Bank of Singapore's inaugural CIO Summit 2024 is driven by the Chief Investment Office (CIO), with the CIO Global Advisory Council (GAC) that convenes leading thought leaders from around the world.

This year, the Summit will delve into structural market-defining Supertrends that will shape the decade ahead - from changes in the global balance of power, to allocating capital in the face of climate change and the transformative impact of artificial intelligence.

The annual CIO Summit will be the platform for global thought leaders and industry experts to share their perspectives, expertise and approaches to these complex challenges, offering the insights and strategies you need as investors for the emerging new world order.

President, Peterson Institute for International Economics

Adam S. Posen has been president of the Peterson Institute for International Economics since January 2013. Over his career, he has contributed to research and public policy regarding monetary and fiscal policies in the G-20, the challenges of European integration since the adoption of the euro, China-US economic relations, and developing new approaches to financial recovery and stability. He was one of the first economists to seriously address the political foundations of central bank independence and to analyze Japan’s Great Recession as a failure of macroeconomic policy.

During Dr. Posen’s presidency, the Peterson Institute has won global recognition as the leading

independent think tank in international economics, including repeated top rankings from the Prospect

Think Tank Awards and the Global Go To Think Tank Index. Under his leadership, PIIE has expanded to include 42 world-renowned resident and nonresident fellows and increased its endowment by 50 percent. Since 2013, PIIE has developed high-level recognition and research partnerships in the People’s Republic of China, while deepening longstanding ties with policymakers in other East Asian, European, and North American capitals. The Institute also has broken new ground in providing accessible economic analysis to the general public.

In September 2009, Posen was appointed by the UK Chancellor of the Exchequer to serve a three-year term as an external voting member of the Bank of England’s rate-setting Monetary Policy Committee (MPC). During this critical period for the world economy, Posen advocated an activist policy response to the financial crisis, led the MPC into quantitative easing, and accurately forecast global inflation developments. The Atlantic named him in its line-up of global “Superstar Central Bankers” in 2012. He also consulted for the UK Cabinet Office for the successful London G-20 summit of 2009 during the global financial crisis.

Posen has been widely cited and published commentary in leading news and policy publications and

he appears frequently on Bloomberg television and radio, among other media programming. Posen

received his BA and PhD from Harvard University.

Head of APAC Active Investments and Chief Investment Officer of Emerging Markets, BlackRock

Belinda Boa, Managing Director, is the Head of Asia Pacific Active Investments & Chief Investment

Officer of Emerging Markets Fundamental Equities. She is responsible for delivering investment

excellence and success in the region. Her role encompasses all areas of the Active Investment business in APAC, including Fundamental Equities, Fundamental Fixed Income, Scientific Active Equity and Multi-Asset Strategies & Solutions. Additionally, she oversees regulated activities of investors in the region and is a member of BlackRock’s Asia Pacific Executive Committee.

Prior to assuming her current role in 2015, Ms. Boa was BlackRock’s Head of Risk and Quantitative

Analysis for the Asia Pacific region, where she was responsible for all areas of risk across APAC including investment risk, credit and counterparty risk, and corporate and operational risk. She has worked in quantitative finance for over 15 years in London, South Africa, Hong Kong, and now Singapore, where she is currently based. Ms. Boa is a qualified Chartered Financial Analyst and a member of the London Quant Group. She earned her degree with honours in Finance and Statistics from the University of the Witwatersrand, South Africa in 1995.

Chief Investment Strategist, Bank of Singapore

Eli Lee is the Chief Investment Strategist at Bank of Singapore and he plays a central role in developing asset allocation and thematic strategies across global asset classes for the Bank. He is a key member of Bank of Singapore’s investment committee, which determines the Group’s overall investment strategy and direction, and serves as a member of the OCBC Group Wealth Panel.

He also previously led the Special Situations Research team at OCBC Investment Research. As an

investment thought leader, Eli’s independent perspectives are often sought after by international media, including the Wall Street Journal, Bloomberg and CNBC. With close to two decades of industry experience, Eli began his investment career at the Wellington Management Company in Boston.

He graduated from Harvard University with an MA in statistics.

Chief Investment Officer, Equities, Multi-Asset and Sustainability, M&G Investments

Fabiana Fedeli is Chief Investment Officer Equities, Multi Asset and Sustainability at M&G Investments.

She is a member of the Executive Committee of M&G Investments (Asset Management) and a non-executive director of M&G Investments Southern Africa. Ms Fedeli leads a team of investment professionals deploying over US$70bn globally across multiple asset classes, based in the UK, Continental Europe, the US and Asia.

Prior to joining M&G Investments, Ms. Fedeli served as Global Head of Fundamental Equities and

Emerging Markets Equities Portfolio Manager at Robeco. Prior to joining Robeco, she was a Portfolio Manager Asian Equities at Pioneer Asset Management and at Occam Asset Management.

Ms. Fedeli began her career at ING Barings Tokyo as a Research Analyst in Japanese equities in 1999.

Ms. Fedeli holds a Master's in Economics from Hitotsubashi University in Tokyo and a Bachelor's in

Economic and Social Sciences from Bocconi University in Milan. She also received a Certificate in

Financial Asset Management and Engineering from the University of Lausanne, Swiss Finance Institute, in Lausanne, Switzerland.

Ms. Fedeli is a member of the Investment Committee of The Investment Association, a trade body

representing Investment Managers in the UK that collectively manage over US$12 trillion in assets. She is also a member of the Investment Committee of UK-based The Open University. Ms. Fedeli is also a non-executive director of Relmada Therapeutics (Nasdaq: RLMD), a late-stage biotechnology

company. In 2022, Ms. Fedeli was named among Financial News’ 100 Most Influential Women in Finance

Chief Executive Officer, Bank of Singapore

Jason Moo was appointed Chief Executive Officer of Bank of Singapore in March 2023. He joined Bank of Singapore from Julius Baer, where he was Head Private Banking Southeast Asia and Branch Manager Singapore.

Prior to joining Julius Baer in 2020, Jason worked at Goldman Sachs for more than two decades and

has held several senior roles, including CEO of Goldman Sachs Singapore and Head of Southeast Asia and Australia for Private Wealth Management (PWM). Before relocating back to Singapore, he was based in Hong Kong as Head of Market Solutions Group and Head of Alternative Capital Markets Asia Pacific.

Prior to that, he worked in the Equities Merchandising Group in New York. He joined Goldman Sachs as a financial analyst in PWM in Singapore upon graduation. Jason earned a BA in Economics and East Asia Studies, with a focus on Japan, from Brown University, USA.

He serves on the Board of Governors of Raffles Institution

Global Chief Investment Officer, Bank of Singapore

Jean Chia is responsible for Bank of Singapore’s CIO Views, Macroeconomics, Investment Strategy, FX, Equity & Fixed Income Research, as well as Discretionary Portfolio Management (DPM), Advisory Portfolio Management (APM) and Funds Selection teams at Bank of Singapore. She is a member of the board of directors for BOS International Funds, Luxembourg and a member of the OCBC Wealth Panel.

Jean has over 20 years of experience in Private Banking and Asset Management. Prior to her current role, she was previously Head, Equities Advisory & Sales, responsible for the equities and derivatives business at Bank of Singapore, and Head of Client Advisory Services for Equities, Investment Products & Services at UBS Wealth Management, Singapore.

Prior to UBS, she was Vice President, Head of Grassroots Research at Allianz Dresdner Asset

Management (now known as Allianz Global Investors). Jean graduated with an MA in Philosophy,

Politics and Economics from University of Oxford, UK. She recently completed a Sustainable Finance certification from Cambridge Institute of Sustainable Leadership (CISL).

Jean is currently a Financial Women’s Association of Singapore (FWA) Female Champion and an

Institute of Banking and Finance (IBF) Fellow for Private Banking and Wealth Management.

Global Co-Chief Investment Officer, Blackstone

Kenneth A. Caplan is the Global Co-Chief Investment Officer of Blackstone. As Co-CIO, he works in

conjunction with business unit CIOs and Group Heads to provide additional firm-level investment

oversight, primarily across Real Estate and Credit & Insurance (BXCI).

Mr. Caplan previously served as Global Co-Head of Blackstone Real Estate. Blackstone is the largest owner of commercial real estate and an industry leader in opportunistic, core plus and debt investing across North America, Europe and Asia. Prior to becoming Global Co-Head of Blackstone Real Estate, Mr. Caplan served as Global Chief Investment Officer of Blackstone Real Estate and Head of Real Estate Europe. Since joining the firm in 1997, Mr. Caplan has been involved in over $100 billion of real estate acquisitions and initiatives in the United States, Europe and Asia. These include major acquisitions such as Equity Office Properties, Hilton Hotels, Logicor and GE Real Estate.

Before joining Blackstone, he was at Lazard Freres & Co. in the real estate investment banking group. Mr. Caplan received an AB in Economics from Harvard College, where he graduated magna

cum laude, was elected to Phi Beta Kappa and was a John Harvard Scholar. He currently serves on the Board of Trustees of Prep for Prep.

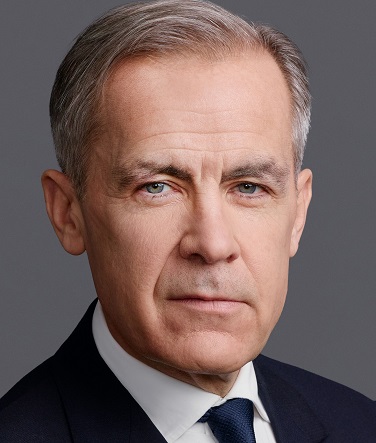

Chair and Head of Transition Investing, Brookfield Asset Management

Mark Carney is the Chair of Brookfield Asset Management and Head of Transition Investing. In this role, he is focused on the development of products for investors that will combine positive social and

environmental outcomes with strong risk-adjusted returns.

Mr. Carney served as the Governor of the Bank of England from 2013 to 2020, and prior to that as

Governor of the Bank of Canada from 2008 until 2013. He was Chairman of the Financial Stability Board from 2011 to 2018. Prior to his governorships, Mr. Carney worked at Goldman Sachs as well as the Canadian Department of Finance.

He is currently the United Nations Special Envoy for Climate Action and Finance and Co-Chair for the Glasgow Finance Alliance for Net Zero.

He is also Chair of the Group of Thirty and Bloomberg LP’s Board of Directors, as well as the Board of Stripe, a member of the Global Advisory Board of PIMCO, the Board of Overseers of Harvard University, and the boards of The Rideau Hall Foundation, the Peterson Institute for International Economics, the Blavatnik School at Oxford, and the Hoffman Institute at INSEAD; as well as Senior counsellor of the MacroAdvisory Partners, and President of Chatham House.

Mr. Carney holds doctorate and master’s degrees from Oxford University and a bachelor’s degree from Harvard University.

Chief Economist, Bank of Singapore

Mansoor is a macroeconomist and financial market strategist with two decades experience covering

institutional investors around the world. Mansoor speaks to policymakers and central bankers and

maintains links with think-tanks in Washington and Beijing. He appears on CNBC and Bloomberg

Television, his work features in The Economist and he has written for the Financial Times.

Mansoor was most recently at the Royal Bank of Scotland’s investment arm, NatWest Markets, where he was the Asia region’s Macro Strategist and previously the bank’s Global Head of FX Strategy. Prior to joining RBS, Mansoor spent 17 years at UBS in London, Zurich and Singapore where he was also Global Head of FX Strategy from 2002 to 2014.

Mansoor holds a Bachelor’s and a Master’s degree in Economics from the London School of Economics.

He was tutored by Professor Charles Goodhart, a former Chief Adviser at the Bank of England.

Chief Investment Strategist for Global Wealth, KKR

Paula Campbell Roberts joined KKR in 2017 and is the Chief Investment Strategist for our Global Wealth business and a Managing Director on KKR’s Global Macro & Asset Allocation team. As Chief Investment Strategist, Paula advises KKR’s wealth management partners on macroeconomics and asset allocation, with a focus on the role that private assets, including private equity, real estate, infrastructure, and credit, can play in individual investor portfolios. As a Managing Director on the Global Macro & Asset Allocation team, Paula also works with KKR’s investment teams on the identification and evaluation of macro considerations as it relates to both deployment and monetization opportunities. Paula is a member of KKR’s Global Wealth Executive Committee, the Global Macro, Risk and Balance Sheet (GBR) Senior Leadership team, and is a designated sponsor of KKR’s America’s Inclusion and Diversity Committee.

Prior to joining KKR, Ms. Roberts was an economist at Morgan Stanley, providing views on the economy and the consumer sector to asset management clients, using big data to predict inflections in key sectors of the economy, and advising Fortune 500 CEOs on their consumer strategy. Before Morgan Stanley, Ms. Roberts was a management consultant leading case teams and advising Fortune 500 companies at Bain & Co. Paula is one of fifteen members of the Federal Reserve Bank of New York’s Economic Advisory Panel and a member of the Economic Club of New York. Ms. Roberts earned her MBA from Harvard Business School and a BA from Yale University. Ms. Roberts is currently a Lincoln Center Leadership Fellow, and she also serves on the boards of the New York City Ballet and the American Friends of Jamaica.

Asia Chair, Milken Institute; Advisor Senior Director, Temasek

Mr. Hu held various senior management roles with and is currently Advisory Senior Director to Temasek, a Singapore headquartered global investment firm. He is Chairman Constellar Holding Ltd, a Temasek owned exhibitions company that manages The Singapore EXPO. He is Chairman Mandai Nature, a non-profit foundation dedicated to protecting biodiversity and wildlife conservation in Southeast Asia.

Prior to Temasek, Robin was CEO of Hong Kong listed English language Daily South China Morning Post Group where he led the group’s transformation into a digital centric media platform that led to its subsequent divestiture. Robin serves on the board of MediaCorp, Singapore’s national broadcaster.

Beginning 2023, Mr. Hu was made Singapore’s Non-Resident Ambassador to Timor Leste ahead of it impending ascension to full ASEAN membership. At around the same time, he assumed the role of Asia Chairman to American think tank Milken Institute.

Mr. Hu has worked and lived in multiple cities in Asia, including Singapore, Taipei, Beijing, Shanghai,

Suzhou, and Hong Kong, spanning multiple industries such as IT, Internet, media, finance and

government. He is a keen follower of current affairs, international policy, and geopolitics. He is a

member of the international advisory council of London based think tank Official Monetary and

Financial Institutions Forum (OMFIF).

Co-Head, Office of Government Affairs APAC, Goldman Sachs

Stewart James is co-head of the Office of Government Affairs for Asia Pacific, based in Hong Kong. In this role, he focuses on the firm’s public policy agenda in Asia Pacific Ex-Japan, and manages the firm’s relationships with key regulators, policy officials, business groups and community leaders in the region.Stewart joined Goldman Sachs as a managing director in 2022.

Prior to joining the firm, Mr. James held multiple roles in international public policy and the private sector. Most recently, he served as a member of the Executive Office at HSBC, advising on sustainability policy and regulation. Before that, Stewart relocated to Hong Kong to lead Government Affairs for HSBC’s Asia Pacific region. He joined HSBC in 2016 as deputy head of Group Government Affairs, helping to establish a new global function to engage with public policy makers across the company’s geographical footprint. Earlier in his career, Stewart worked at the Bank of England, where he acted as Governor Mark Carney’s Financial Stability Board (FSB) Sherpa, leading the team to support the governor in his role as FSB chair. Before that, in 2008, he worked as alternate executive director on the board of the World Bank Group, representing the UK government in Washington, DC. Mr. James began his career in HM Treasury, working for five years in London on the UK’s strategic approach to the European Union (EU) and six years in Brussels, focused on EU financial regulation.

Mr. James earned a BS in Physics from the University of Glasgow

Chief Investment Officer, Nomura Asset Management

Mr. Yuichi Murao is Nomura Asset Management’s Chief Investment Officer, starting in the position in

April 2024. Prior to that, he was CIO of the firm’s active Japanese equity strategies. He started his career with Nomura in 1990 as a portfolio manager in charge of domestic pension funds and has since extended coverage to international institutional investors. Previously, he has also been chairman of Nomura Asset Management’s Japanese Stock Selection Committee as well as Japanese Equity Investment Strategy Committee.

Mr. Murao holds an MBA from London Business School and a B.A. in Economics from Hitotsubashi

University. He is a CFA charterholder.

.jpg)