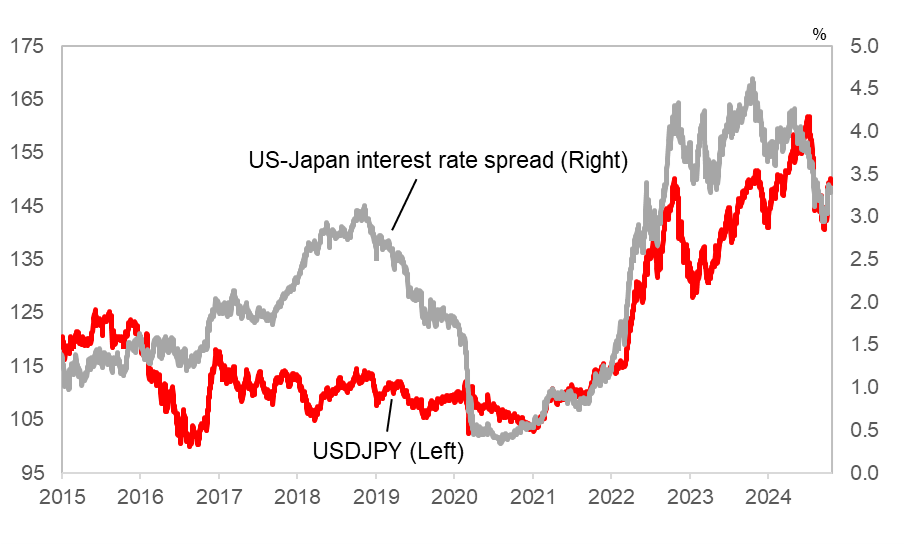

The environment has turned less JPY-friendly following the JPY’s strong summer rally driven by carry trade unwind. USDJPY has recently rebounded on widening US-Japan yield differentials. But the setback for the JPY is unlikely to last. A USDJPY rally beyond 150 would raise BoJ’s hiking prospects, thereby putting a cap on USDJPY.

We continue to think that the JPY can modestly appreciate, targeting USDJPY at 137 in a year’s time. JPY valuations are still exceptionally cheap, and the currency should be supported by the BoJ hikes while other central banks pursue rate cuts. Among the low-yielders, we still prefer CHF to JPY as the funder of choice.

Exhibit 6: USDJPY and US-Japan yield differential

Source: Bloomberg, Bank of Singapore.

JPY performs best when both US yields and equities are falling. Such an outcome could happen if there is a hard landing in the US economy, requiring more aggressive rate cuts by the Federal Reserve (Fed). But more upbeat US dataflow pointing to lower recession risk has not only driven 10Y US Treasury (UST) yields back above 4% but also kept US equities supported even as investors are cautious over stretched valuations.

But following a significant repricing of terminal rates – the level at which the Fed stops cutting – from sub-3% in September back to the vicinity of our estimate of US neutral rate at 3.0-3.5% (the rate that neither stimulates nor slows down US economic activity being about 2%), the scope for additional USDJPY gains is likely to be more limited.

Japan’s election results show that the LDP-Komei Party coalition has fallen short of securing the 233 seats needed for an overall majority in the lower house. The parties have 30 days to agree on the composition of the new government. Political uncertainty has also weighed on the JPY. But renewed weakening of the JPY is likely to increase pressure on BoJ to hike rates, which in turn should help limit further USDJPY upside. The authorities could also counter JPY weakness with FX intervention warnings.

Exhibit 7: Wage growth has finally risen in Japan

Note: Same sample basis

Source: Bloomberg, Bank of Singapore

We expect the pace and extent of the BoJ hikes to exceed the current interest rate pricing, paving the way for a stronger JPY. The BoJ has maintained that it would adjust the extent to which monetary policy is accommodative by hiking rates if the virtuous cycle between wages and prices develops in line with the central bank’s outlook.

Solid wage gains provide more proof the BoJ’s outlook is on track. A nearly 3% year-on-year (YoY) rise in scheduled earnings in August is the fastest pace of gains since the early 1990s.

A shift by Japanese investors away from their long-held “invest overseas” strategy is an area we are watching closely. We are not seeing such a behaviour shift although the Government Pension Investment Fund is due to review its medium-term investment plans soon. A change of tack to boost its allocation to domestic assets in the upcoming review could add to JPY strength.

Equities – Risk-reward appears balanced at this juncture

We foresee continued volatility for Japanese equities in the near term following the unexpected outcome of the Lower House elections on 27 October 2024, which could lead to uncertainties over policy direction and implementation. The upcoming US elections in early November would also act as a source of uncertainty. Furthermore, fluctuations in the JPY are expected to contribute to market volatility. We note that the correlation (rolling 12-month basis) between the performance of the MSCI Japan Index and USDJPY rate has risen more sharply since July this year. Positive earnings revision momentum by the street has also waned over the past few weeks. Looking at investor flows data from Japan Exchange Group, there was a marked shift in sentiment from foreign investors towards Japanese equities, as they net sold JPY2.9t of equities on the Tokyo Stock Exchange Prime Market for the month of September. This was a reversal as compared to five consecutive months of net inflows from April to August 2024. However, we note that inflows from foreign investors turned positive again for the three weeks ending 18 Oct (JPY639b).

Other positives include ongoing corporate governance reforms, higher Nippon Individual Savings Account (NISA) participation rates and transition to an inflationary economy which are medium to longer-term drivers for the Japanese equity market.

In terms of positioning, we see opportunities in Japanese banks following their share price pullbacks from the peak, coupled with our house view that the BoJ will hike its benchmark rate by another 25bps in December to 0.50%. The gradual normalisation in interest rates will support the improvements in Japanese banks’ ROE over time.

We also like domestic-oriented sectors and companies given our expectations of JPY appreciation ahead. Rising real wages can provide a boost to domestic consumption. Besides Japanese banks and domestic-oriented companies, there are also opportunities within the industrial automation and generative artificial intelligence (AI) space.

Japan’s factory automation players could see tailwinds from the bottoming of China’s economic growth and global interest rate cuts. Japan robot orders, a leading indicator of factory activity, surpassed robot shipments in 2Q24 for the first time since 4Q22, and this could suggest the start of a recovery.

Fixed Income – Premium for scarcity

Japanese credits have continued to garner strong demand and we attribute it to the lack of supply and the issuers are considered as having strong fundamentals with high overall ratings (averaging “A”-ratings). Issuances by Japan are dominated by financials (both banks and insurance companies) with corporates mostly well-placed in Investment Grade (IG) ratings and a handful of names in the High Yield (HY) ratings.

Fluctuations in the JPY are expected to contribute to volatility in the credit market; as seen in the early August market sell-off which was triggered by the unwinding of the JPY carry trades, following strong JPY appreciation and a hawkish BoJ.

For Japan corporate borrowers, the biggest impact from JPY appreciation is a reduction on the translated income from non-JPY proceeds. All else equal, this will result in earnings drag but we think this factor alone is unlikely to trigger concerns among investors and rating agencies.

For Japan financials (banks and life insurance companies), the implications from the market volatility appear manageable:

JPY appreciation: Strong JPY reduces earnings due to lower translation gains given substantial exposure to non-JPY assets. For banks, the loan repricing from BoJ rate hike more than offset the earnings drag from JPY movements. For insurers, the overall higher hedging costs have resulted in a recalibration on their investment approach, including a reduction in hedged foreign exposure.

BoJ rate hike: For banks, BoJ rate hike allows margin expansion (with loan repricing more impact than deposit repricing). Mark-to-market (MTM) losses on bonds are likely to be modest given the gradual rise in yields but higher net interest margin will boost banks’ profitability. For insurers, there has been a notable increase in insurer’s investments into JGBs, which we think is credit positive as that is accompanied with a boost to its liquidity and solvency profile.

Equity market sell-off: Unrealised gains from equity portfolio will likely fall but it is unlikely to have a material impact on banks’ CET1 ratios. For insurers, equity exposure has increased over the past two years, but this is largely due to market appreciation, instead of new positions. Despite this trend, the underlying strategy of most insurers has been to trim equity exposure to mitigate market risk and promote portfolio stability.

Disclaimers and Disclosures

This material is prepared by Bank of Singapore Limited (Co Reg. No.: 197700866R) (the “Bank”) and is distributed in Singapore by the Bank.

This material does not provide individually tailored investment advice. This material has been prepared for and is intended for general circulation. The contents of this material does not take into account the specific investment objectives, investment experience, financial situation, or particular needs of any particular person. You should independently evaluate the contents of this material, and consider the suitability of any product discussed in this material, taking into account your own specific investment objectives, investment experience, financial situation and particular needs. If in doubt about the contents of this material or the suitability of any product discussed in this material, you should obtain independent financial advice from your own financial or other professional advisers, taking into account your specific investment objectives, investment experience, financial situation and particular needs, before making a commitment to purchase any product.

The Bank shall not be responsible or liable for any loss (whether direct, indirect or consequential) that may arise from, or in connection with, any use of or reliance on any information contained in or derived from this material, or any omission from this material, other than where such loss is caused solely by the Bank’s wilful default or gross negligence.

This material is not and should not be construed, by itself, as an offer or a solicitation to deal in any product or to enter into any legal relations. You should contact your own licensed representative directly if you are interested in buying or selling any product discussed in this material.

This material is not intended for distribution, publication or use by any person in any jurisdiction outside Singapore, Hong Kong or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank or its related corporations, connected persons, associated persons or affiliates (collectively “Affiliates”) to any licensing, registration or other requirements in such jurisdiction.

The Bank and its Affiliates may have issued other reports, analyses, or other documents expressing views different from the contents of this material, and may provide other advice or make investment decisions that are contrary to the views expressed in this material, and all views expressed in all reports, analyses and documents are subject to change without notice. The Bank and its Affiliates reserve the right to act upon or use the contents of this material at any time, including before its publication.

The author of this material may have discussed the information or views contained in this material with others within or outside the Bank, and the author or such other Bank employees may have already acted on the basis of such information or views (including communicating such information or views to other customers of the Bank).

The Bank, its employees (including those with whom the author may have consulted in the preparation of this material))and discretionary accounts managed by the Bank may have long or short positions (including positions that may be different from or opposing to the views in this material or may be otherwise interested in any of the product(s) (including derivatives thereof) discussed in material, may have acquired such positions at prices and market conditions that are no longer available, may from time to time deal in such product(s) and may have interests different from or adverse to your interests.

Analyst Declaration

The analyst(s) who prepared this material certifies that the opinions contained herein accurately and exclusively reflect his or her views about the securities of the company(ies) and that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein.

The analyst(s) who prepared this material and his/her associates [have / do not] have financial interests in the company(ies). Financial interests refer to investments in securities, warrants and/or other derivatives. The analyst(s) receives compensation based on the overall revenues of Bank of Singapore Limited, and no part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this material. The reporting line of the analyst(s) is separate from and independent of the business solicitation or marketing departments of Bank of Singapore Limited.

The analyst(s) and his/her associates confirm that they do not serve as directors or officers of the company(ies) and the company(ies)or other third parties have not provided or agreed to provide any compensation or other benefits to the analyst(s) in connection with this material.

An “associate” is defined as (i) the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child, or any sibling or step-sibling of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, parent or step-parent, minor child (natural or adopted) or minor step-child, or sibling or step-sibling is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Conflict of Interest Declaration

The Bank is a licensed bank regulated by the Monetary Authority of Singapore in Singapore. Bank of Singapore Limited, Hong Kong Branch (incorporated in Singapore with limited liability), is an Authorized Institution as defined in the Banking Ordinance of Hong Kong (Cap 155), regulated by the Hong Kong Monetary Authority in Hong Kong and a Registered Institution as defined in the Securities and Futures Ordinance of Hong Kong (Cap.571) regulated by the Securities and Futures Commission in Hong Kong. The Bank, its employees and discretionary accounts managed by its Singapore Office/Hong Kong Office may have long or short positions or may be otherwise interested in any of the investment products (including derivatives thereof) referred to in this document and may from time to time dispose of any such investment products. The Bank forms part of the OCBC Group (being for this purpose Oversea-Chinese Banking Corporation Limited (“OCBC Bank”) and its subsidiaries, related and affiliated companies). OCBC Group, their respective directors and/or employees (collectively “Related Persons”) may have interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Group and its Related Persons may also be related to, and receive fees from, providers of such investment products. There may be conflicts of interest between OCBC Bank, the Bank, OCBC Investment Research Private Limited, OCBC Securities Private Limited or other members of the OCBC Group and any of the persons or entities mentioned in this report of which the Bank and its analyst(s) are not aware due to OCBC Bank’s Chinese Wall arrangement.

The Bank adheres to a group policy (as revised and updated from time to time) that provides how entities in the OCBC Group manage or eliminate any actual or potential conflicts of interest which may impact the impartiality of research reports issued by any research analyst in the OCBC Group.

Other Disclosures

Singapore

Where this material relates to structured deposits, this clause applies:

The product is a structured deposit. Structured deposits are not insured by the Singapore Deposit Insurance Corporation. Unlike traditional deposits, structured deposits have an investment element and returns may vary. You may wish to seek independent advice from a financial adviser before making a commitment to purchase this product. In the event that you choose not to seek independent advice from a financial adviser, you should carefully consider whether this product is suitable for you.

Where this material relates to dual currency investments, this clause applies:

The product is a dual currency investment. A dual currency investment product (“DCI”) is a derivative product or structured product with derivatives embedded in it. A DCI involves a currency option which confers on the deposit-taking institution the right to repay the principal sum at maturity in either the base or alternate currency. Part or all of the interest earned on this investment represents the premium on this option.

By purchasing this DCI, you are giving the issuer of this product the right to repay you at a future date in an alternate currency that is different from the currency in which your initial investment was made, regardless of whether you wish to be repaid in this currency at that time. DCIs are subject to foreign exchange fluctuations which may affect the return of your investment. Exchange controls may also be applicable to the currencies your investment is linked to. You may incur a loss on your principal sum in comparison with the base amount initially invested. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether this product is suitable for you.

Hong Kong

This material has not been delivered for registration to the Registrar of Companies in Hong Kong and its contents have not been reviewed by any regulatory authority in Hong Kong. Accordingly: (i) the shares/notes may not be offered or sold in Hong Kong by means of any document other than to persons who are "Professional Investors" within the meaning of the Securities and Futures Ordinance (Cap. 571) of Hong Kong and the Securities and Futures (Professional Investor) Rules made thereunder or in other circumstances which do not result in the document being a "prospectus" within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance; and (ii) no person may issue any invitation, advertisement or other material relating to the shares/notes whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to the shares/notes which are or are intended to be disposed of only to persons outside Hong Kong or only to "Professional Investors" within the meaning of the Securities and Futures Ordinance and the Securities and Futures (Professional Investor) Rules made thereunder.

Where this material involves derivatives, do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you have any doubt, you should seek independent professional financial, tax and/or legal advice as you deem necessary.

Where this material relates to a Complex Product, this clause applies:

Warning Statement and Information about Complex Product

(Applicable to accounts managed by Hong Kong Relationship Manager)

Where this material relates to a Complex Product – funds and ETFs, this clause applies additionally:

Where this material relates to a Complex Product (Options and its variants, Swap and its variants, Accumulator and its variants, Reverse Accumulator and its variants, Forwards), this clause applies additionally:

Where this material relates to a Loss Absorption Product, this clause applies:

Warning Statement and Information about Loss Absorption Products

(Applicable to accounts managed by Hong Kong Relationship Manager)

Before you invest in any Loss Absorption Product (as defined by the Hong Kong Monetary Authority), please read and ensure that you understand the features of a Loss Absorption Product, which may generally have the following features:

Where this material relates to a certificate of deposit, this clause applies:

It is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Where this material relates to a structured deposit, this clause applies:

It is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Where this material relates to a structured product, this clause applies:

This is a structured product which involves derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you are in any doubt about the risks involved in the product, you may clarify with the intermediary or seek independent professional advice.

Dubai International Financial Center

Where this material relates to structured products and bonds, this clause applies:

The Distributor represents and agrees that it has not offered and will not offer the product to any person in the Dubai International Financial Centre unless such offer is an “Exempt Offer” in accordance with the Market Rules of the Dubai Financial Services Authority (the “DFSA”).

The DFSA has no responsibility for reviewing or verifying any documents in connection with Exempt Offers.

The DFSA has not approved the Information Memorandum or taken steps to verify the information set out in it, and has no responsibility for it.

The product to which this document relates may be illiquid and/or subject to restrictions in respect of their resale. Prospective purchasers of the products offered should conduct their own due diligence on the products.

Please make sure that you understand the contents of the relevant offering documents (including but not limited to the Information Memorandum or Offering Circular) and the terms set out in this document. If you do not understand the contents of the relevant offering documents and the terms set out in this document, you should consult an authorised financial adviser as you deem necessary, before you decide whether or not to invest.

Where this material relates to a fund, this clause applies:

This Fund is not subject to any form of regulation or approval by the Dubai Financial Services Authority (“DFSA”). The DFSA has no responsibility for reviewing or verifying any Prospectus or other documents in connection with this Fund. Accordingly, the DFSA has not approved the Prospectus or any other associated documents nor taken any steps to verify the information set out in the Prospectus, and has no responsibility for it. The Units to which this Fund relates may be illiquid and/or subject to restrictions on their resale. Prospective purchasers should conduct their own due diligence on the Units. If you do not understand the contents of this document you should consult an authorized financial adviser. Please note that this offer is intended for only Professional Clients and is not directed at Retail Clients.

These are also available for inspection, during normal business hours, at the following location:

Bank of Singapore

Office 30-34 Level 28

Central Park Tower

DIFC, Dubai

U.A.E

BOS Wealth Management Europe S.A., UK Branch

BOS Wealth Management Europe S.A., UK Branch (BOSWME UK), is authorized and regulated by the Financial Conduct Authority (FCA) and is providing this material for informational purposes only. BOSWME UK does not endorse any specific investments or financial products mentioned in this material. BOSWME UK and its employees accept no liability for any loss or damage arising from the use of this material or reliance on its content.

This material is being distributed to and is directed only at persons in the UK who meet the requirements to be considered “Professional Clients” within the meaning of the Conduct of Business Sourcebook rules on client categorisation, part of the FCA Handbook (the “FCA Rules”) and is not intended for retail investors.

Any person in the UK who receives this material will be deemed to have represented and agreed that it can be considered a Professional Client. Any such recipient will also be deemed to have represented and agreed that it has not received this material on behalf of persons in the UK other than Professional Clients for whom the investor has authority to make decisions on a wholly discretionary basis. BOSWME UK will rely upon the truth and accuracy of the foregoing representations and agreements. Any person who is not a Professional Client should not act or rely on this material or any of their contents.

Investing in financial markets carries the risk of losing capital, and investors should be aware of and carefully consider this risk before making any investment decisions. The value of investments can fluctuate, and there is no guarantee that investors will recoup their initial investment. Past performance is not indicative of future results, and the performance of investments can be affected by various factors, including but not limited to market conditions, economic factors, and changes in regulations or tax laws. Forward-looking statements should not be considered as guarantees or predictions of future events. Investors should be prepared for the possibility of losing all or a portion of their invested capital. It is recommended that investors seek professional advice and conduct thorough research before making any investment decisions.

Cross Border Disclaimer and Disclosures

Refer to https://www.bankofsingapore.com/Disclaimers_and_Disclosures.html for cross-border marketing disclaimers and disclosures.