Developed in collaboration with EY, this report outlines key frameworks and principles of environmental, social and governance (ESG) making sustainability accessible to all.

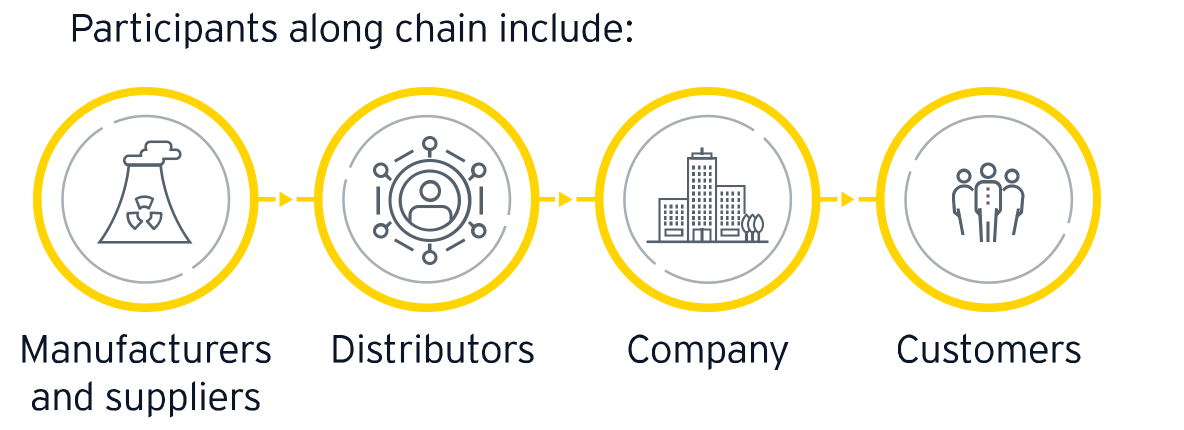

In order to mitigate ESG risks, companies should engage relevant stakeholders and assess possible risks along the value chain periodically. Companies can further distinguish themselves through benchmarking their practices against ESG industry leaders to create long-term value.

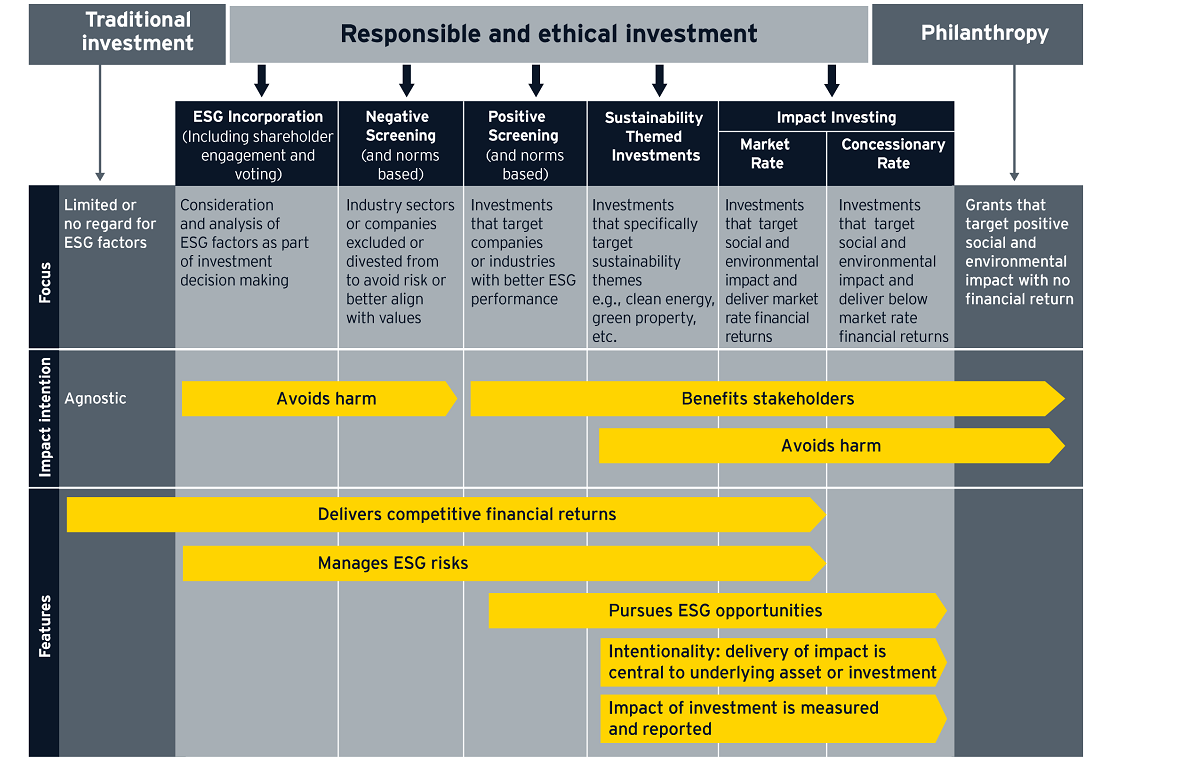

ESG driven investing does not preclude financial returns. An analysis of nearly 11,000 ESG focused funds over a 14-year period from 2004 to 2018 revealed that returns on sustainable funds did not differ materially from the performance of traditional funds. Furthermore, sustainable funds potentially offered lower market risk, which could appeal to investors seeking less volatility.

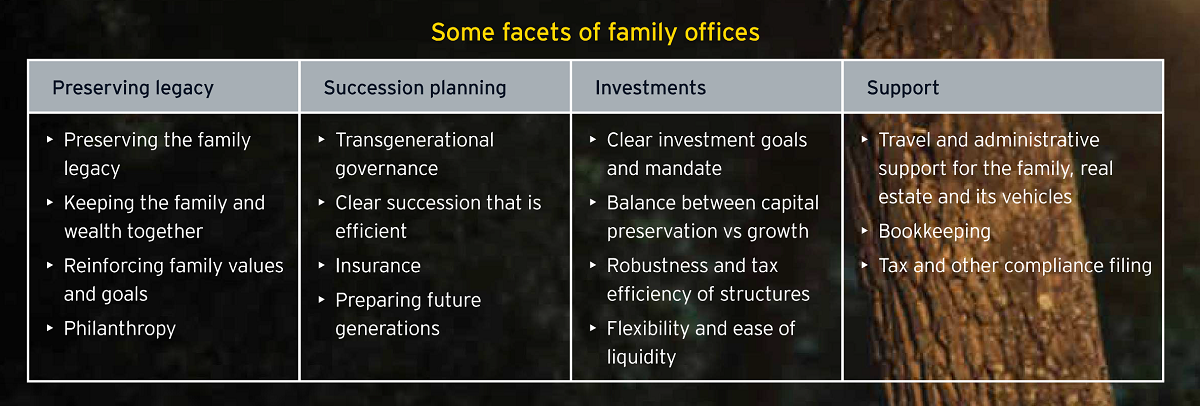

There is a direct correlation between families’ personal involvement in evaluating philanthropic progress and their overall interest in effective giving. 95% of millennial investors are interested in responsible portfolios, making ESG a good way to engage the next generation in meaningful pursuits with long-term positive impact. However, insufficient understanding of the ESG investment landscape and an absence of clearly defined environmental or social outcomes can pose a challenge to effective philanthropy. Family offices can support a family’s philanthropic goals by providing accurate, measurable and relevant metrics to accurately determine the impact of their giving.